The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$XLY Forecasting the Decline and Selling The Rallies at Blue Box

Read MoreHello Everyone! In this technical blog, we are going to take a look at the Elliott Wave path in Consumer Discretionary ETF ($XLY). We keep telling members that $XLY is showing an incomplete bearish sequence in the higher timeframes and any rallies can be sold in 3 or 7 swings at blue boxes for more downside. […]

-

Elliott Wave View: S&P 500 (SPX) Expect Short Term Weakness To Continue

Read MoreShort term, Elliott wave view in S&P 500 (SPX) showing 5 swing sequence lower from 12.01.2022 peak of 4087.3 as the part of correction lower in (2) against 10.13.2022 low. Ideally, (2) expects to unfold in 3, 7 or 11 swings and should hold above 10.13.2022 low to turning higher. Below 4087.3 high, it starts […]

-

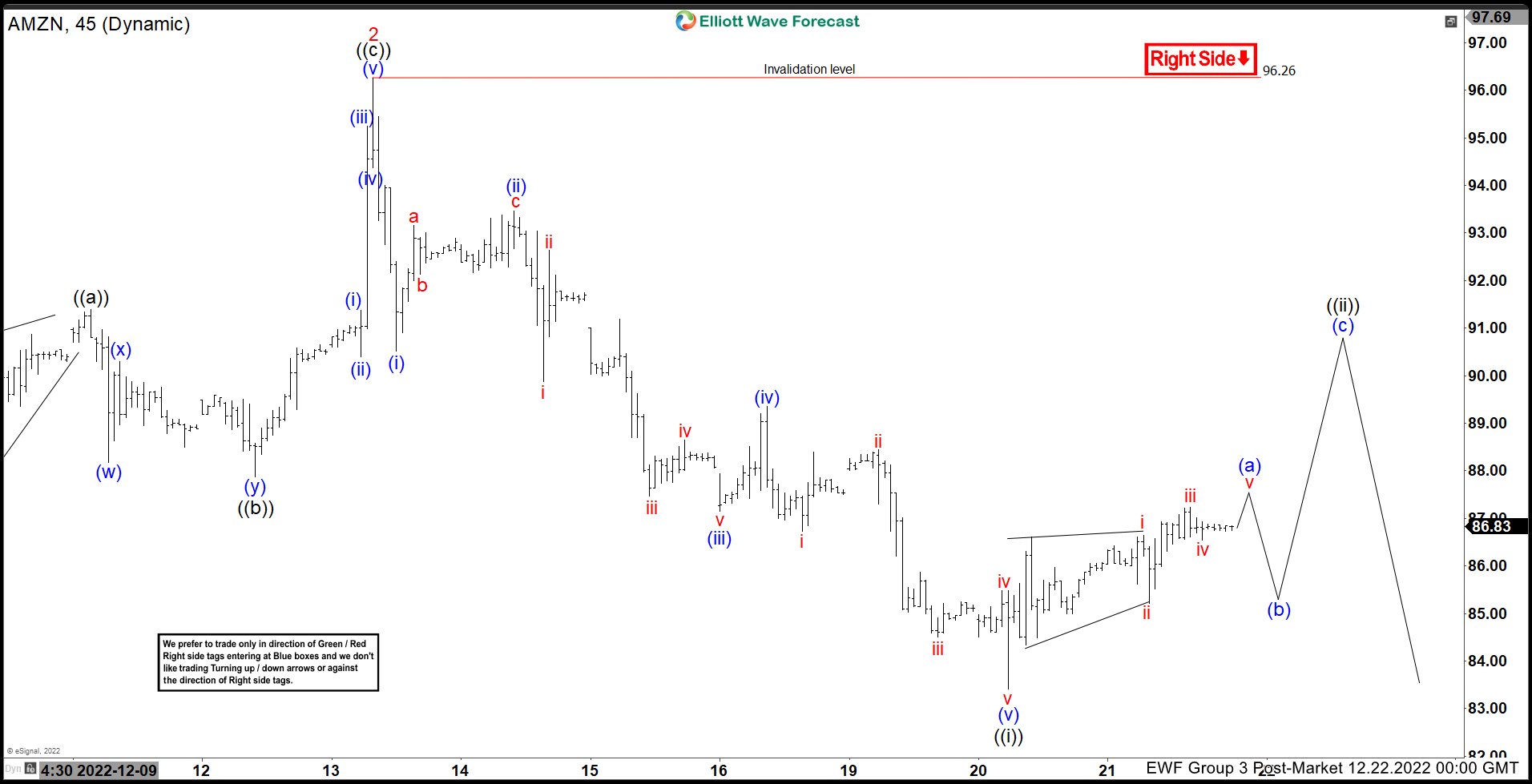

Elliott Wave View: Amazon (AMZN) Should Bounce Before Downside Resumes

Read MoreShort term Elliott wave View in Amazon (ticker; AMZN) suggests the decline from 12.13.2022 peak in 45 min chart, was clear 5 swings impulse lower, which ended ((i)) as the part of wave 3. The current sequence lower is the part of (3) of ((A)) in higher degree started from 11.15.2022 peak. It already confirms lower […]

-

BX : Expect Short Term Weakness To Continue Before Turning Higher

Read MoreBlackstone Inc., (BX) is an alternative asses management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt & multi-asset class strategies. The firm typically invests in early stage companies. It is based in New York, comes under Financial services sector & trades as “BX” ticker at NYSE. […]

-

FTSE Elliott Wave Zigzag Decline in Progress

Read MoreFTSE is correcting cycle from 10.13.2022 low in 3, 7, or 11 swing before the rally resumes. This article looks at the Elliott Wave path.

