In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

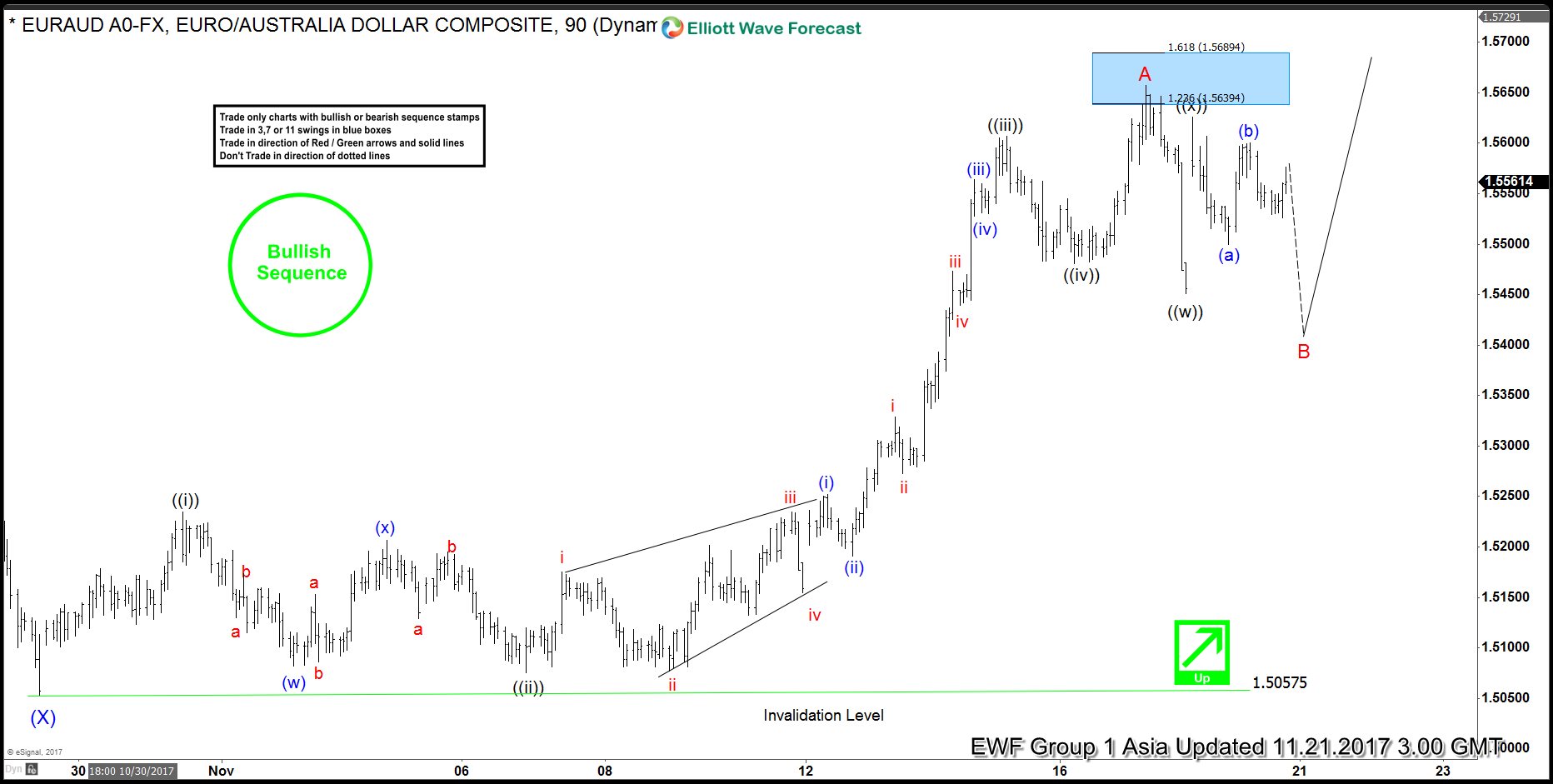

EURAUD Short Term Elliott Wave Analysis

Read MoreEURAUD Short-Term Elliott Wave view suggests that the decline to 1.5057 ended Intermediate wave (X). The rally from there appears to be unfolding as a 5 waves impulse Elliott Wave structure, suggesting that as long as the pullbacks stay above 1.5057, it could see further upside. Up from 1.5057, Minute wave ((i)) ended at 1.5234, Minute wave ((ii)) ended […]

