In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

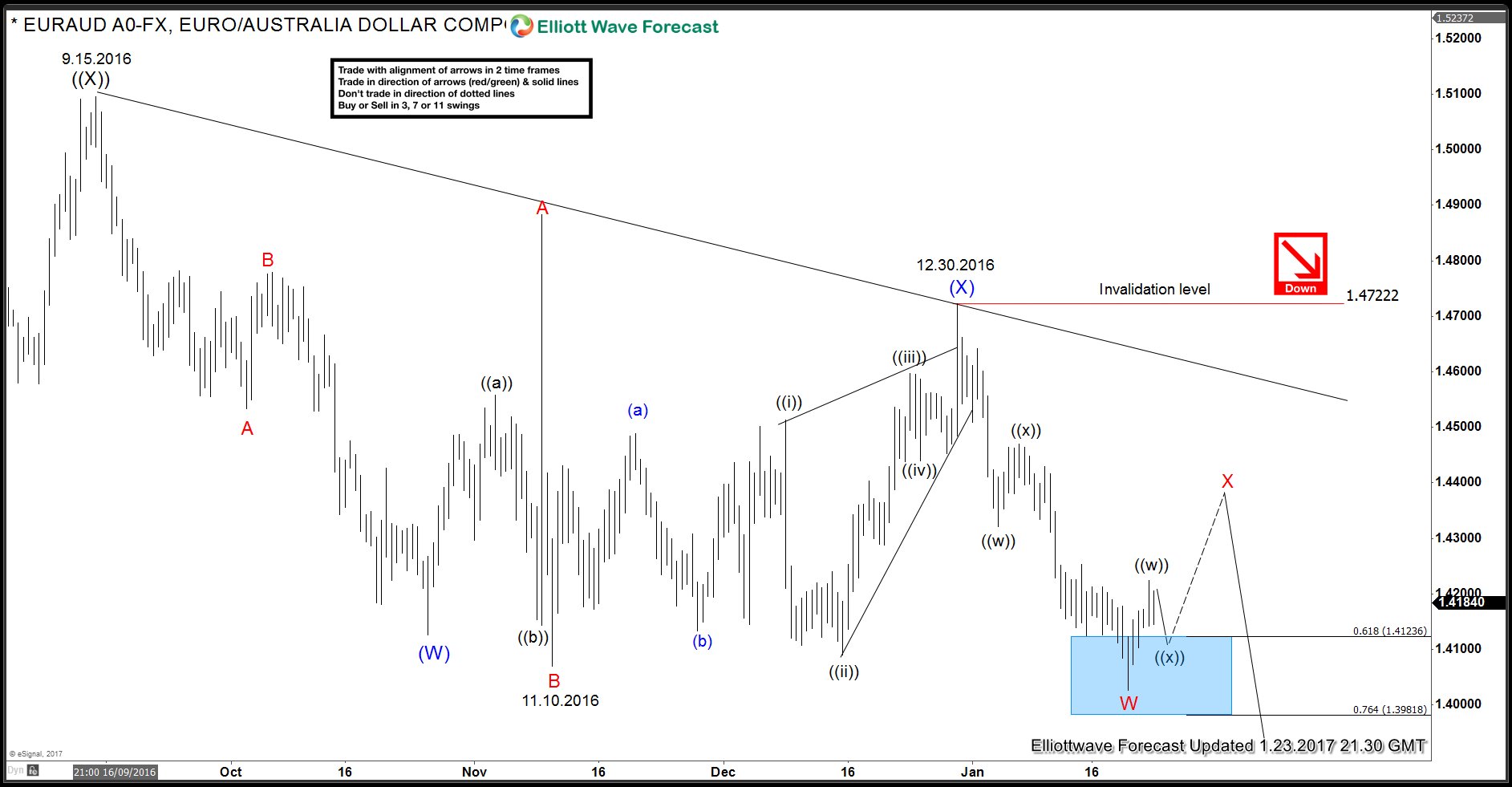

EURAUD: More downside after a bounce

Read MoreEURAUD has been in a steady downtrend since forming a peak on 8/24/2015 (1.6585). Although, pair is very close to 100% Fibonacci extension down from 8/24/2015 peak, Elliott wave sequence to the downside is incomplete and is calling for rallies to prove corrective and result in more downside in the pair. Last week, pair broke […]

