In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

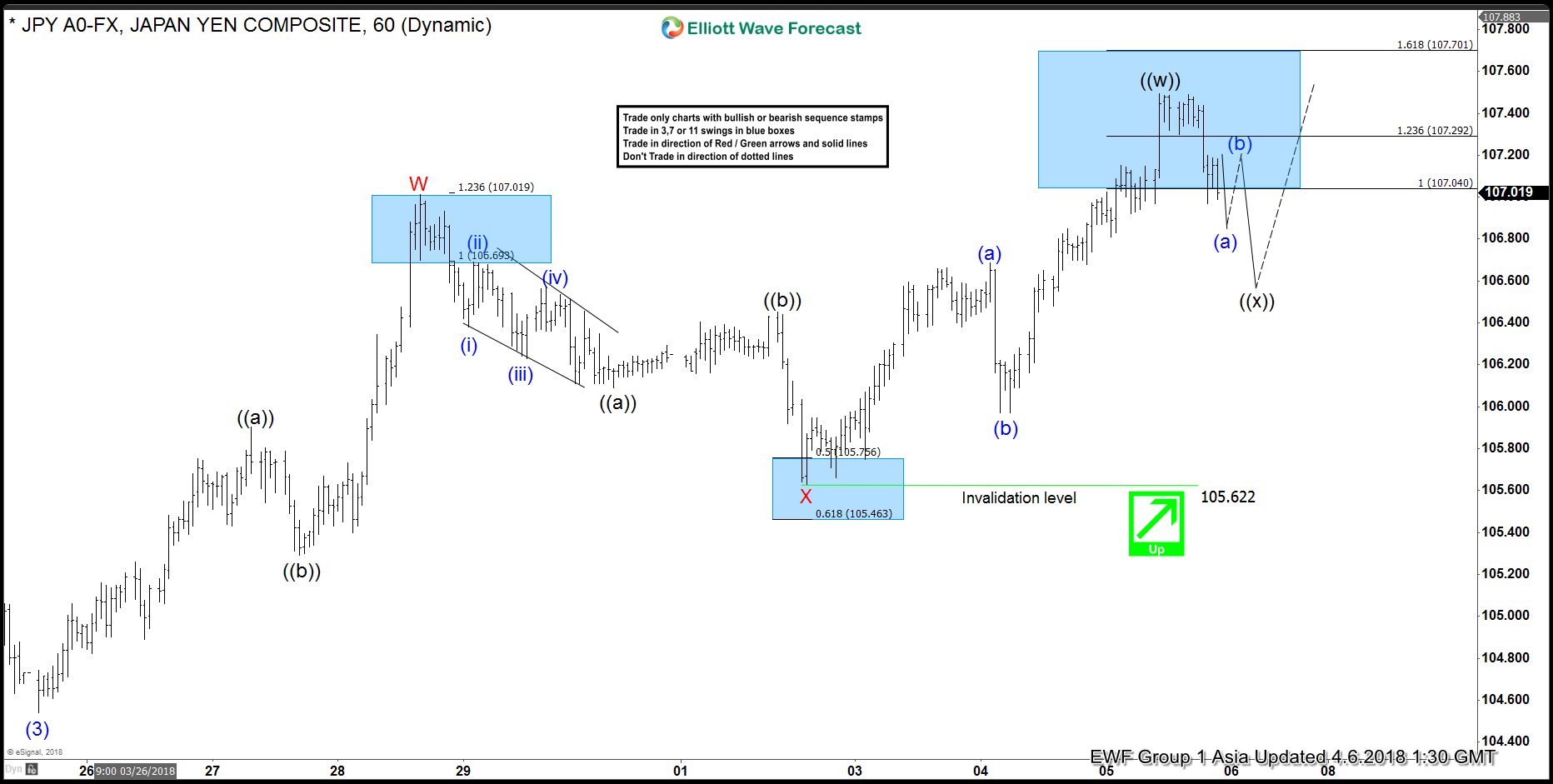

Elliott Wave Analysis: Further Strength in USDJPY

Read MoreUSDJPY short term Elliott Wave view suggests that the decline to 104.54 low on March 26 ended Intermediate wave (3). Wave (4) correction is in progress as a double three Elliott Wave Structure. A double three is a 7 swing corrective structure with WXY label. In the case of USDJPY, minor wave W of (4) […]

