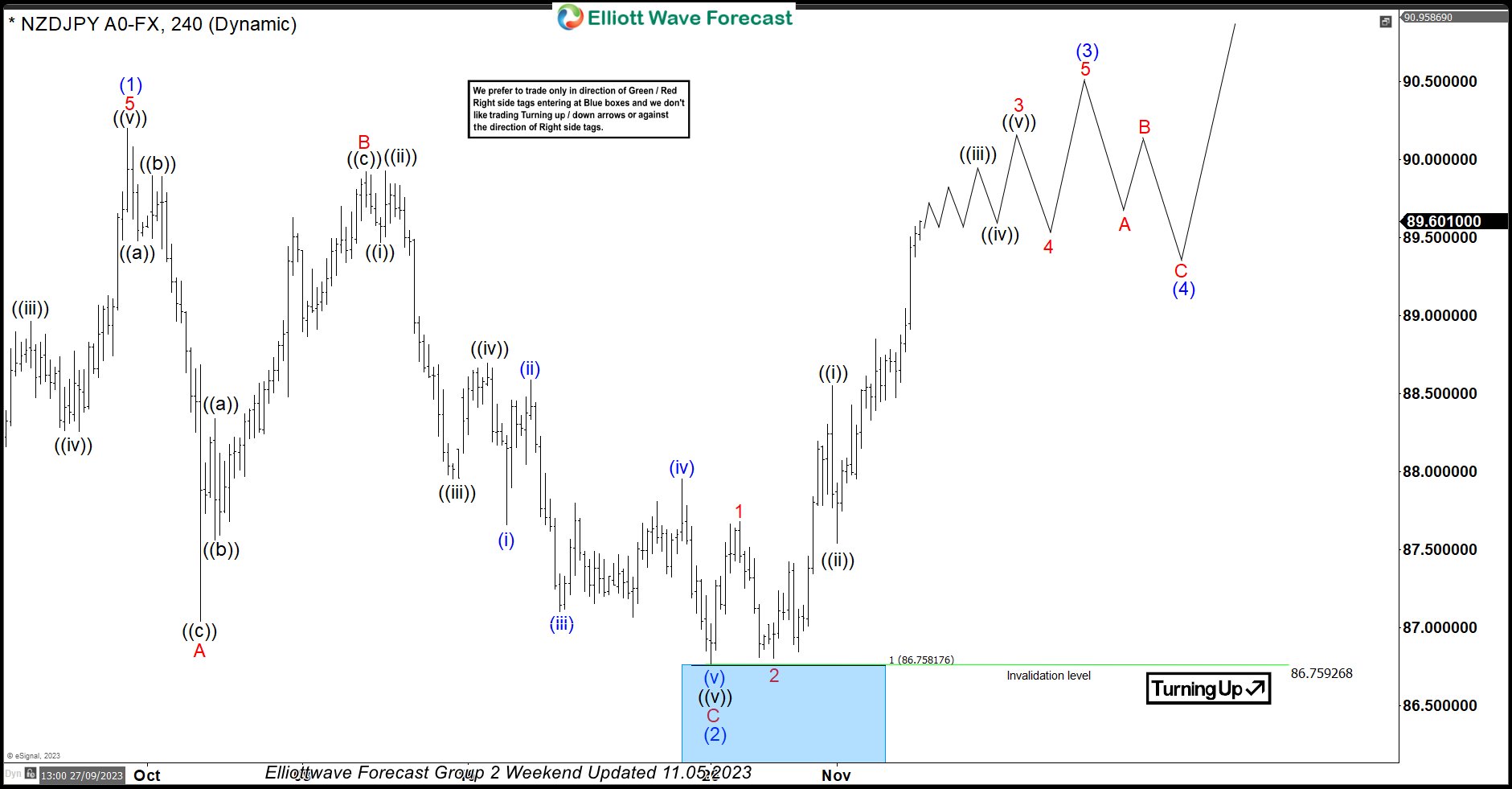

In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

$GBPAUD Short-term Elliott Wave Analysis 7.21.2016

Read MoreShort term Elliottwave structure suggests rally from 7/11 low is unfolding as a double correction where wave W ended at 1.763 and wave X pullback ended at 1.731. From there, pair resumes rally where wave ((w)) ended at 1.777 and wave ((x)) pullback is currently in progress in 3, 7, or 11 swing to correct the rally from 1.731 before […]

