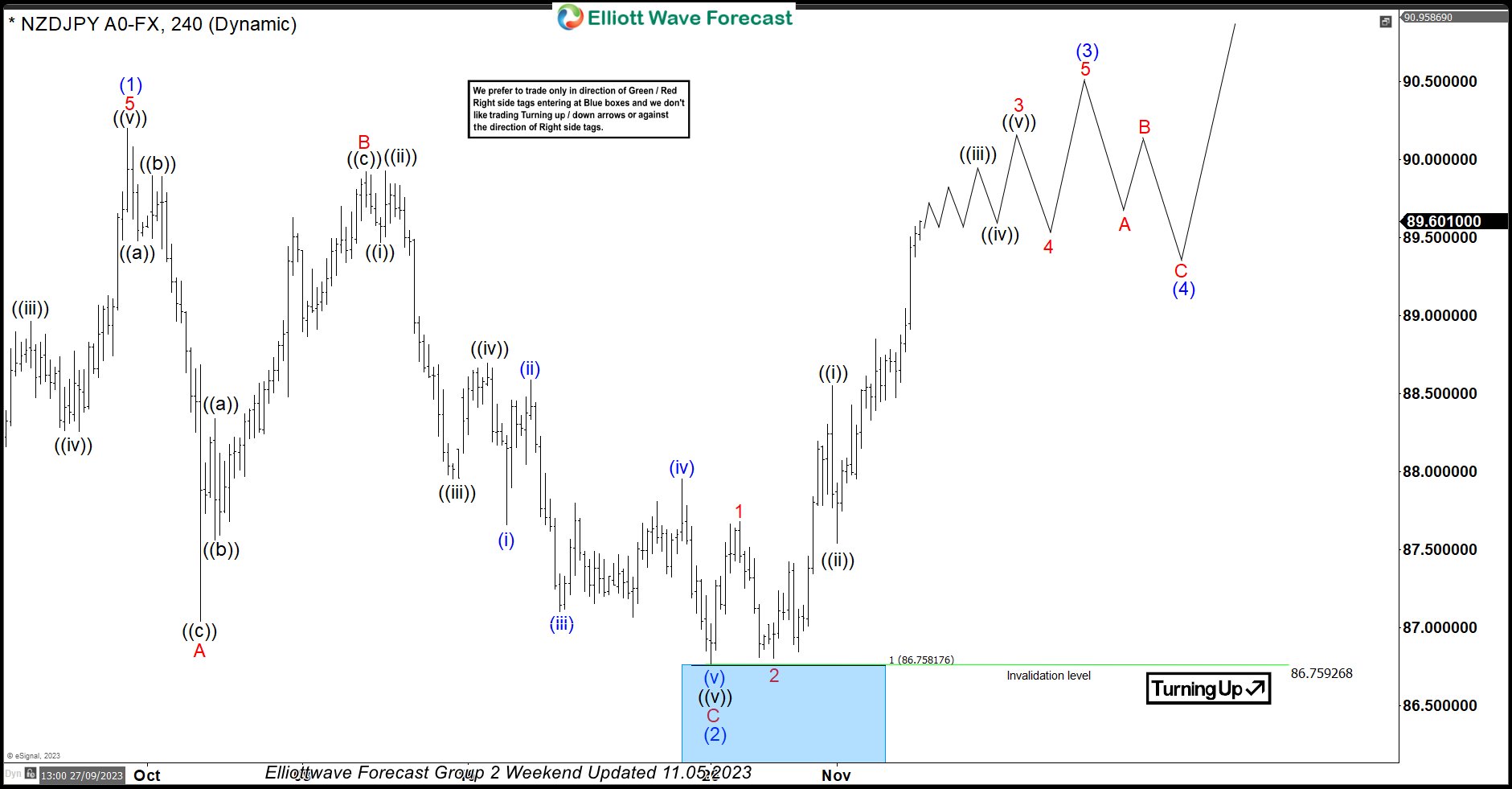

In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

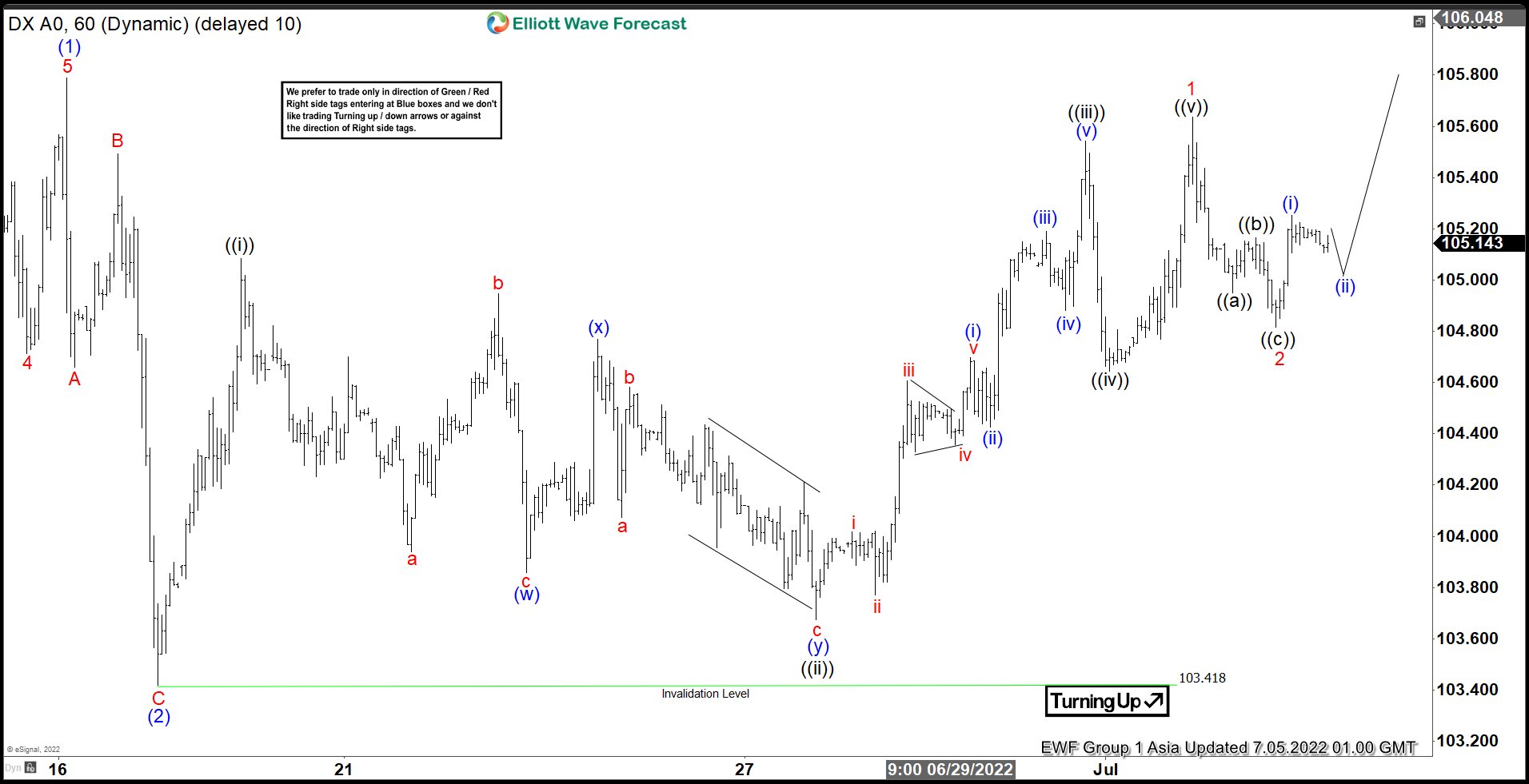

Elliott Wave View: Dollar Index (DXY) Remains Bullish

Read MoreDollar Index (DXY) continues to make higher high and higher low and it should remain bullish. This article and video look at the Elliott Wave path.

-

EURNZD Buying The Dips At The Blue Box Area

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of EURNZD published in members area of the website. As our members knew, we’ve been favoring the long side in EURNZD since it broke above May 12, 2022 high. Break of May 12, 2022 high created an incomplete bullish sequence in […]

-

USDCAD Is Showing Reaction From The Blue Box Area

Read MoreHello fellow traders. USDCAD has given us another trading opportunity recently. As our members know, we’ve been favoring the long side in USDCAD and buying the dips in 3,7,11 swings. Reason for expecting further rally is incomplete bullish structure the pair is showing in the weekly cycle from the 05.30. low . In this technical […]

-

CHFJPY – Taking Advantage of Weakening Yen

Read MoreWe saw a surge in the market in CHFJPY last week. First time since 2007, SNB have increased their interest rate by 50 basis points. This occurred as soon as the FED raised their interest rates. Therefore, the next step was us to wait for a 3 or a 7 swing correction. A good way […]

