The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Tesla (TSLA) Impulsive Rally Should Continue Higher

Read MoreTesla (TSLA) looking to extend higher as an impulse structure. This article and video look at the Elliott Wave path of the stock.

-

VanEck Gold Miners ETF ($GDX) Reacts Lower From The Blue Box Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of VanEck Gold Miners ETF ($GDX). The pullback from 7.18.2023 high unfolded as a 5 wave impulse with an incomplete bearish sequence from 5.04.2023 high. So, we advised members to sell the bounce in 3 swings […]

-

AT&T (T) Ended A Cycle Possible Corrective Bounce Ahead

Read MoreAT&T Inc. (T) is an American multinational telecommunications holding company headquartered in Dallas, Texas. It is the world’s largest telecommunications company by revenue and the third-largest provider of mobile telephone services in the U.S. T Monthly Chart Septembre 2023 In the monthly chart above, we can see that AT&T shares finished an all-time high with […]

-

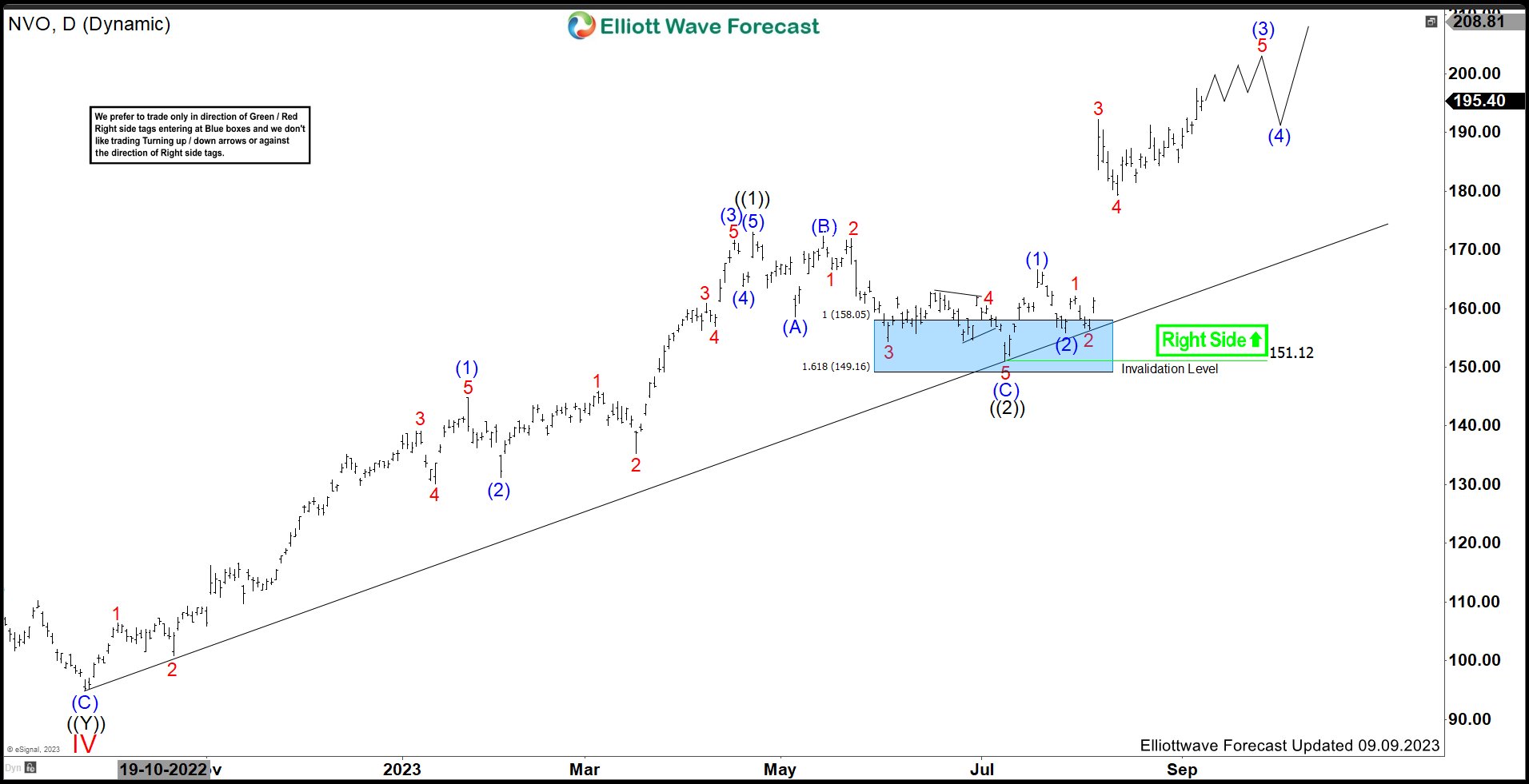

Novo Nordisk (NVO) Reacted Higher From Support Area

Read MoreNovo Nordisk A/S (NVO), a healthcare company engages in the research, development, manufacture & marketing of the pharmaceutical products worldwide. It operates in two segments, Diabetes & Obesity care & Biopharm. It is based in Denmark, comes under Healthcare – Biotechnology sector & trades as “NVO” ticker at NYSE. As mentioned in the previous article, […]

-

Elliott Wave Analysis Offers Insight into LVS’s Potential Trajectory

Read MoreLas Vegas Sands Corp. (NYSE: LVS), a prominent player in the global integrated resort industry, has seen its fortunes shift amidst changing landscapes in the world of entertainment and hospitality. This article delves into the present Elliott Wave analysis for the stock, exploring two potential pathways based on Elliott Wave Theory and future prospects. Examining LVS’s […]

-

Nikkei Futures (NKD) Looking to Extend Higher as an Impulse

Read MoreNikkei Futures (NKD) rallies higher as an impulse Elliott Wave structure. This article and video look at the Elliott Wave path.