In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

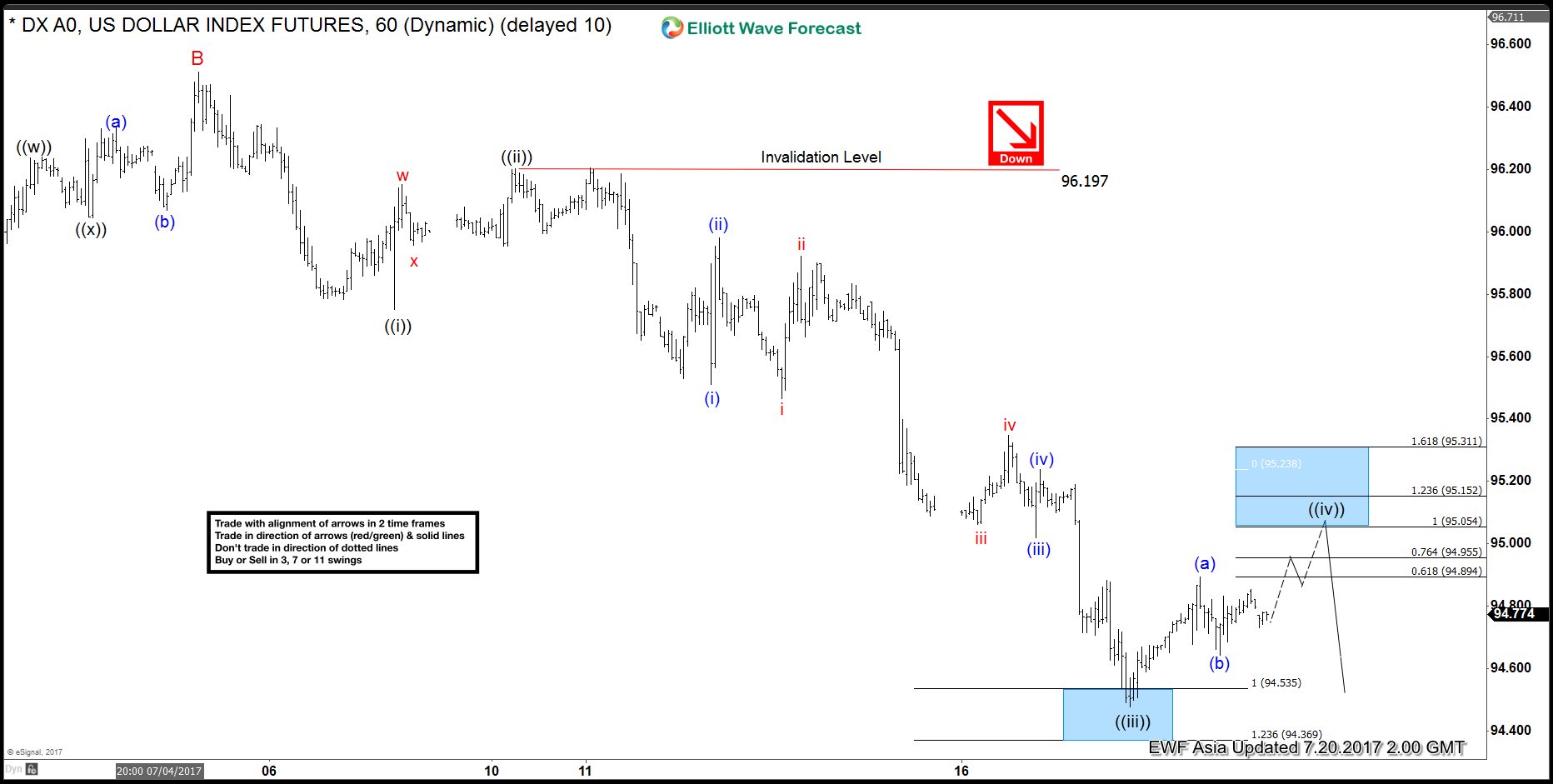

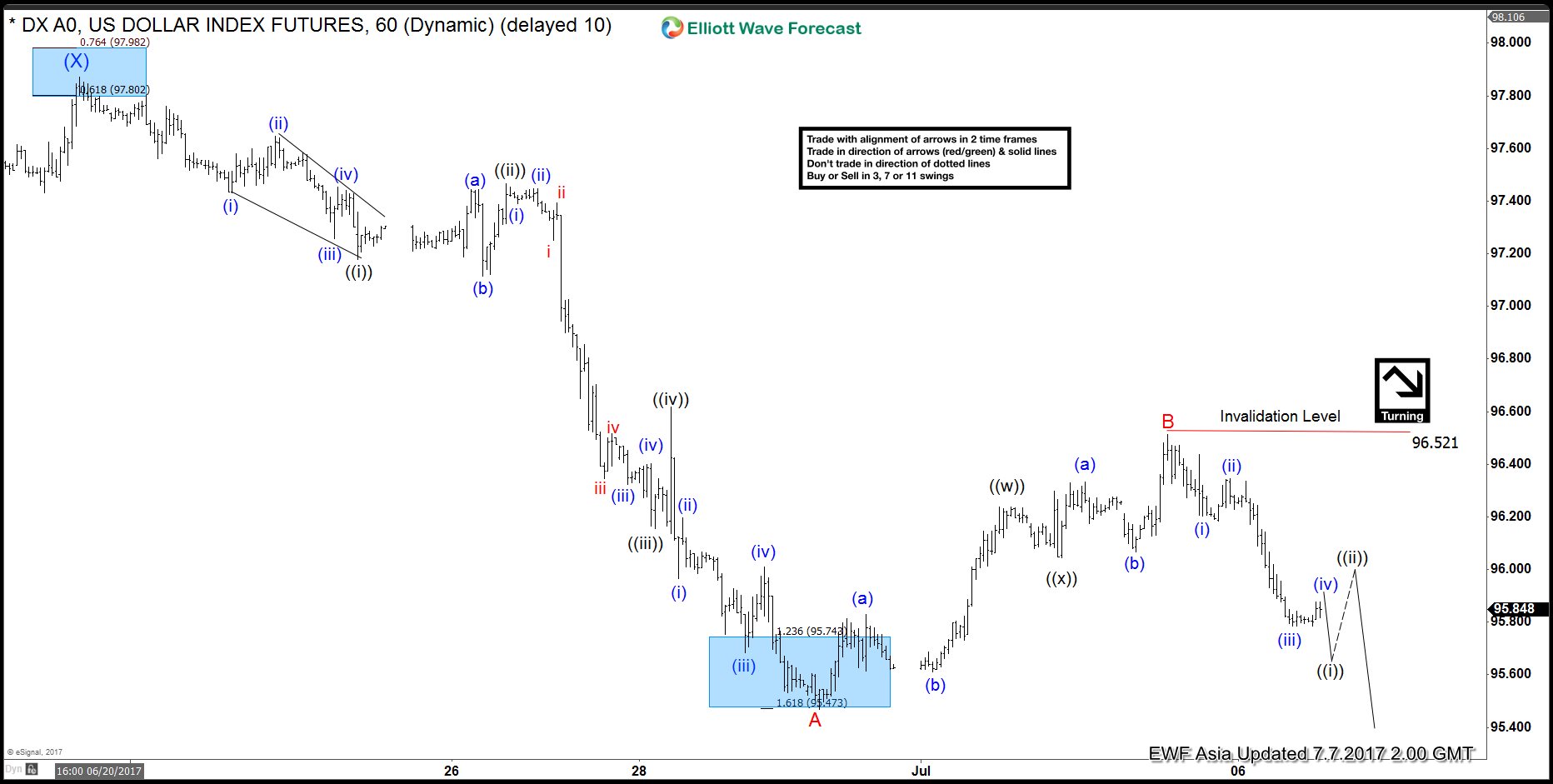

DXY Elliott Wave View : Bounce in progress

Read MoreShort term DXY (USD Index) Elliott Wave view suggests the decline from 6/20 peak (97.87) is unfolding as a Zigzag Elliott Wave structure. Down from 97.87 high, decline to 95.47 ended Minor wave A, and bounce to 96.51 high ended Minor wave B. Wave C is unfolding as an Elliott wave Impulse structure with extension where Minute wave ((i)) ended […]

