In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Best Forex Currency Pairs to Trade in 2024

Read MoreFrom Sunday evening through Friday night, the currency market is open 24 hours a day, taking advantage of the international time zone disparities between London, Tokyo, and New York. Because currency traders can open and cancel positions at any time of the day without other markets’ constraints, forex market hours are considered more flexible. There […]

-

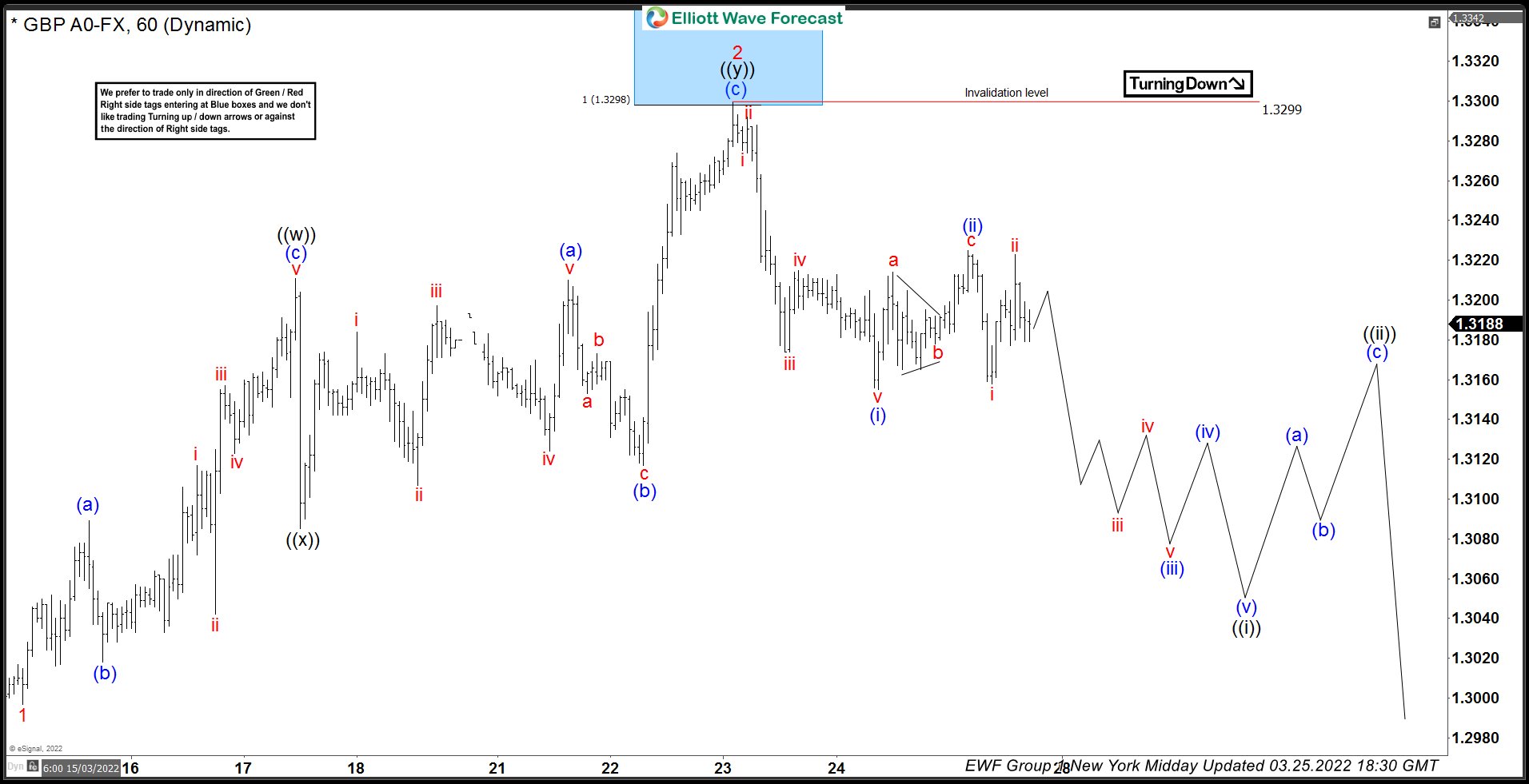

GBPUSD Elliott Wave : Forecasting The Short Term Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPUSD. The pair has given us nice trading opportunity recently. We have been selling the rallies at 1.3298-1.3348 area as explained in previous article on GBPUSD . Reasons for calling further weakness in pair are […]

