The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Caterpillar (CAT) Shows Incomplete Bullish Structure

Read MoreCaterpillar ($CAT) is one of the largest and most recognizable names in the heavy equipment industry. It produces a wide range of machinery used in construction, mining, agriculture, and various other industries. In this article, we will look at the Elliott Wave chart to see why the stock should continue higher in coming weeks. Caterpillar […]

-

Berkshire Hathaway (BRK.B) Signals Strong Upside

Read MoreWarren Buffett’s Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) stands as a beacon of enduring success in the investment world. With a reputation built on prudent financial decisions and a long history of market acumen, Berkshire Hathaway has become synonymous with stability and prosperity. In this article, we dive into the latest developments and signals that suggest […]

-

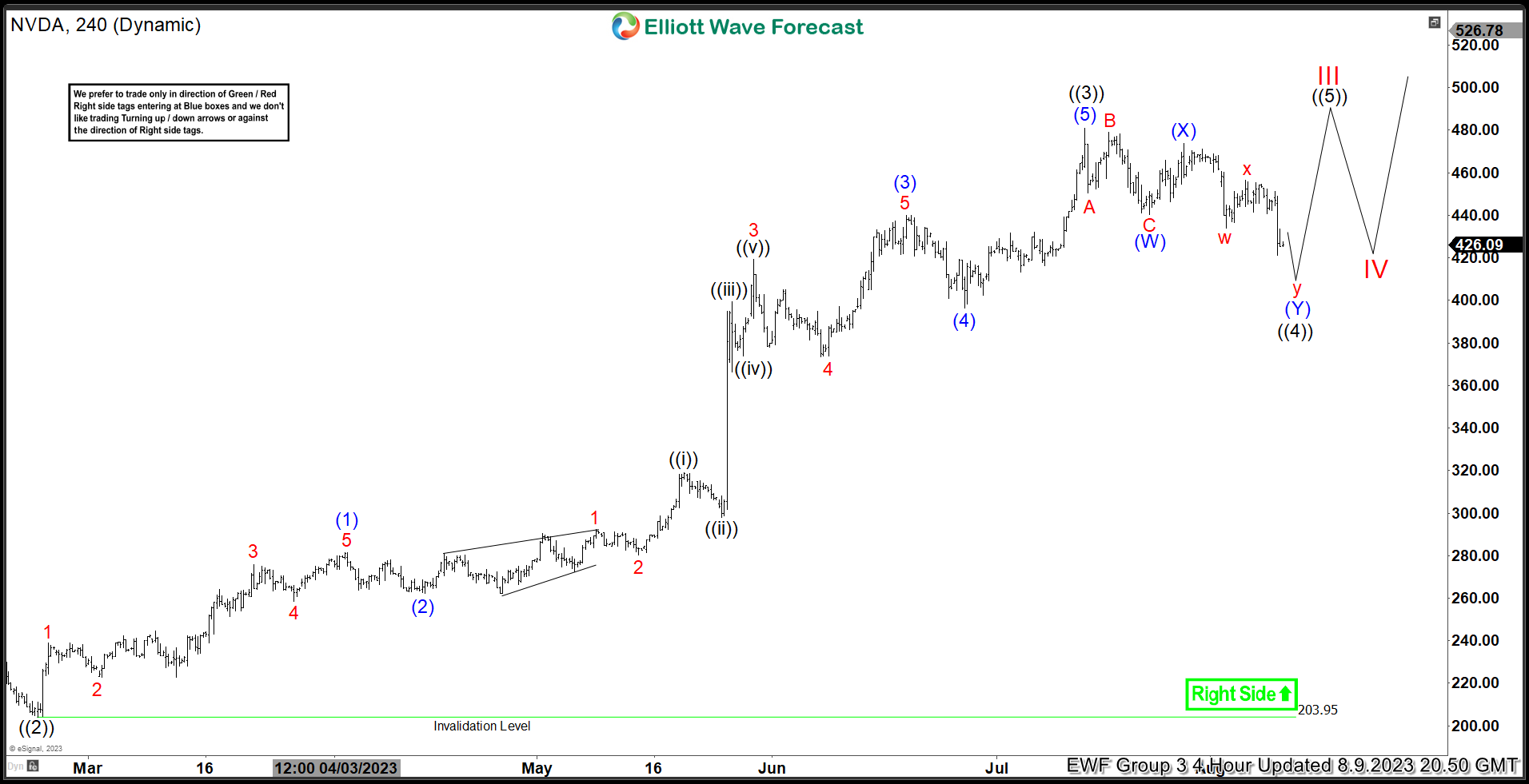

NVDA (Nvidia Corp) Reached Warning Areas But Showing The Future Path

Read MoreNvidia (NVDA) has been one of the most Technical symbols across the market. The symbol reacted off the Blue Box (High-Frequency). We presented this area to members on 10.2022. The instrument corrected the Grand Super Cycle and was a unique opportunity to buy the trend. As expected, the rally happened and reached the extreme area […]

-

Eli Lilly & Company (LLY) Remains Supported In Bullish sequence

Read MoreEli Lilly & Company (LLY) discovers, develops & markets human pharmaceuticals worldwide. It is based in Indianapolis, Indiana, US, comes under Healthcare sector & trades as “LLY” ticker at NYSE. As shown from previous article, LLY favors higher in ((3)) of III as the part of impulse sequence & expect to extend towards 584 or […]

-

Tesla (TSLA) Correction Remains in Progress

Read MoreTesla (TSLA) cycle from July 19, 2023 high remains incomplete and favors more downside. This article and video look at the Elliott Wave path.

-

NVIDIA Corp. ($NVDA) Found Buyers After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4 Hour Elliott Wave chart of NVIDIA Corp. ($NVDA) The rally from 10.13.2022 low unfolded as a 5 wave impulse breaking to new all time highs with an incomplete bullish sequence from 2.28.2023 low. So, we expected the pullback to unfold […]