-

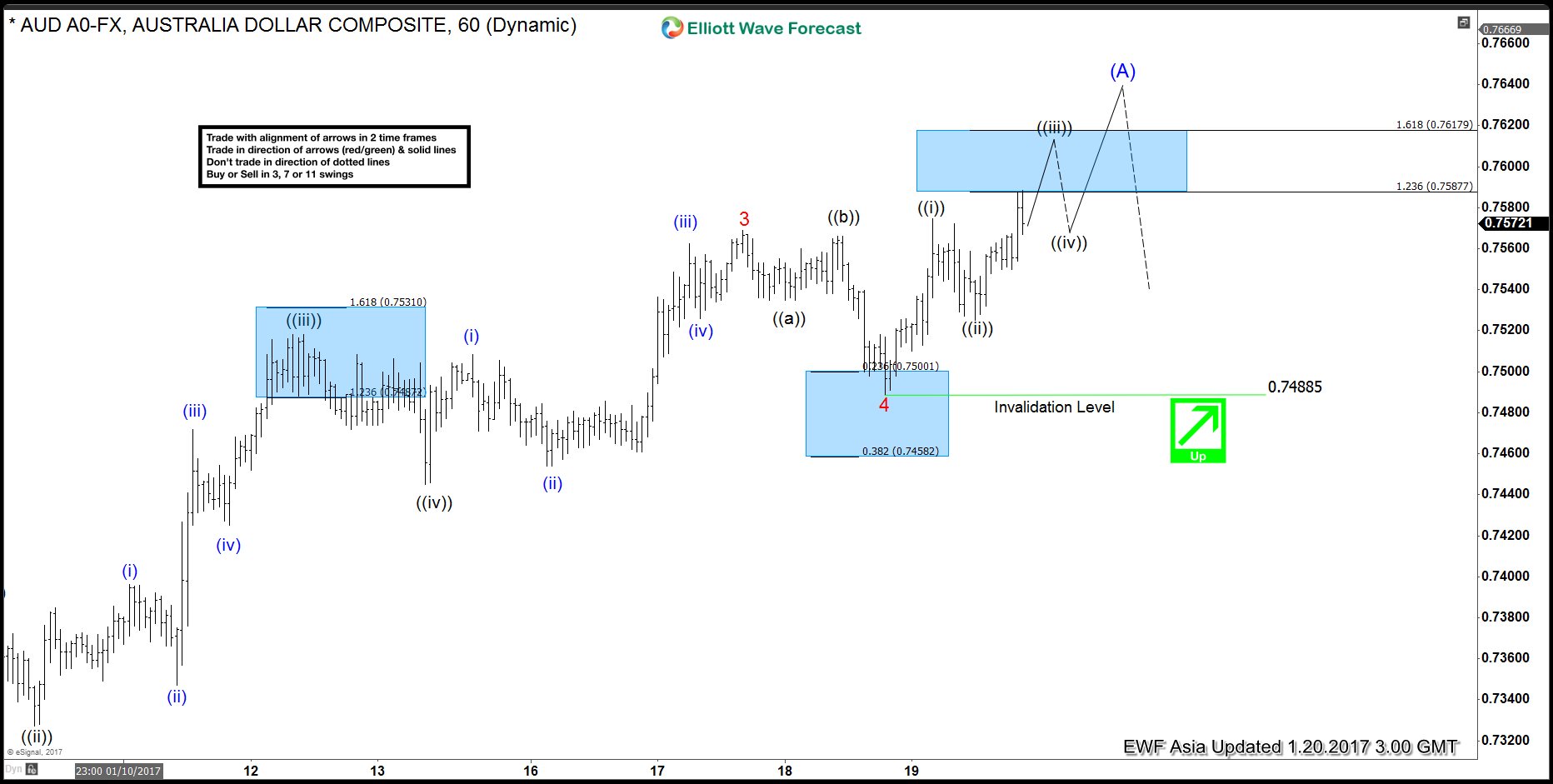

AUDUSD Elliott Wave Analysis 1.20.2017

Read MoreAUDUSD move up from 12/23 low is extending and as pair keeps extending higher with shallow pull backs, it looks like the move up from 12/23 low is unfolding as an Elliott wave impulse and although the cycle is mature, more upside within wave 5 is expected before pair ends the cycle from 12/23 low. […]

