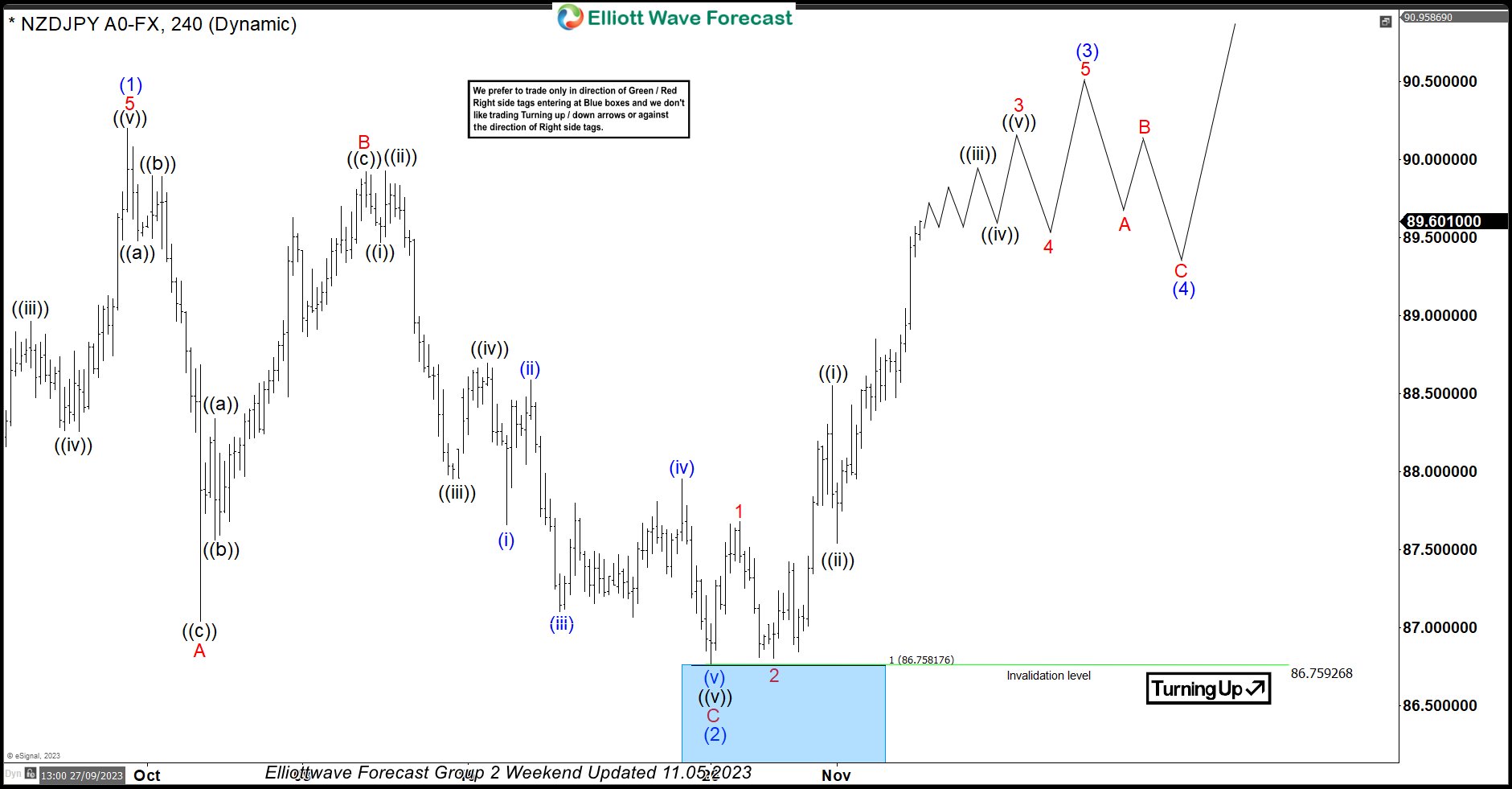

In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

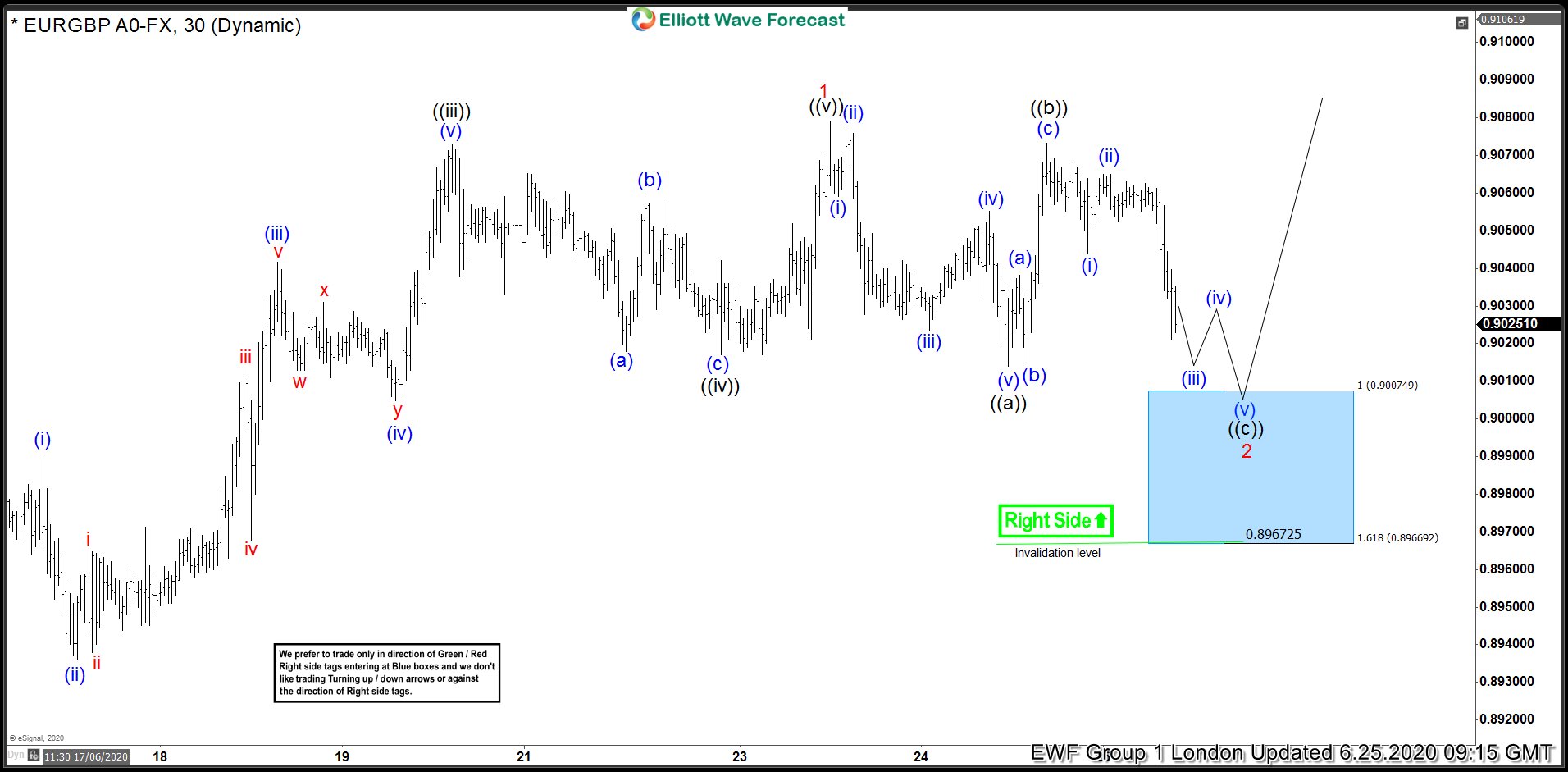

EURGBP Resume Higher After Buyers Appear At Blue Box Area

Read MoreIn this blog, we are going to take a look at the Elliott Wave chart of EURGBP. The 1 hour London chart update from June 25, 2020 shows that the pair has ended the cycle from June 9 low in wave 1 at 0.9078 high. The rally unfolded as 5 waves impulse Elliott Wave Structure. […]

-

Bullish Sequence in EURGBP Favors More Upside

Read MorePound Sterling declined against a basket of currencies last week after a series of negative news. First of all, Bank of England (BOE) decided to increase quantitative easing by £100BN, putting pressure to Pound Sterling. Secondly, the deadlock in EU and UK trade negotiations over Brexit would likely persist until the year-end. Then finally, Bank of […]

-

Elliott Wave View: EURJPY Can See More Downside

Read MoreEURJPY decline from 6/5 high is unfolding as an impulse and can see further downside while below 6/16/2020 high.This article looks at the Elliott Wave path.