-

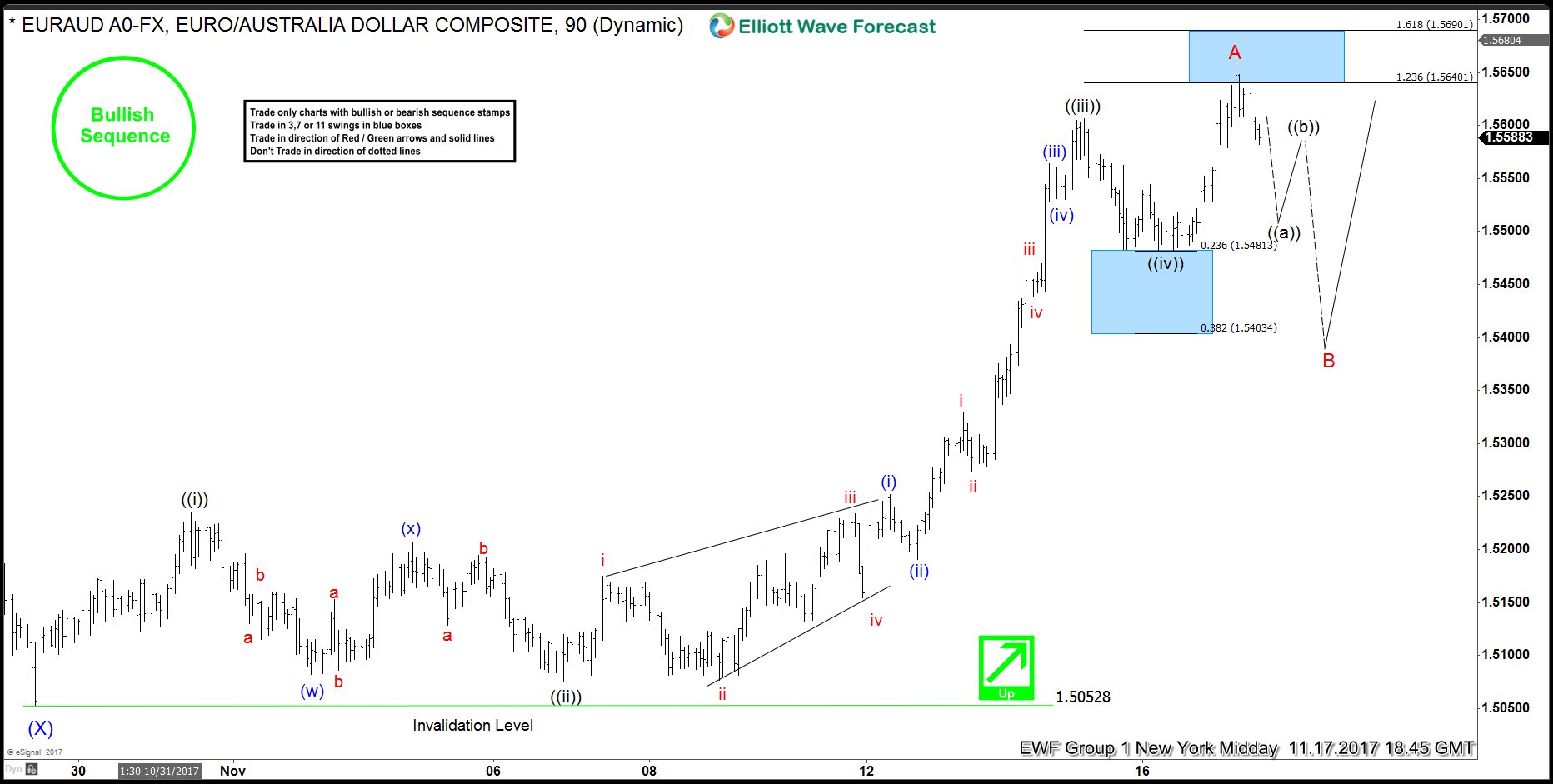

EURAUD Showing 5 Waves Impulse

Read MoreEURAUD Short term Elliott Wave view suggests that the decline to 10/27 low 1.5052 ended intermediate (X). A rally from there is unfolding as an impulse Elliott Wave structure with extension and showing bullish sequence in the pair. This 5 waves move should end Minor wave A of an Elliott wave zigzag structure. In which case, after 5 waves move ends, […]

