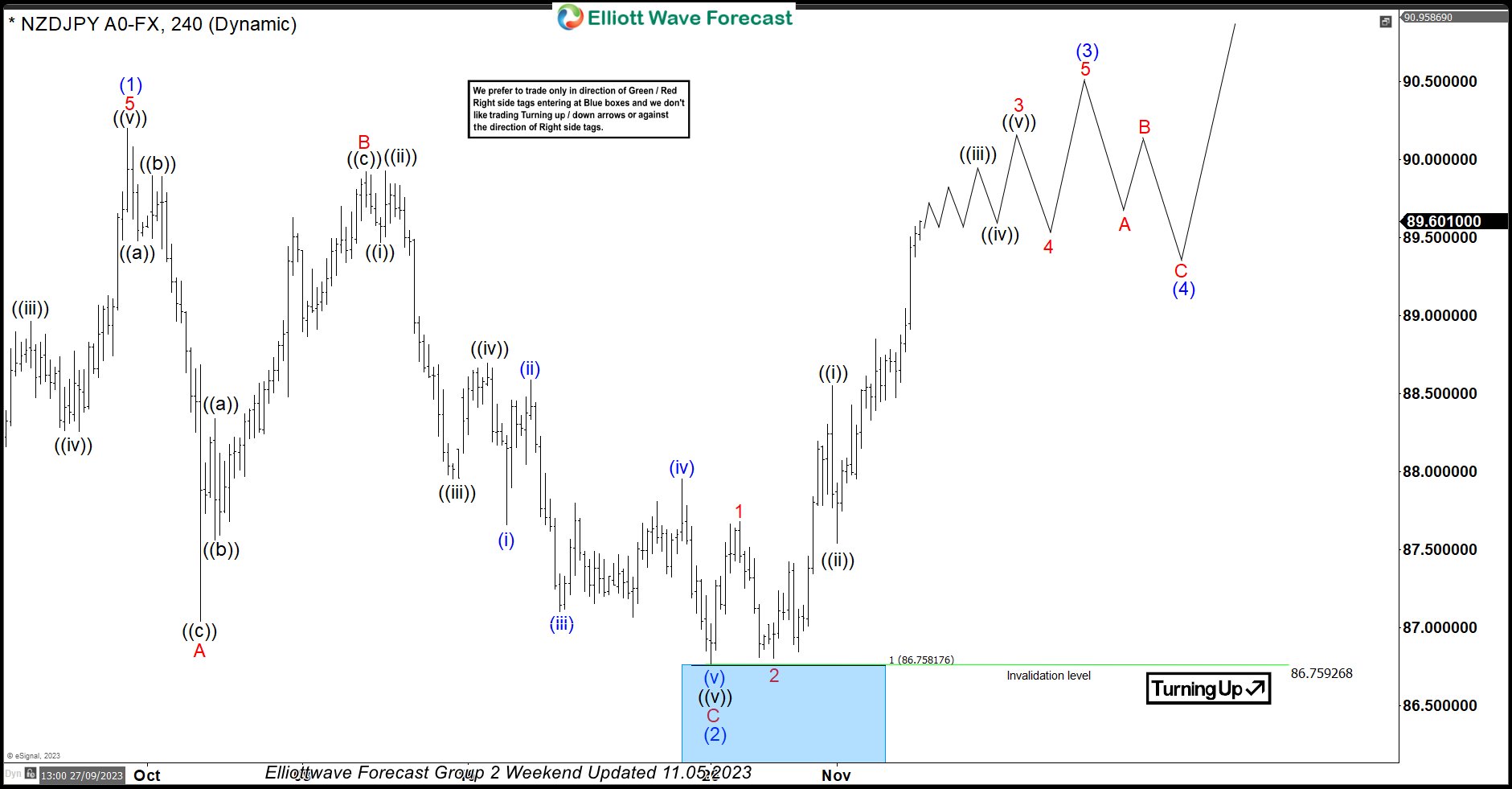

In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

NZDCAD Medium Term Elliottwave Analysis 10.6.2015

Read MoreThis is a medium term Elliottwave Analysis video on $NZDCAD. Bias is to the downside as far as 0.883 pivot stays intact. EWF currently covers 50 instrument ranging from forex, indices, and commodities in 4 different time frames. We just recently added 8 more instrument in EWF Plus Plan ($AUDCAD, $AUDNZD, $EURCAD, $EURNZD, $USDSEK, $GBPCAD, Apple, Coffee). […]

-

GBPCAD Short Term Elliott Wave Analysis 10.6.2015

Read MoreBest reading of the cycle suggests that rally to 2.057 ended wave X. From this level, the pair resumed the decline in wave ((w)) as a double three structure wxy where wave w ended at 2.0168, wave x ended at 2.04, and wave y of ((w)) is in progress towards 1.97 – 1.979 area. Once wave […]

-

$EURGBP Ending Diagonal structure

Read MoreElliott Wave Ending diagonal is 5 wave structure which often occurs in last wave C of Flat pattern. Ending Diagonal has 3-3-3-3-3 subdivision, as each of these 5 waves is corrective structure (ABC, WXY or WXYXZ) Let’s take a quick look at Elliott Wave charts of $EURGBP to see what Ending Diagonal looks like and […]

-

$AUDUSD Trading Plan Recap

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. AUD/USD Live […]