-

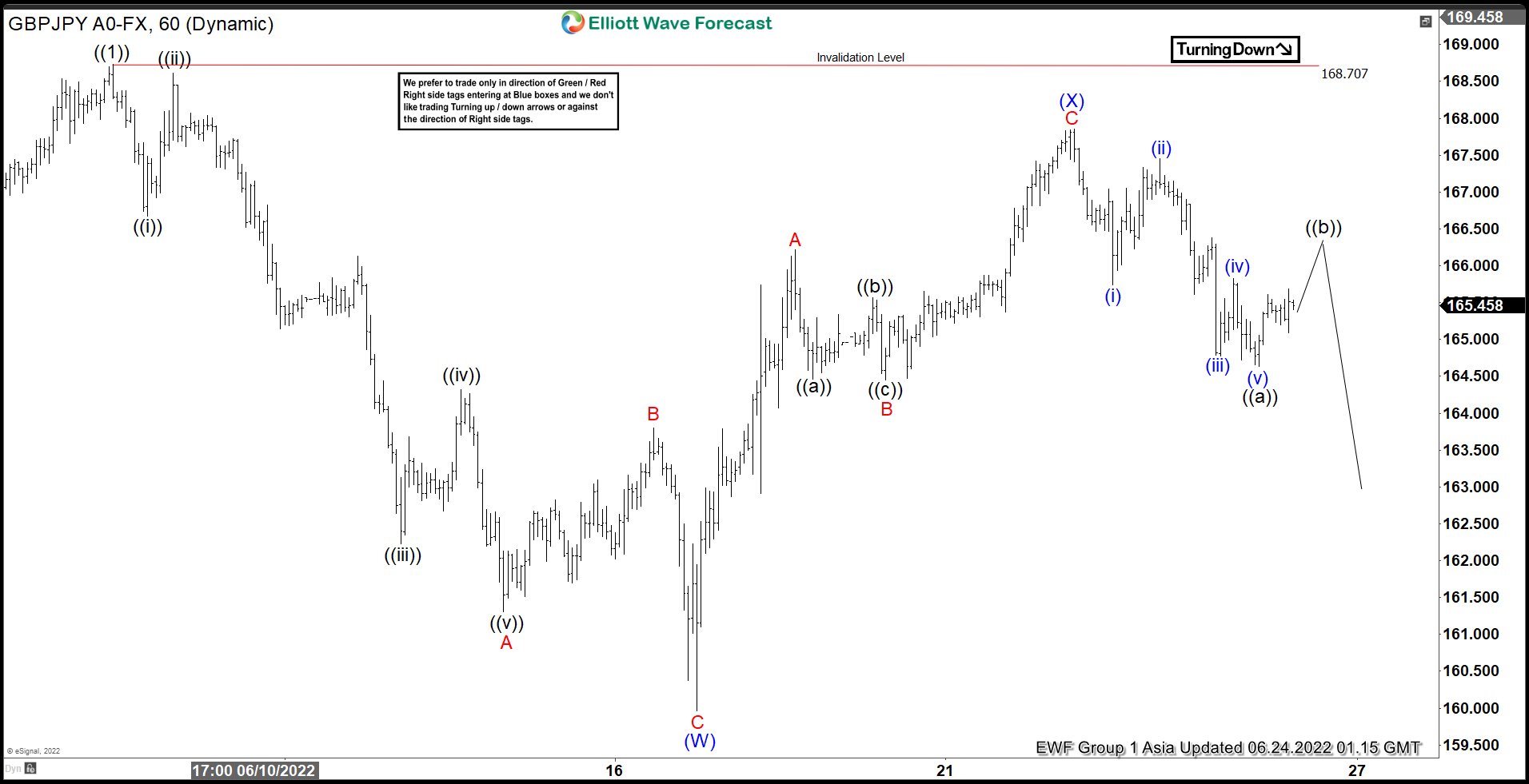

Elliott Wave View: GBPJPY Correction Can Extend

Read MoreShort term Elliott Wave in GBPJPY suggests cycle from 12/3/2021 low has ended as wave ((1)) with the rally to 168.7. Wave ((2)) pullback is currently in progress to correct cycle from December 2021 low. Internal subdivision of wave ((2)) is unfolding as a double three Elliott Wave structure. Down from wave ((1)), wave A […]

-

USDNOK – Dollar Sees a Reaction from Blue Box

Read MoreWe have been pretty bullish on the USDNOK throughout the year and Dollar has more strength to come to support this pair. Recently, we posted a trade idea on USDNOK that the market was correcting in a 3 or 7 swing structure and we took advantage of this. This has been a pretty successful trade […]