-

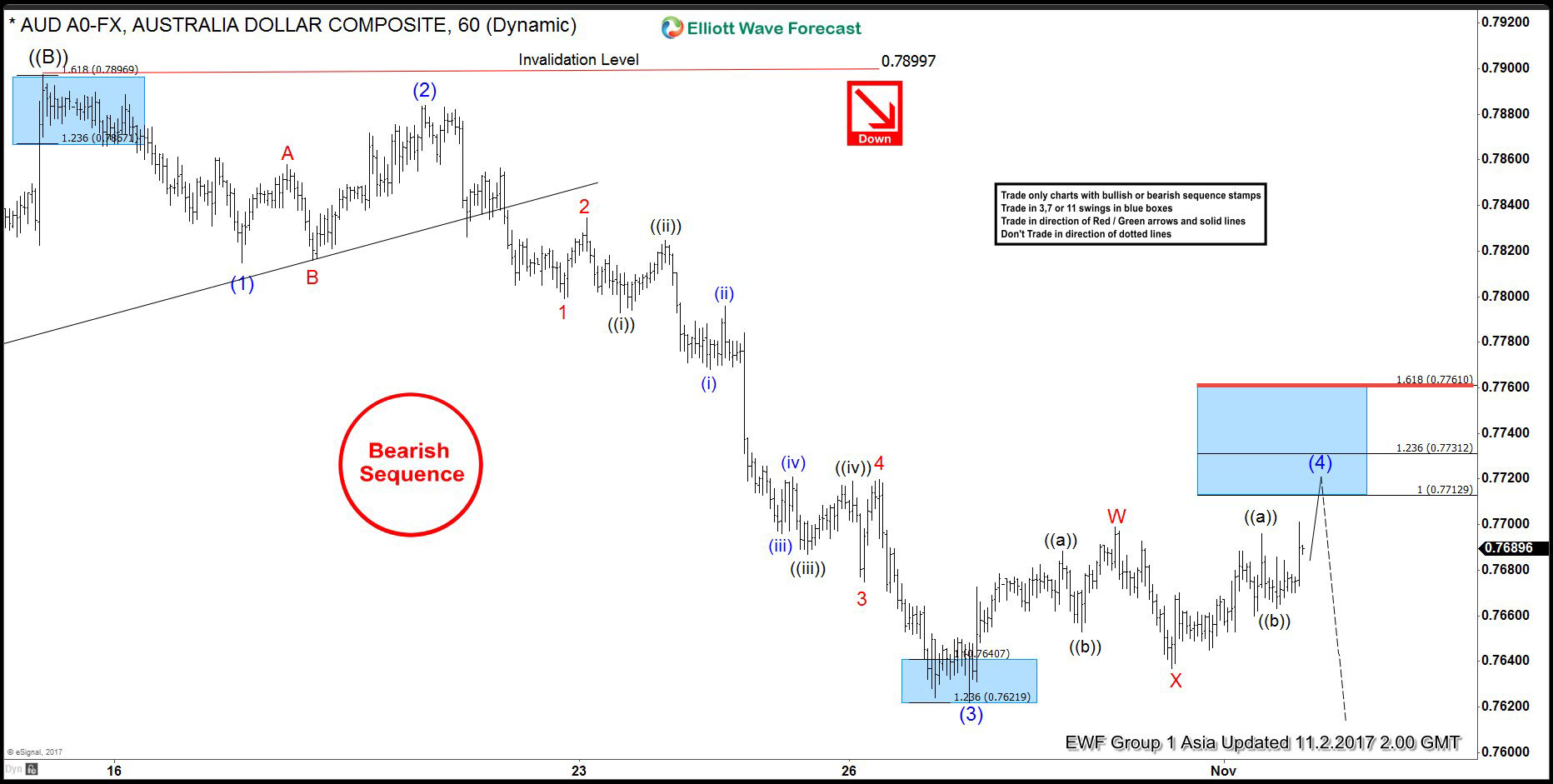

AUDUSD Swings Sequences Calling The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of AUDUSD published in members area of www.sifaha.com. In further text we’re going to explain the short term Elliott Wave view. AUDUSD Elliott Wave 1 Hour Chart 11.02.2017 As our members know, AUDUSD has had incomplete […]