-

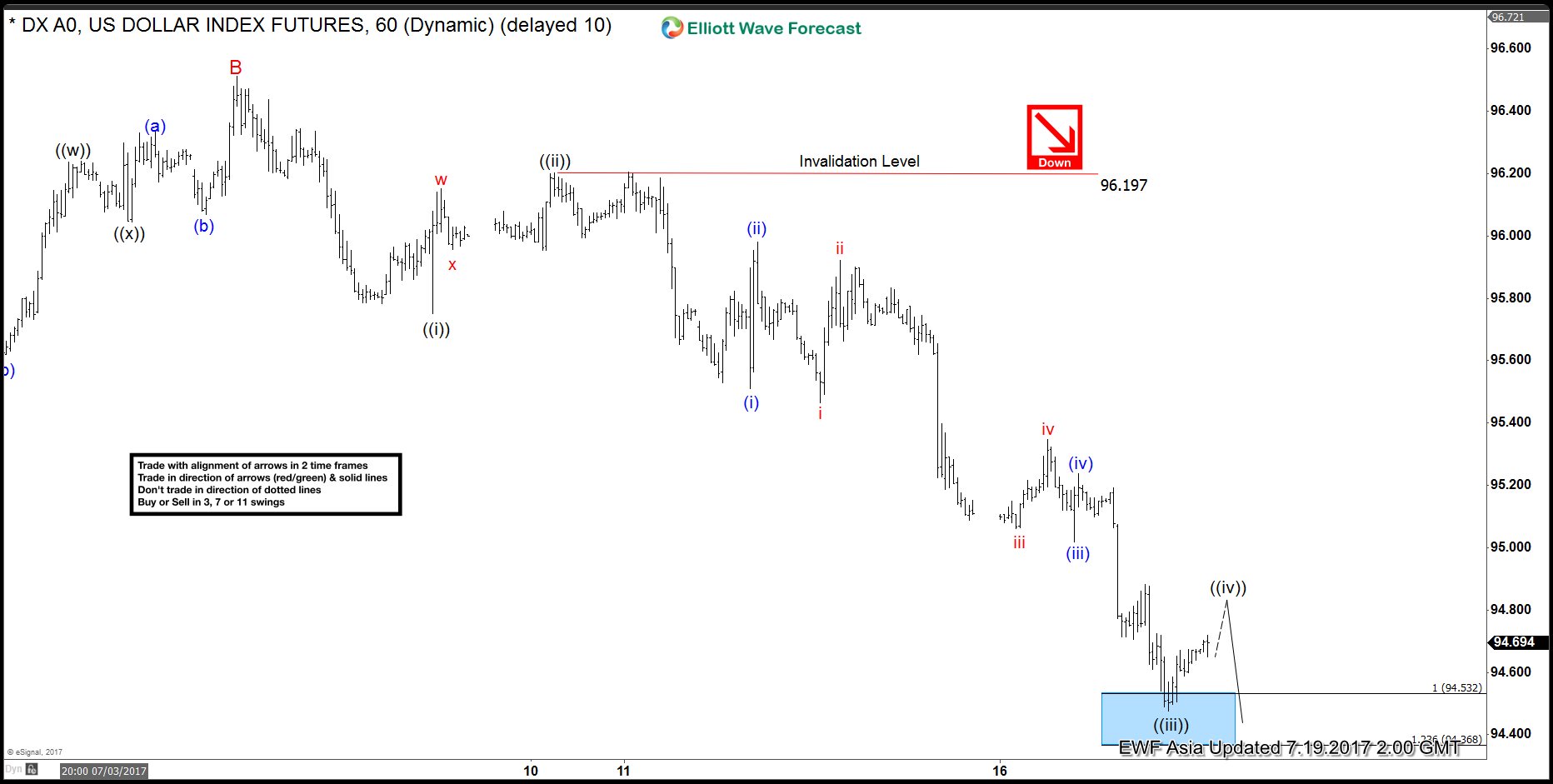

DXY Elliott Wave View 7.19.2017

Read MoreShort term DXY (USD Index) Elliott Wave view suggests the decline from 6/20 peak (97.87) is unfolding as a Zigzag Elliott Wave structure. Down from 97.87 high, decline to 95.47 ended Minor wave A, and bounce to 96.51 high ended Minor wave B. Wave C is unfolding as an Elliott wave Impulse structure with extension where Minute wave ((i)) ended […]