-

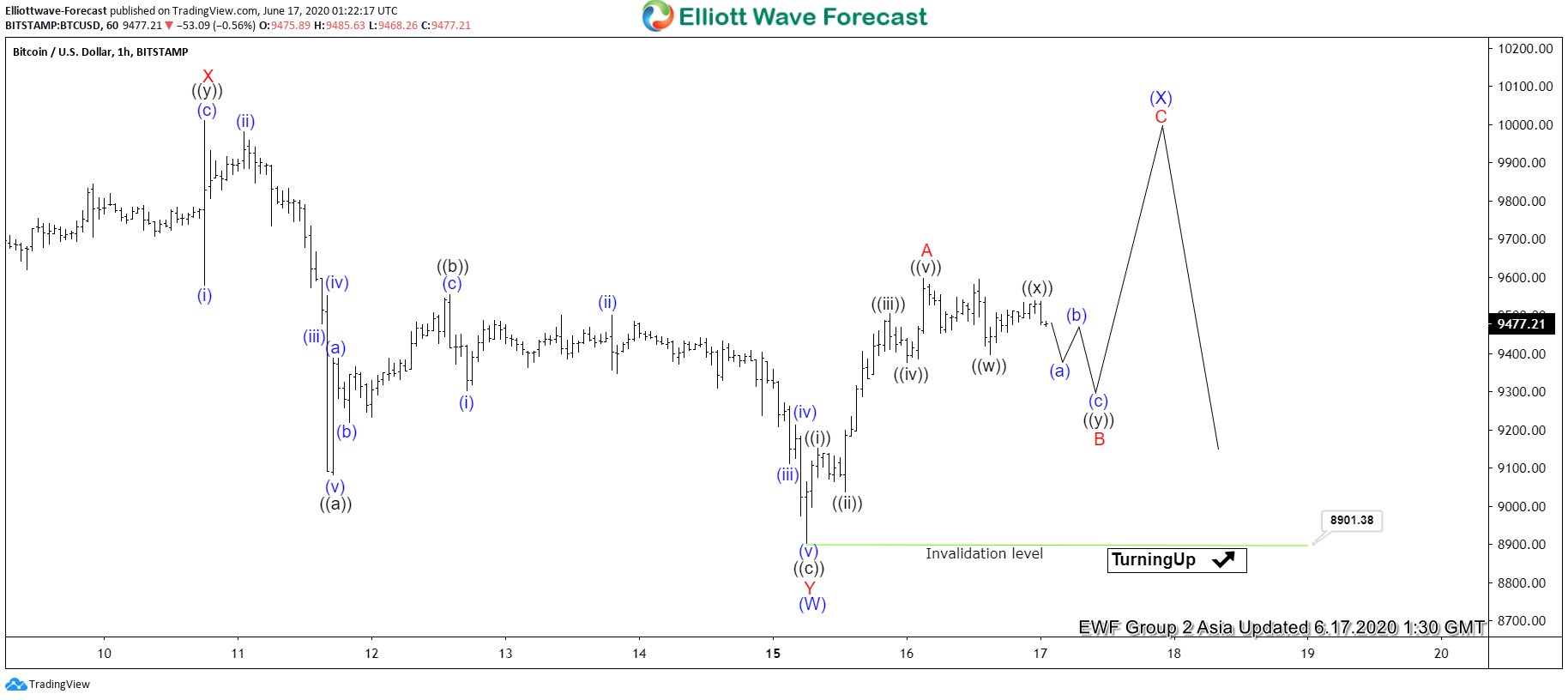

Elliott Wave View: Bitcoin shows short term impulse up

Read MoreBitcoin (BTC/USD) is currently correcting the cycle from 3.13.2020 low. The instrument has just ended cycle from 6.1.2020 high (10429) as a double three structure. Down from 6.1.2020 high, wave W ended at 9135 low. The bounce in wave X ended at 10011 high. From there, the instrument extended lower and ended wave Y at […]