-

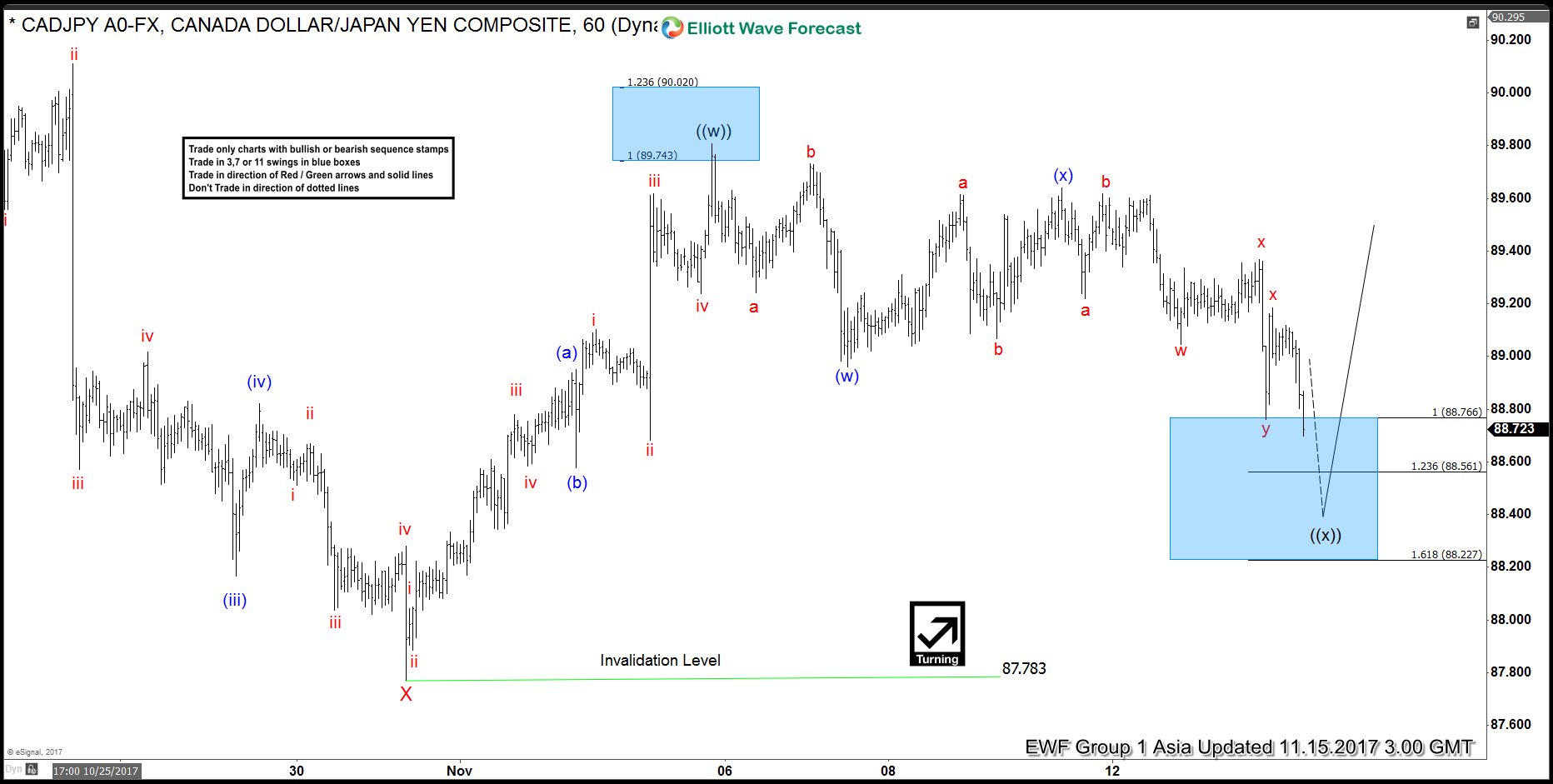

CADJPY Short Term Elliott Wave Analysis

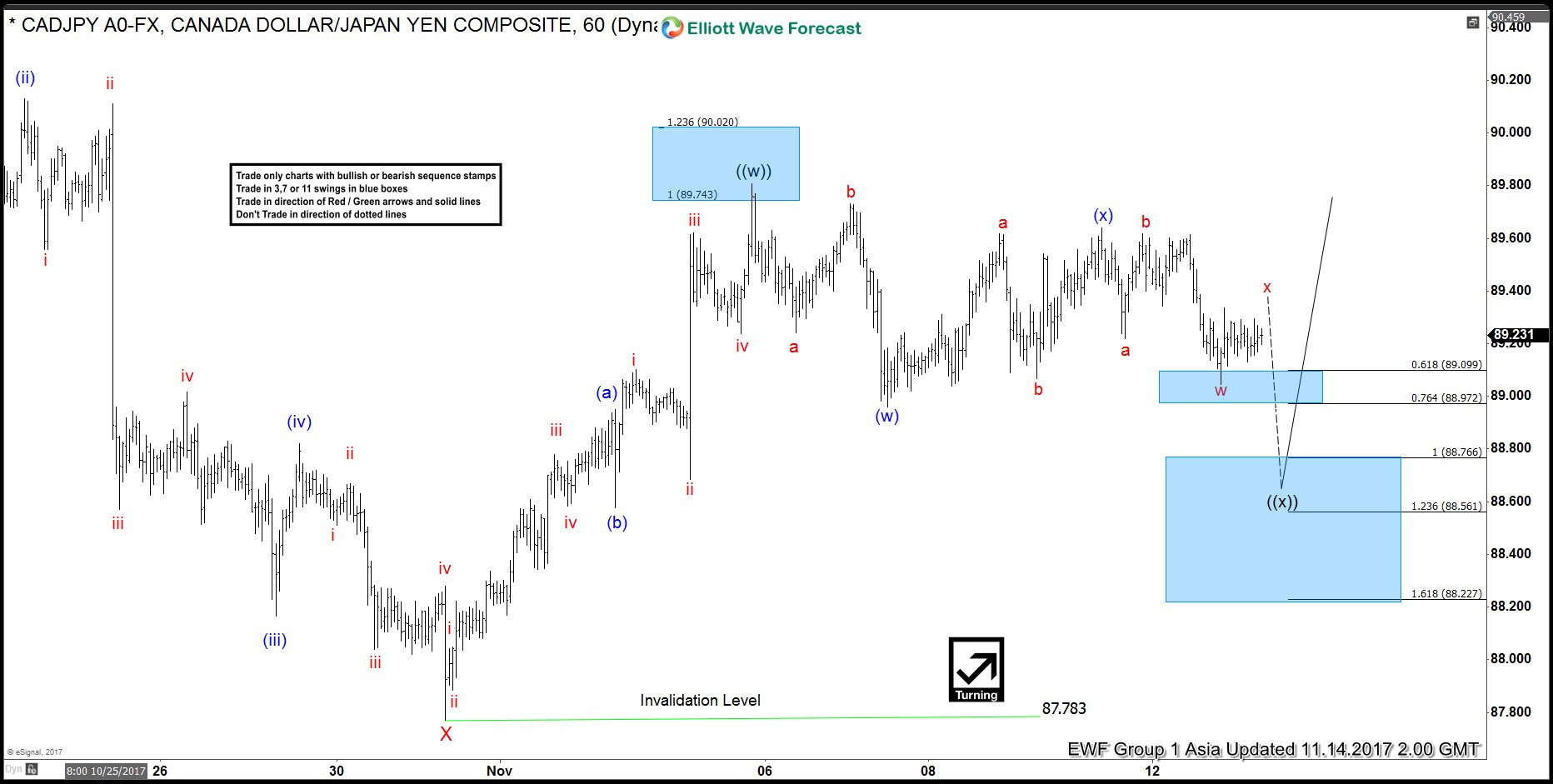

Read MoreCADJPY Short Term Elliott Wave view suggests that Minor wave X ended at 87.78. Up from there, pair rallies as a double three Elliott Wave structure where Minute wave ((w)) ended at 89.8 and Minute wave ((x)) is in progress. Subdivision of Minute wave ((x)) takes the form of a double three Elliott Wave structure. Decline […]

-

CADJPY Elliott Wave Analysis 11.14.2017

Read MoreCADJPY Elliott Wave view suggests that the decline to 87.78 ended Minor wave X. Pair starts a new rally from there as a double three Elliott Wave structure where Minute wave ((w)) ended at 89.8. Minute wave ((x)) pullback is currently in progress to correct cycle from 10/31 low in 3, 7, or 11 swing before the […]