-

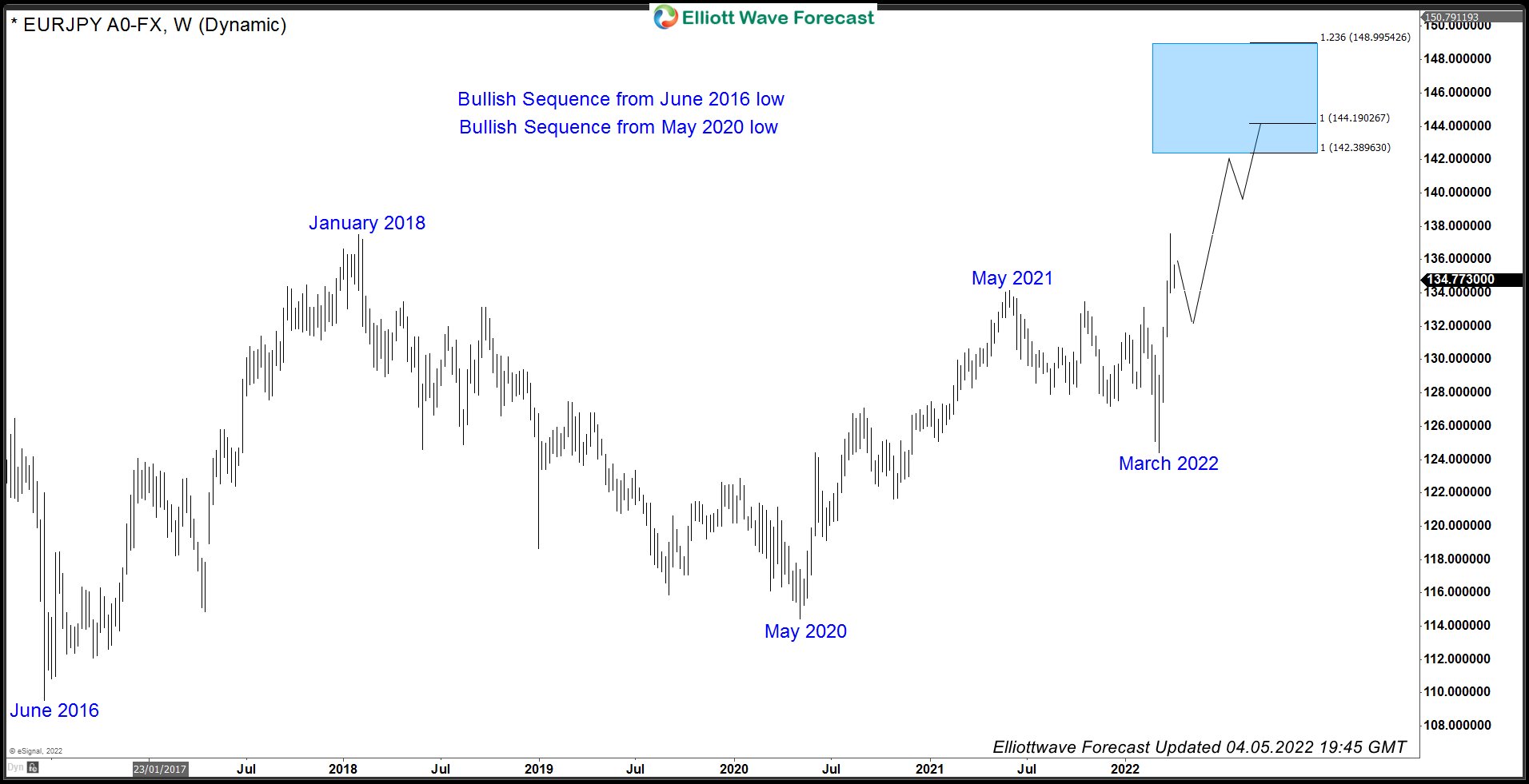

EURJPY Incomplete Bullish Sequence Calls for More Upside

Read MoreEURJPY has rallied 1300+ pips during three weeks of March. It found a low at 124.39 on March 7, 2022 and reached a high of 137.54 on March 28, 2022. This equates to 10.57% gain within just three weeks. It seems to have ended a cycle from March 7, 2022 low and pulling back. In […]

-

Elliott Wave View: Dollar Index (DXY) Resumes Higher

Read MoreDXY has started a new leg higher and rally from March 30 low looks impulsive favoring more upside. This article and video look at the Elliott Wave path.