-

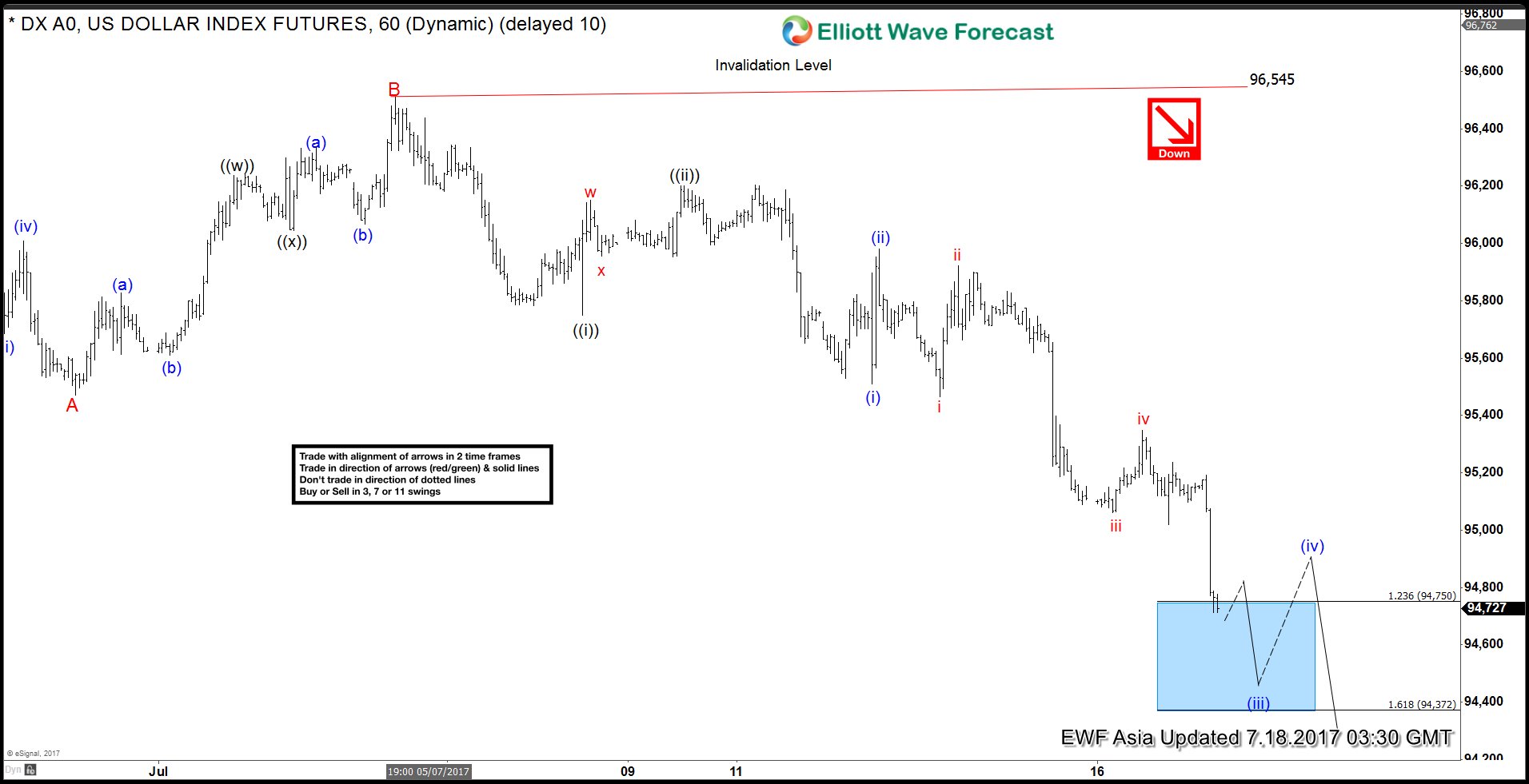

DXY Elliott Wave View: More Downside

Read MoreShort term DXY (USD Index) Elliott Wave view suggests the decline from 6/20 peak (97.87) is unfolding as a Zigzag Elliott Wave structure. Down from 97.87 high, decline to 95.47 ended Minor wave A, and bounce to 96.51 high ended Minor wave B. Wave C is unfolding as an Elliott wave Impulse structure with extension where Minute wave ((i)) […]