-

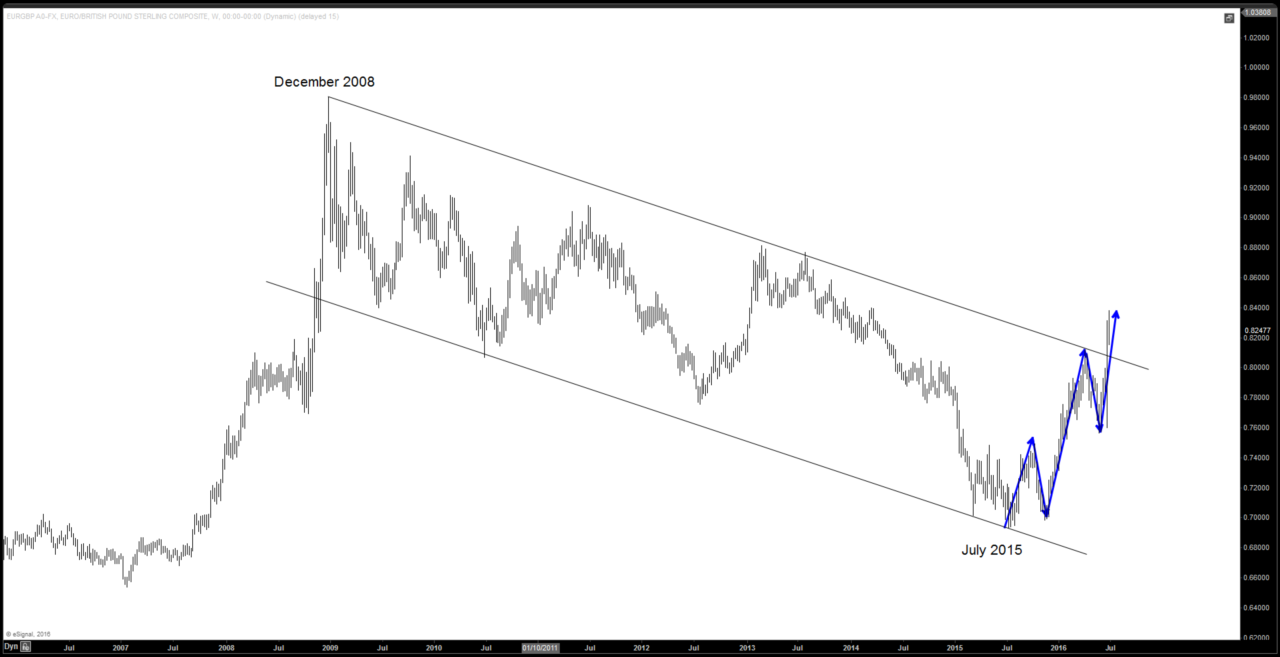

Yen weakness may be temporary

Read MoreDefying many market participants that anticipate a fallout after the unexpected Brexit vote, many risk assets including stock markets and Yen pairs continue to show strength after a few days of pullback. U.S. Indices prove to be resilient and continue to make new all-time highs. The turning point in the sentiment seems to be right after Japanese Prime Minister Shinzo Abe won […]