-

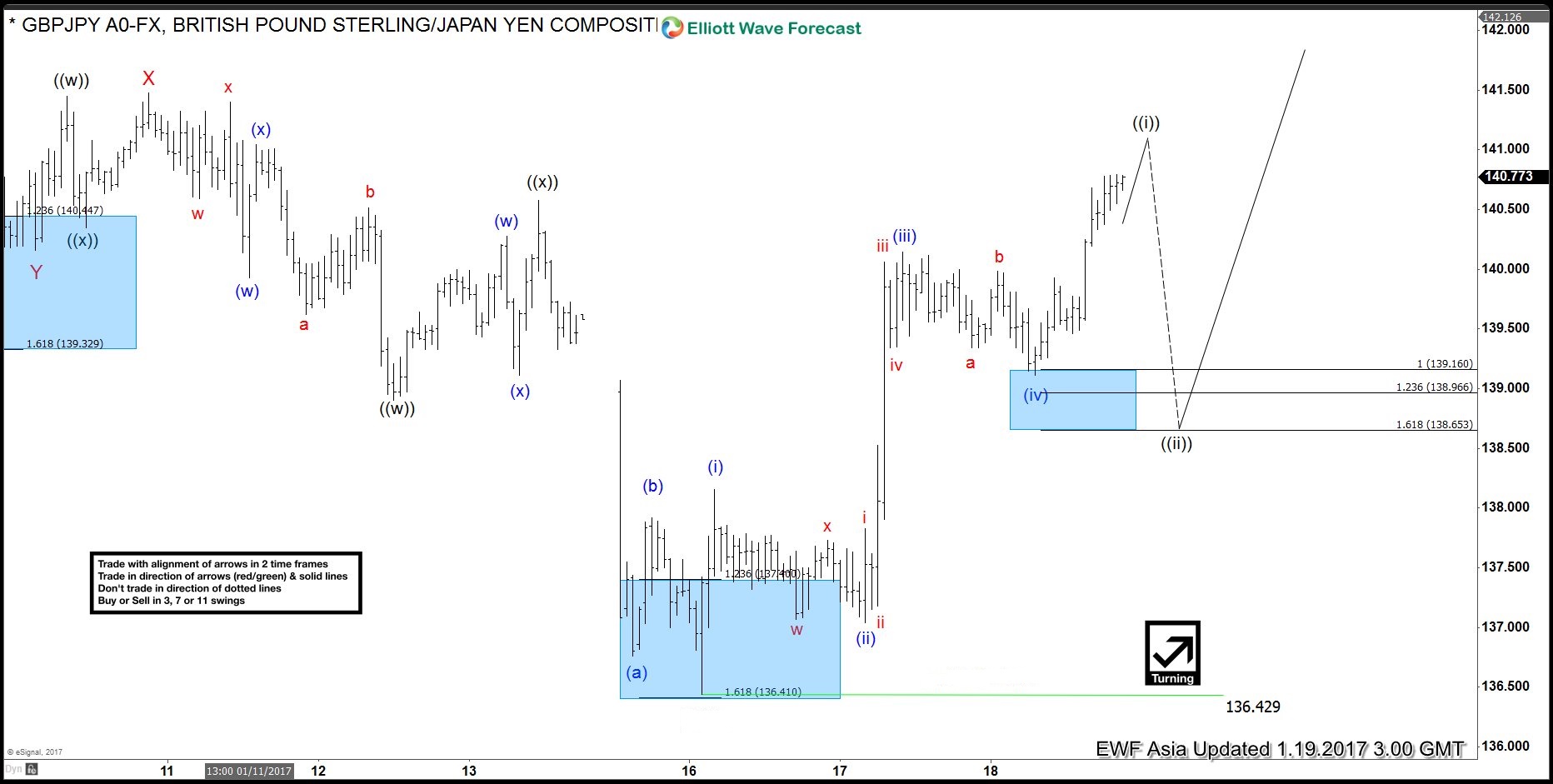

GBPJPY shows 5 waves off the low

Read MoreGBPJPY rally from 1/16 low (136.42) is unfolding as a 5 waves impulse which is expected to complete wave ((i)) of a Minute degree, as shown below in the 1 hour Asia chart from 1/19/2017. As far as momentum divergence is intact between wave (iii) and wave (v) of Minuette degree, the impulse structure remains valid. If […]