-

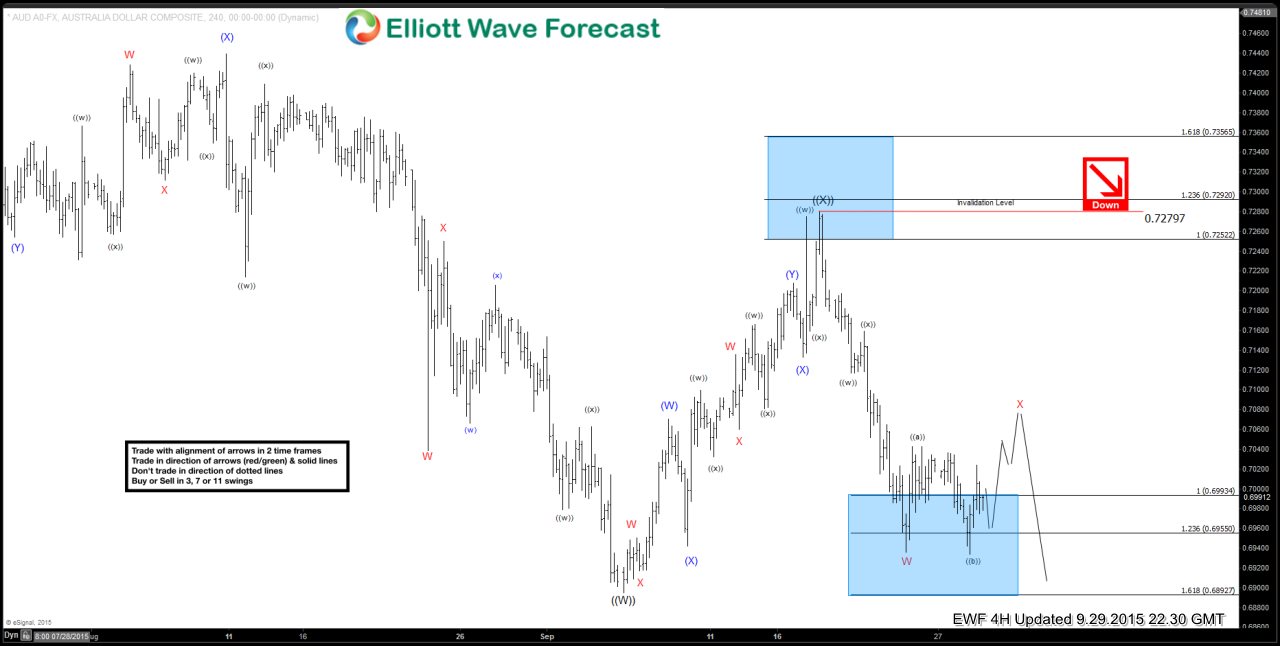

$AUDCAD Medium Term Elliottwave Analysis 9.29.2015

Read MoreThis is a medium term Elliottwave Analysis video on $AUDCAD. Wave (X) bounce is likely still in progress to correct the decline from 1.0345, and more downside is likely after wave (X) bounce is complete. As more downside is still expected at a later stage, we don’t like buying the proposed wave (X) bounce. EWF currently covers […]

-

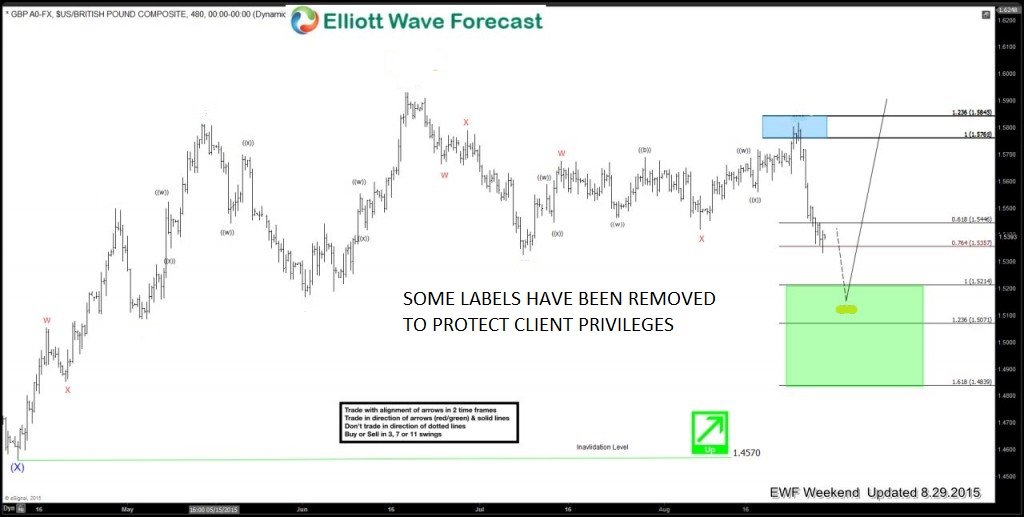

GBPUSD: Anticipating the Bounce for a Swing Move Higher

Read MoreAt EWF we are not just a market forecasting service, we also try to guide our clients to trade on the right side of the markets. And if our 24 hour chatroom, technical and trade setup videos, live analysis sessions, live trading room, educational videos and market reports are not enough enough, we also added Green Boxes(Buy […]