-

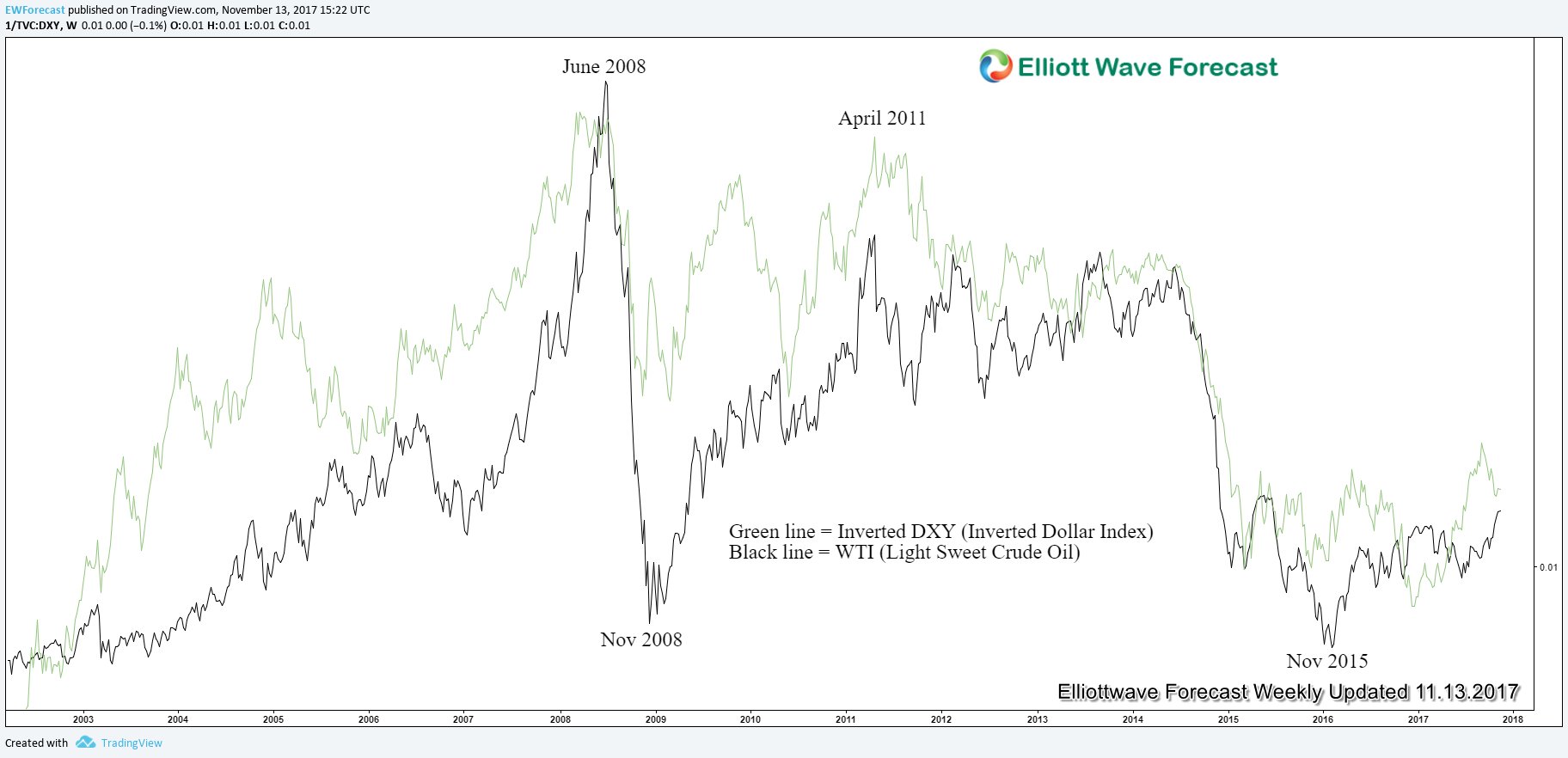

Petroyuan Can Accelerate the De-Dollarization

Read MoreThe move away from Petrodollar In 1974, US President Richard Nixon and King Faisal from Saudi Arabia struck a deal. This deal gave birth to the petrodollar system which still lasts until this day. The deal involves Saudi Arabia selling oil to its largest buyer back then, the U.S. In turn, the U.S. provides Saudi Arabia with money, […]