-

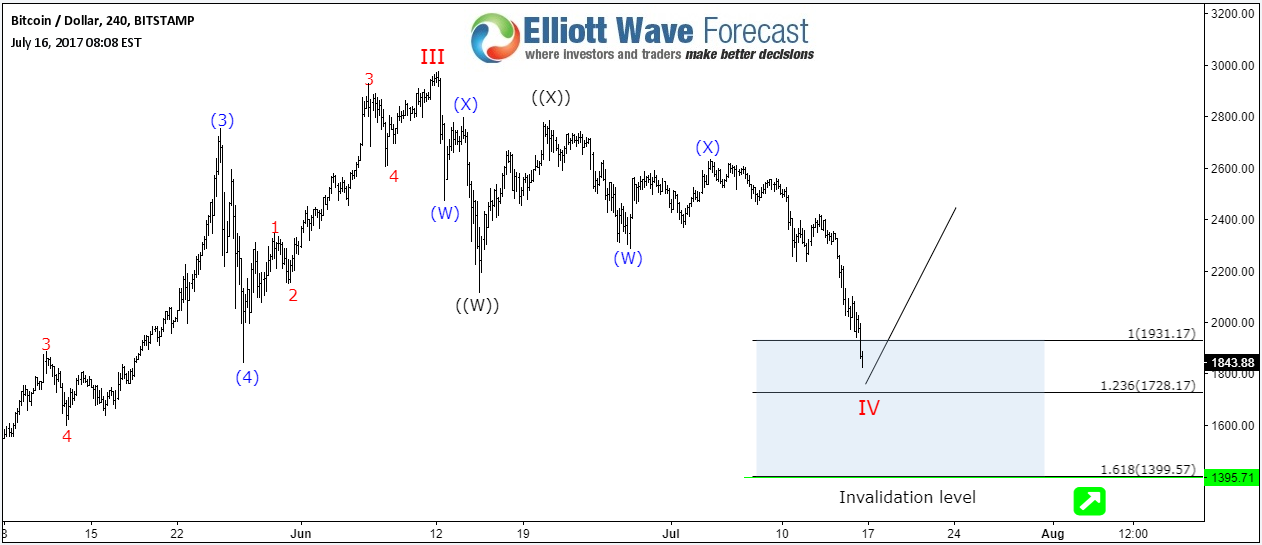

Bitcoin “Deja Vu” corrective sequence

Read MoreSince June peak at $3000, Bitcoin lost 35% of it’s value driving the rest of the cryptocurrency market into chaos as 1st August is approaching which is scheduled to trigger activation of Segregated Witness (SegWit) and could lead to a split in Bitcoin’s blockchain. There is no need to explain what’s going to happen in the coming weeks […]

-

USDJPY Elliott Wave View: Bullish Against 112.86

Read MoreShort term USDJPY Elliott Wave view suggests the pullback to 111.7 low on 6/29 ended Minor wave X. Up from there, wave Y is unfolding as an Elliott wave zigzag structure where Minute wave ((a)) ended at 113.68 and Minute wave ((b)) ended at 112.86. Up from there, Minutte wave (i) of ((c)) ended at 114.3. Minutte wave (ii) of ((c)) […]

-

USDX Elliott Wave View: Downside Resumes

Read MoreShort term USDX (USD Index) Elliott Wave view suggests the rally to 97.88 high on 6/20 ended Intermediate wave (X). Decline from there is unfolding as an impulse Elliott Wave structure with extension and ended at 95.47 low on 6/29. This 5 wave move could be Minor wave A of an Elliott wave zigzag structure structure, where Minute wave ((i)) ended at 97.17 and Minute wave […]