-

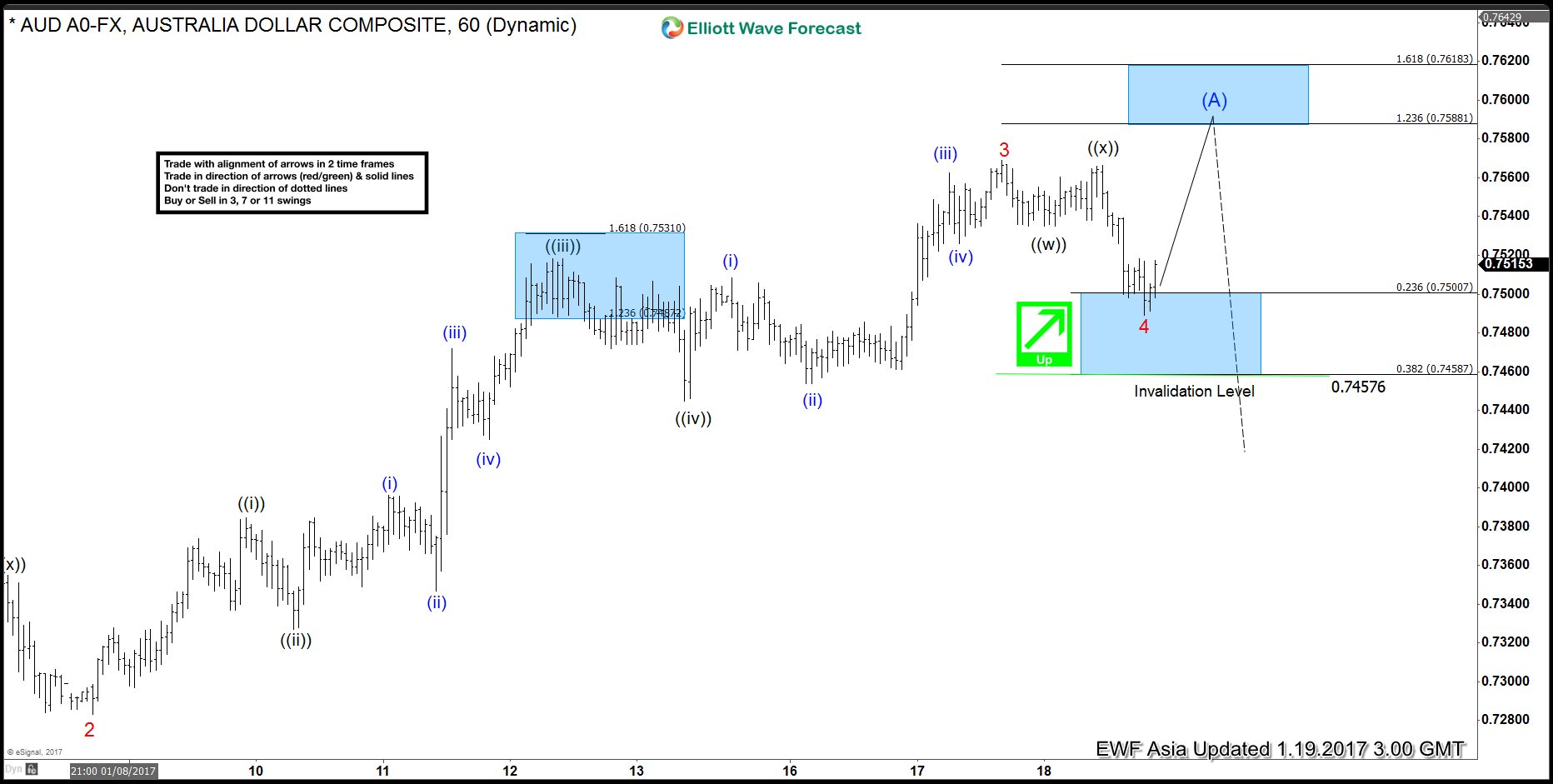

AUDUSD Elliott Wave Analysis 1.19.2017

Read MoreAUDUSD move up from 12/23 low is extending and as pair keeps extending higher with shallow pull backs, it looks like the move up from 12/23 low is unfolding as an Elliott wave impulse and although the cycle is mature, another leg higher in wave 5 still can’t be rule out before pair ends the […]