-

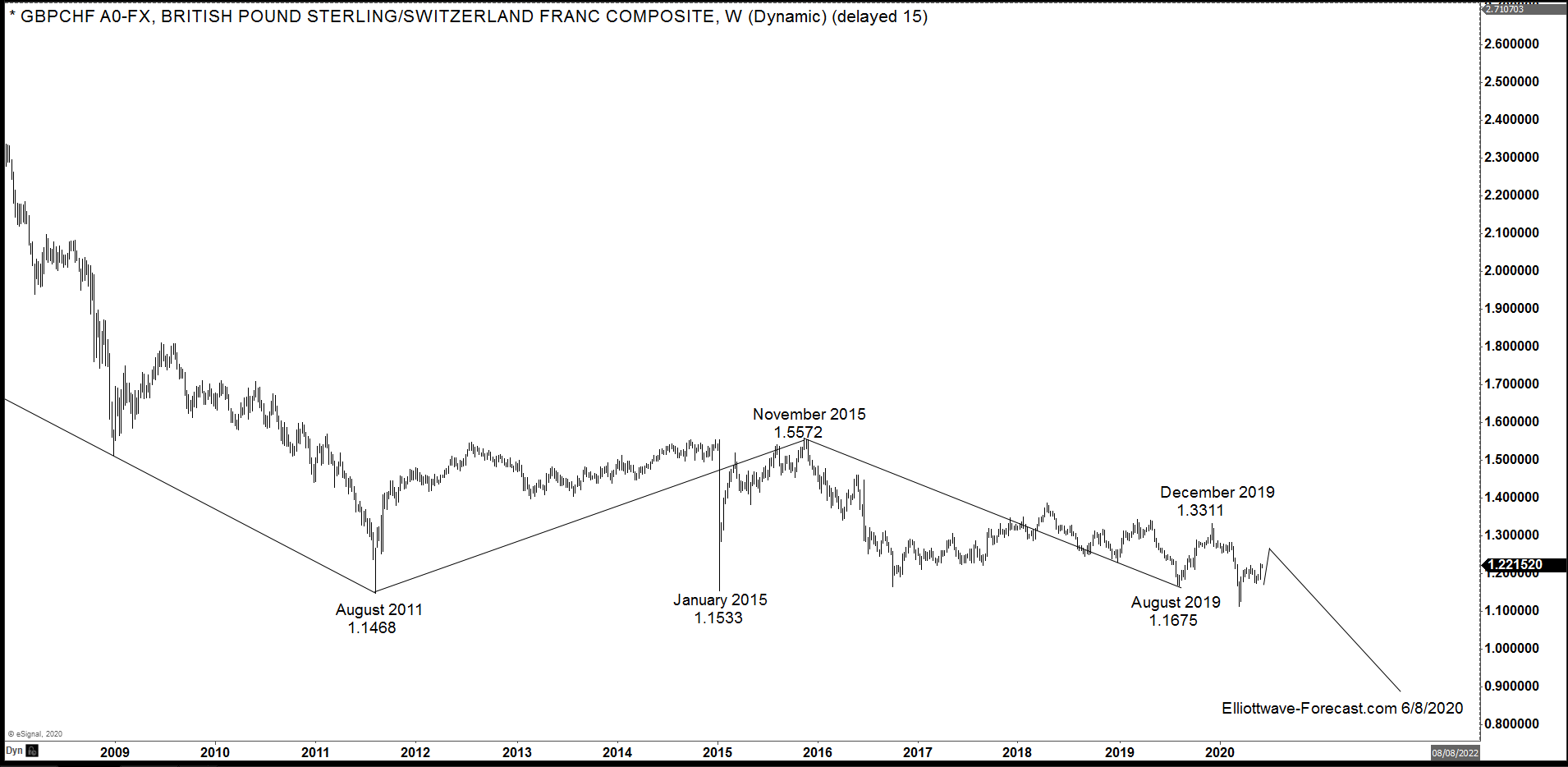

$GBPCHF FX Pair Swings & Long Term Cycles

Read More$GBPCHF FX Pair Swings & Long Term Cycles Firstly as seen on the monthly chart below there is data back to the early 1970’s readily available in the pair. It obviously had a central bank intervention during the month of October 1974 where price topped out at 6.3387. Most all Elliott Wave practitioners are geared […]