-

How Ruble Might Put a Floor in Gold and Vice Versa

Read MoreThe U.S. and its allies have administered economic and financial sanction to Russia as a result of the invasion to Ukraine. As part of this comprehensive sanction, US and its allies barred some of Russia’s banks from the SWIFT international payment system. Moreover, the Western countries have frozen most of $630 billion Russian Central Bank’s […]

-

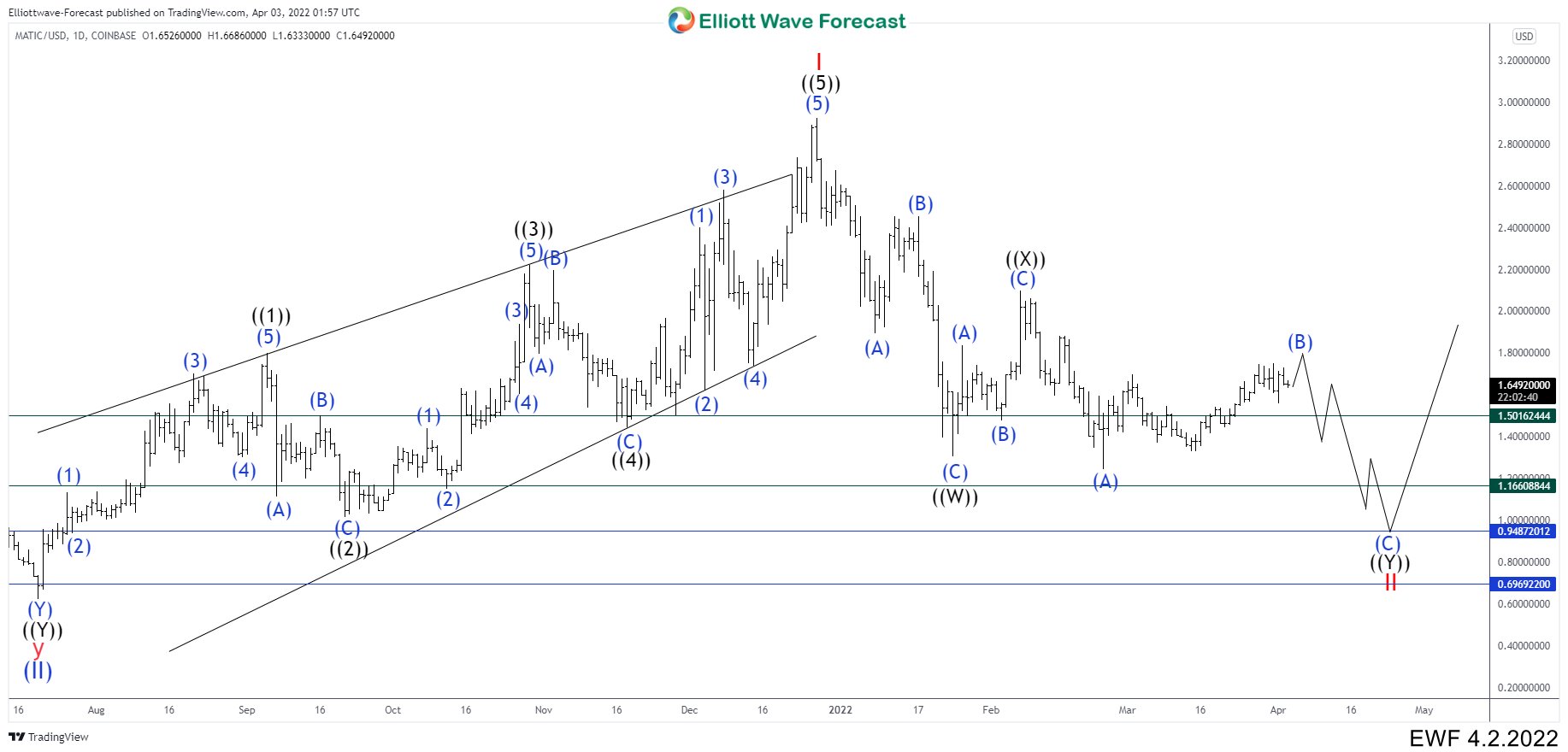

Polygon (MATICUSD) A Double Correction Is Under Way

Read MorePolygon (formerly Matic Network, MATICUSD) is a Layer 2 scaling solution backed by Binance and Coinbase. The project seeks to stimulate mass adoption of cryptocurrencies by resolving the problems of scalability on many blockchains. Polygon combines the Plasma Framework and the proof-of-stake blockchain architecture. MATICUSD January Daily Chart MATICUSD started a rally from July 20th 2021 low. […]