-

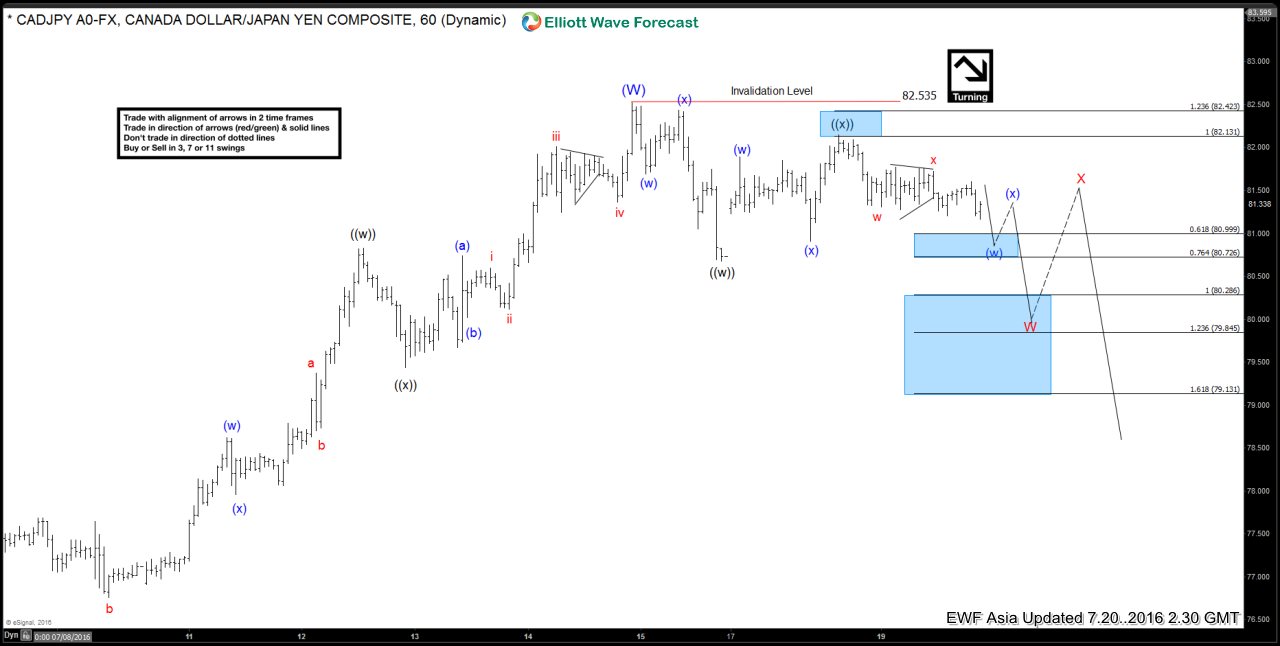

$CADJPY Short-term Elliott Wave Analysis 7.20.2016

Read MoreShort term Elliottwave structure suggests rally to 82.53 ended wave (W). Decline from there is unfolding as a double correction where wave ((w)) ended at 80.67 and wave ((x)) ended at 82.15. While pair stays below 82.15, and more importantly as far as 82.53 pivot stays intact, expect pair to resume lower. Initial target lower for wave […]