-

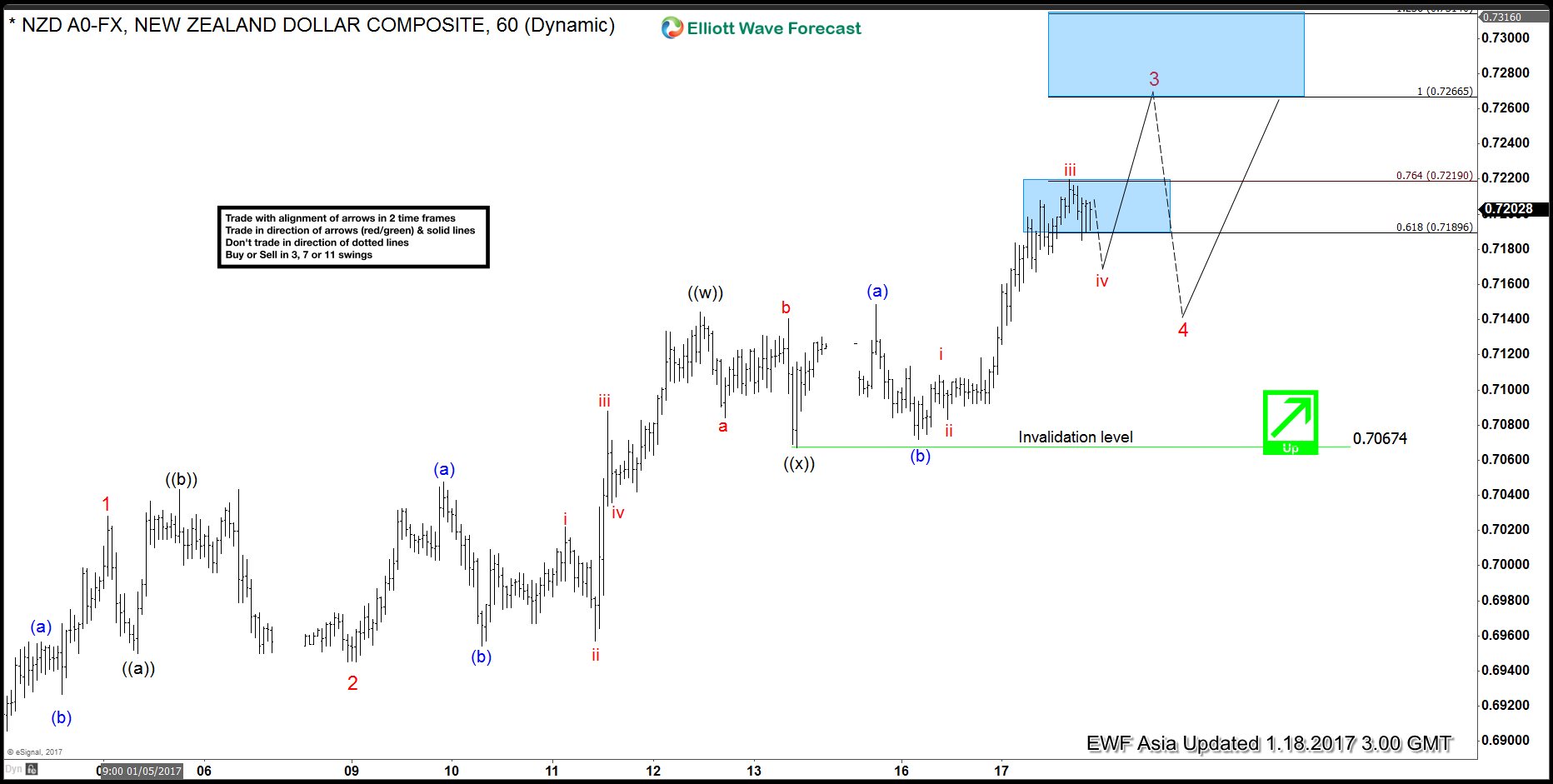

NZDUSD – Possible diagonal move in making

Read MoreNZDUSD move up from 12/23 low is extending and it looks like the move up from 12/23 low is unfolding as an Elliott wave diagonal when pair is still in wave 3. Rally to 0.7028 is labelled as wave 1 and dip to 0.6945 is labelled as a FLAT wave 2. Up from there wave 3 […]

-

NZDCAD Elliottwave Analysis 1/17/2017

Read MoreFor more analysis in other Forex, Indices, and Commodities, take our 14 days FREE trial and get access to Elliottwave charts for 52 instrument in 4 time frames, live sessions, live trading room, 24 hour chat room, and more. Weekly Chart NZDCAD is showing a bullish sequence in the weekly time frame with the break […]