-

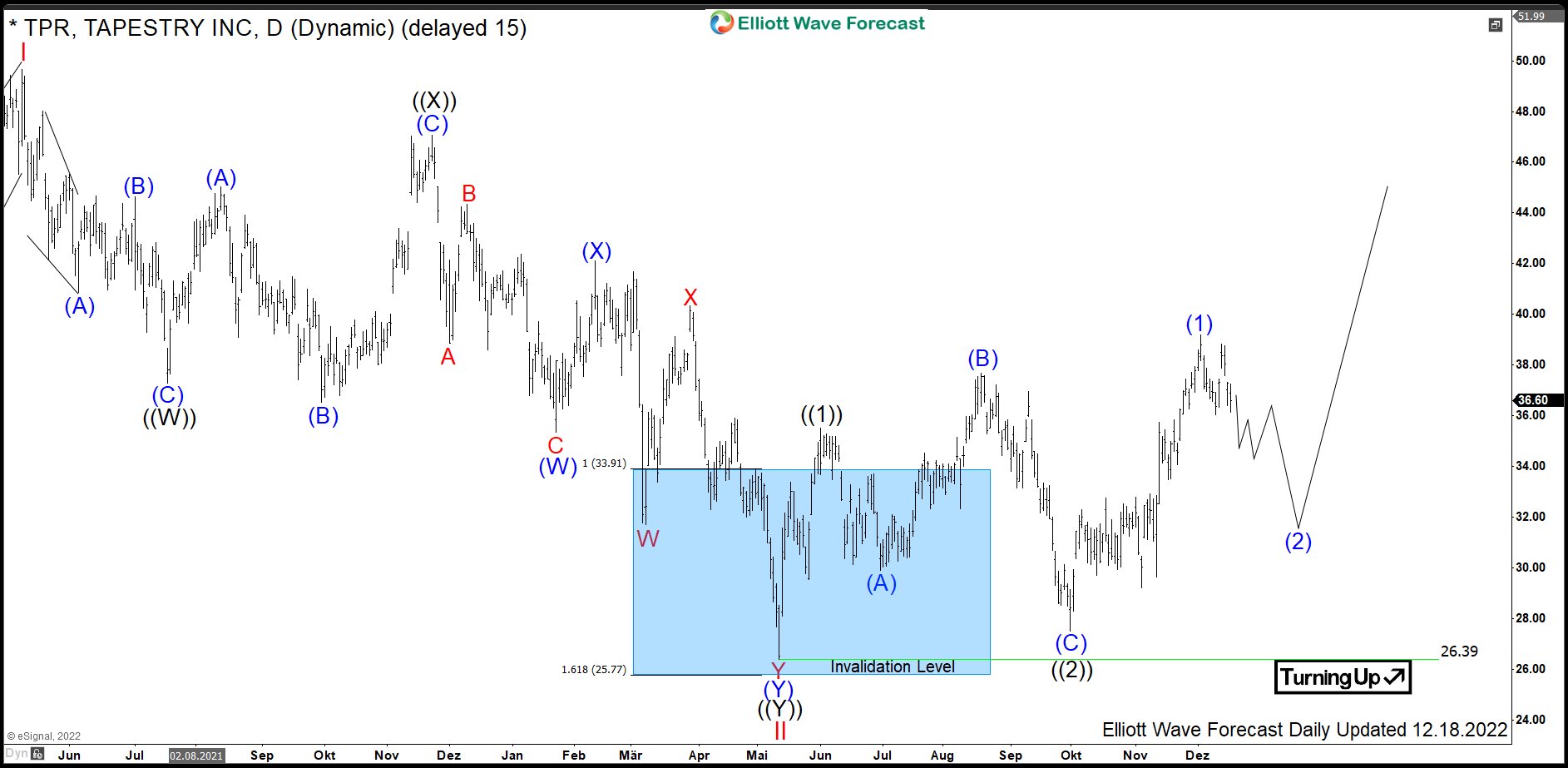

$TPR: Luxury Fashion Stock Tapestry Reacting Higher from Buying Area

Read MoreTapestry, Inc. (formerly: Coach, Inc.) is a multinational luxury fashion holding company based in New York City, USA. The parent company owns three brands: Coach New York, Kate Spade New York and Stuart Weitzman. The stock of the company being a component of the S&P500 index can be traded under ticker $TPR at NYSE. Currently, […]