-

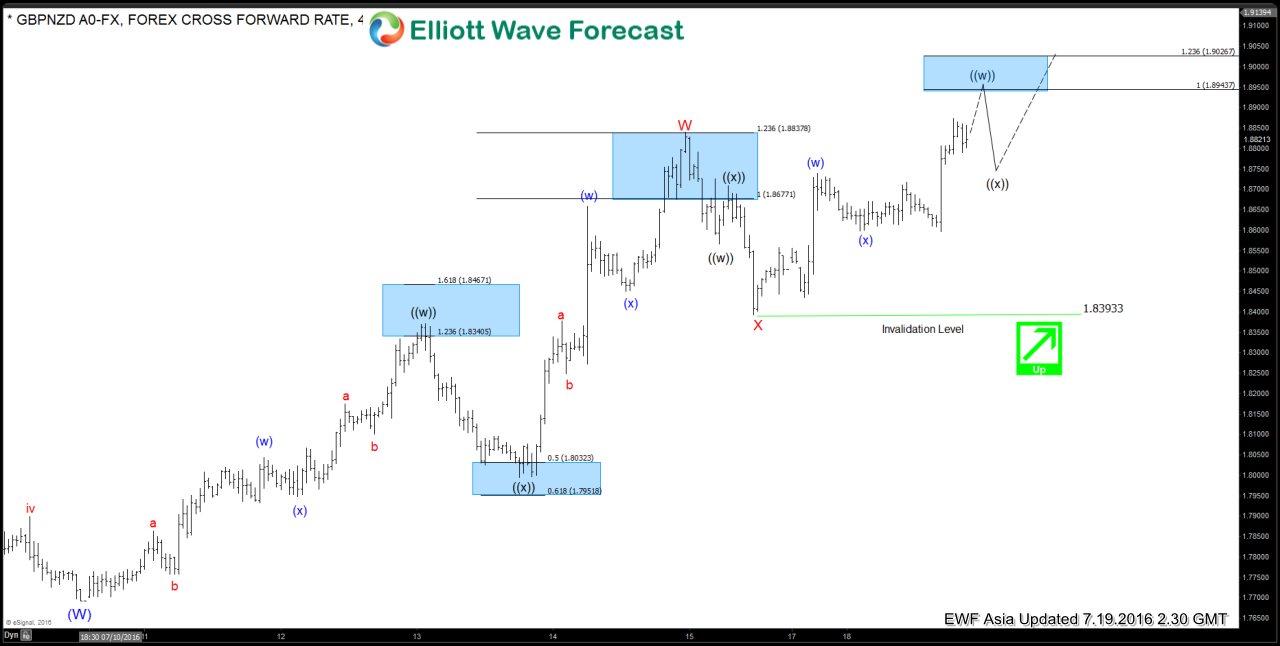

$GBPNZD Short-term Elliott Wave Analysis 7.19.2016

Read MoreShort term Elliottwave structure suggests cycle from 7/9 low is unfolding as a double three where wave W ended at 1.884 and wave X ended at 1.839. Rally from 1.839 is in progress as a double three where wave ((w)) is expected to complete at 1.894 – 1.9026 area, then it should pullback in wave ((x)) […]

-

Potential Impacts of Brexit

Read MoreMarket Impacts The market got off guard with the outcome of the UK referendum to leave European Union. One of the biggest casualties is Poundsterling which tumbled 8% on Friday last week, the biggest single day drop on record. The currency hit 31 year low and momentum and also technicals suggest more weakness is likely. Global equities, […]

-

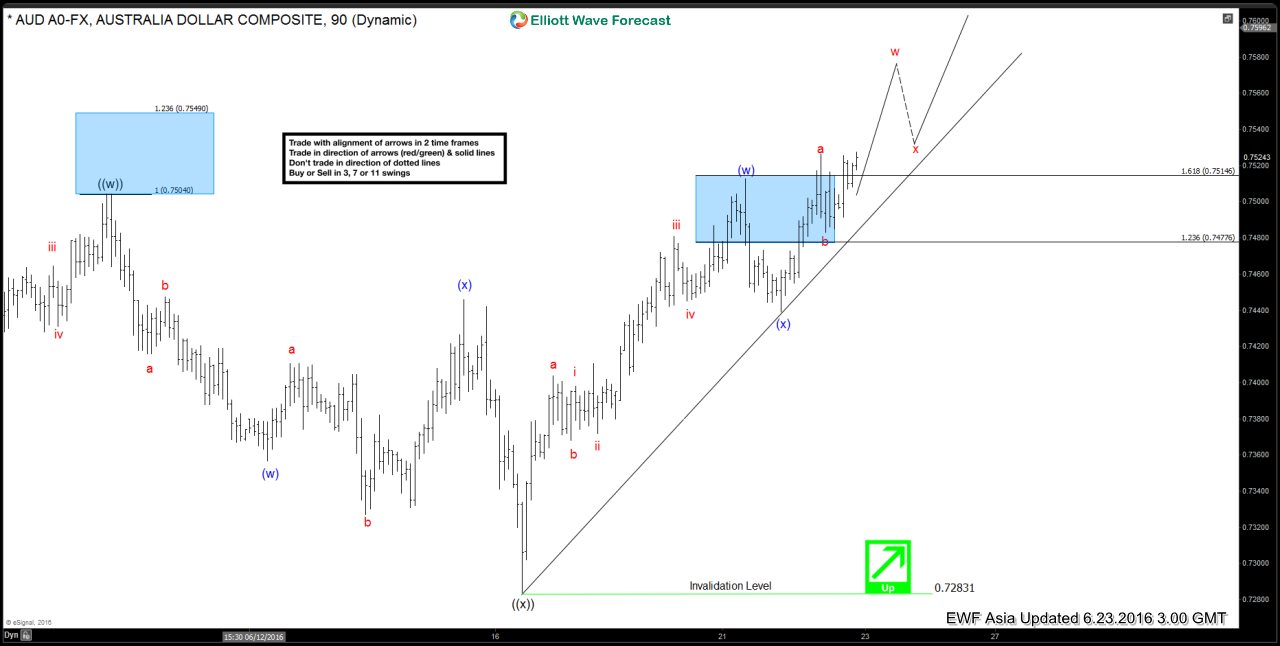

$AUDUSD Short-term Elliott Wave Analysis 6.23.2016

Read MoreShort term Elliottwave structure suggests rally to 0.7504 ended wave ((w)), and pullback to 0.7283 ended wave ((x)). From 0.7283 low, pair ended wave (w) higher at 0.7512, and we take the more aggressive view and call wave (x) pullback completed at 0.7439 as pair has since broken above 0.7512 again. While pair now stays above wave (x) […]