-

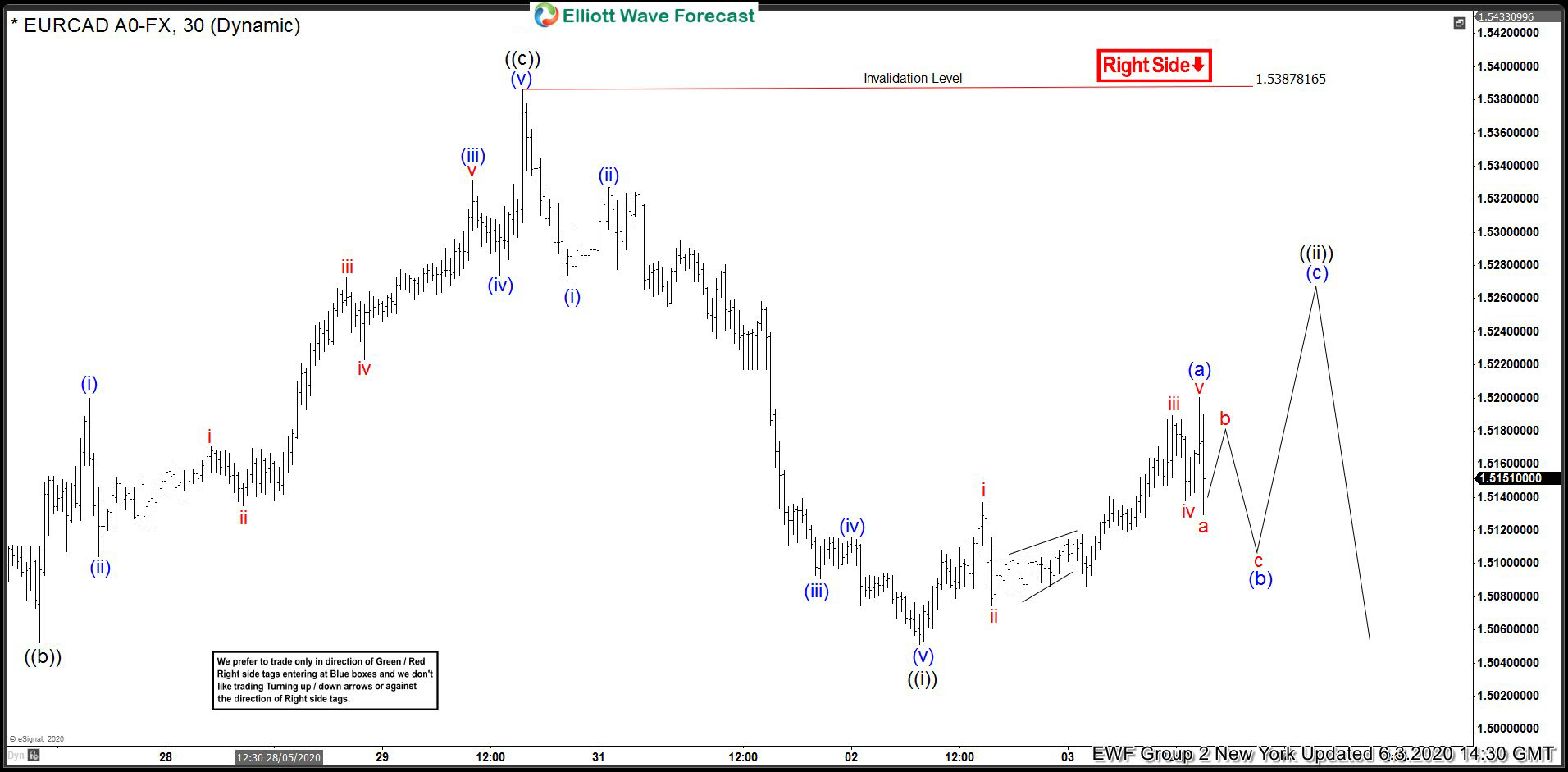

EURCAD Forecasting The Decline After Elliott Wave Zig Zag

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURCAD. As our members know, recently the pair gave us 3 waves bounce against the 1.53878 peak. Recovery unfolded as Elliott Wave Zig Zag pattern (a)(b)(c). Once the price reached equal legs (a)-(b) we knew […]