The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

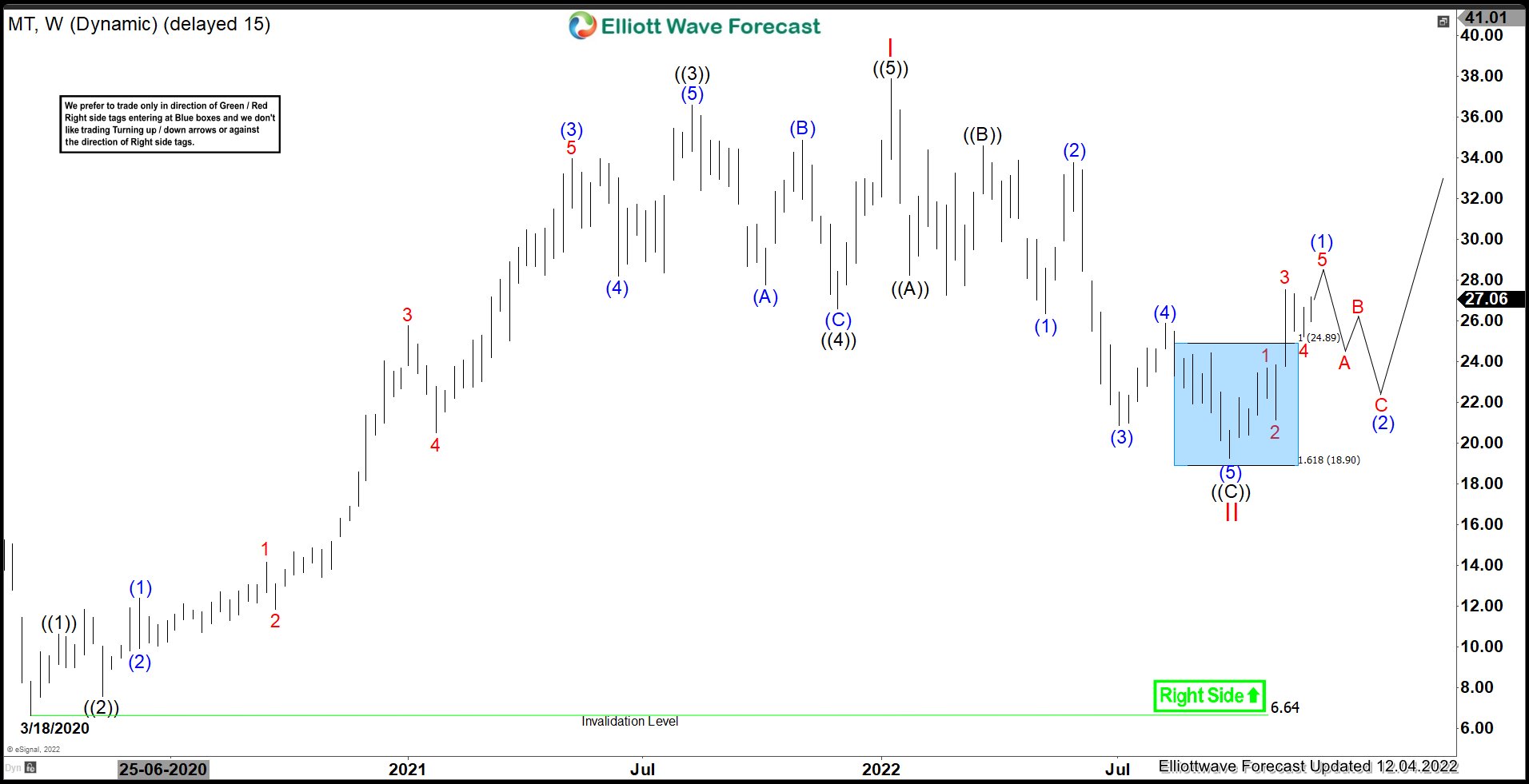

MT : Should It Be Ready For Next Rally ?

Read MoreArcelorMittal S.A., (MT) together with its subsidiaries, operates as integrated steel & mining companies in Europe, North & South America, Asia & Africa. Its principal steel products include semi-finished flat products, including slabs, finished flat products comprising plates, coils & sheets, bars, wire-rods, structural sections, rails, pipes & tubes. It is based in Luxembourg, comes […]

-

VanEck Gold Miners ETF ($GDX) Perfect Reaction from Blue Box Area.

Read MoreGood day Traders and Investors. In today’s article, we will look at the past performance of the Weekly Elliottwave chart of Gold Miners ETF ($GDX). The decline from 08.03.2020 high marked the end of the cycle from Jan 2016 lows. The ETF traded lower in 3 swings and bounced at red w on 09.27.2021. The […]

-

$NEL : Is Hydrogen Stock Nel ASA Bullish amid Energy Crisis?

Read MoreNel ASA is a Norwegian heavy electrical equipment company. It provides solutions for production, storage and distribution of hydrogen from renewable energy sources. Founded in 1927 and headquartered in Oslo, Norway, it can be traded under the ticker $NEL at Oslo Stock Exchange. Nel is a part of OBX25 index. In the initial article from May […]

-

Elliott Wave View: FTSE Looking to End 5 Waves

Read MoreFTSE shows impulsive structure from 10.13.2022 low looking for more upside. This article and video look at the Elliott Wave path.

-

10 Best Coal Stocks To Buy Now

Read MoreWorldwide coal consumption in 2021 rebounded by 5.8 % to 7 947 million tonnes (Mt), according to research by IEA.org. While the economy recovered from the pandemic, the higher natural gas price shifted the consumers towards coal-fired power generation. As a result, global coal consumption rose above 2019 levels. Coal use for power generation increased […]

-

AIZ : Should Expect Short Term Weakness

Read MoreAssurant Inc., (AIZ) together with its subsidiaries, provides lifestyle & housing solutions that support, protect & connect consumer purchases in North America, Latin America, Europe & Asia Pacific. The company operates through two segments: Global lifestyle & Global housing. It is based in New York, Comes under Financial services sector & trades under “AIZ” ticker […]