-

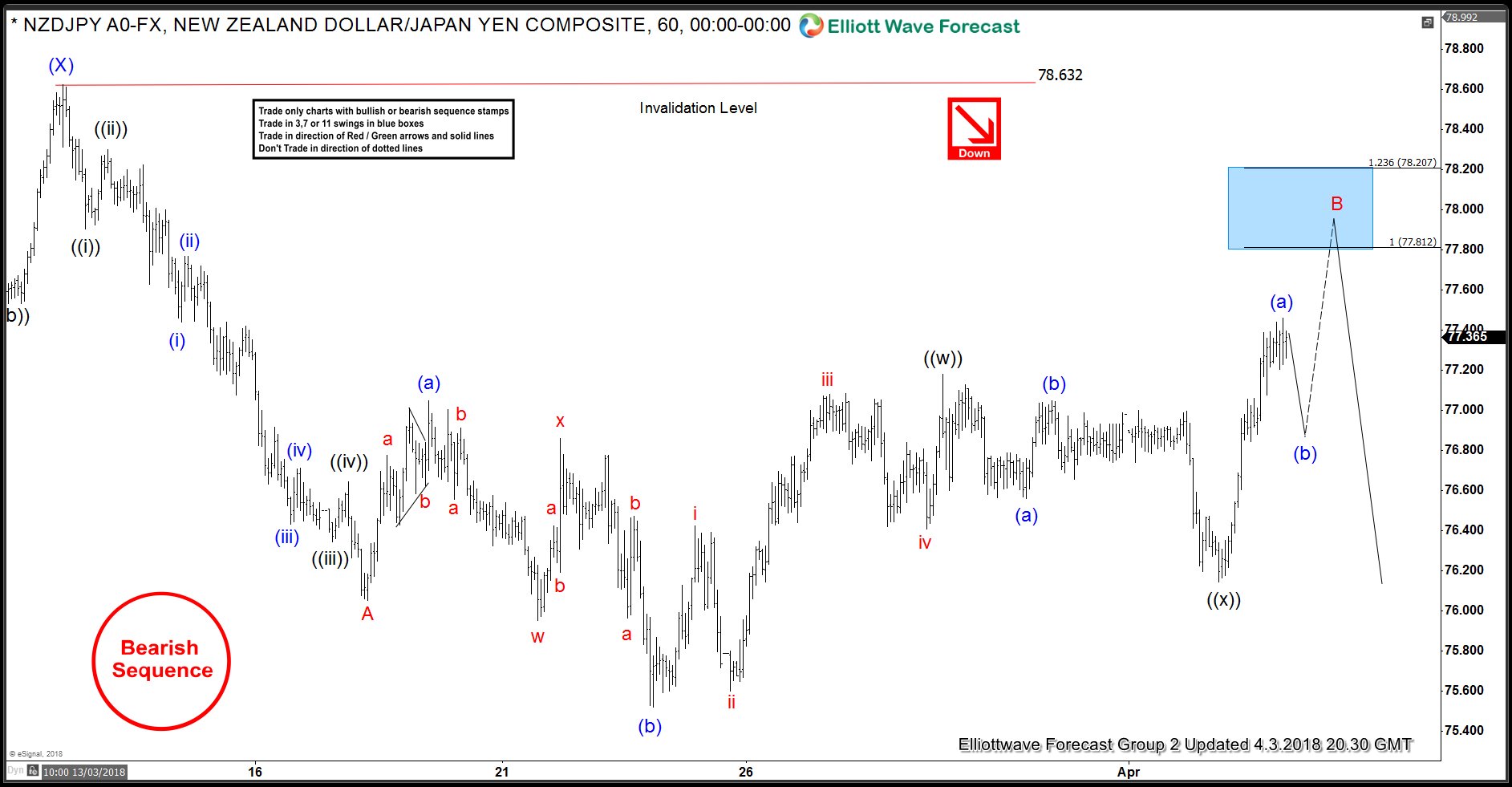

NZD JPY Elliott Wave Analysis: Next Inflection Area

Read MoreNZD JPY has been rallying this week but the question remains if the down move is over and uptrend has resumed or this is just a corrective bounce within an incomplete downward Elliott wave swings sequence. We will take a look at the daily chart of NZD JPY to get an answer to this question […]

-

GBPUSD Elliott Wave View: Calling The Bounce Higher

Read MoreGBPUSD Elliott Wave short-term sequence from 3/01 low (1.3709) ended as a Leading Diagonal structure in Minor wave 1 at 1.4248 high in 5 waves. Down from there, the pair is correcting that cycle in Minor wave 2 pullback in 3, 7 or 11 swings before it resumes the upside. So far pair is showing […]

-

Elliott Wave Analysis: EURUSD in Sideways Consolidation

Read MoreCurrent Elliott Wave view in EURUSD suggests that the pair remains in sideways triangle Elliott Wave structure between 1.2153 low and 1.255 high. Triangle is a consolidation structure with ABCDE label. It has no particular trend and is usually a continuation structure. Since the previous trend in EURUSD up to 1.255 high on 2.16.2018 is bullish, […]

-

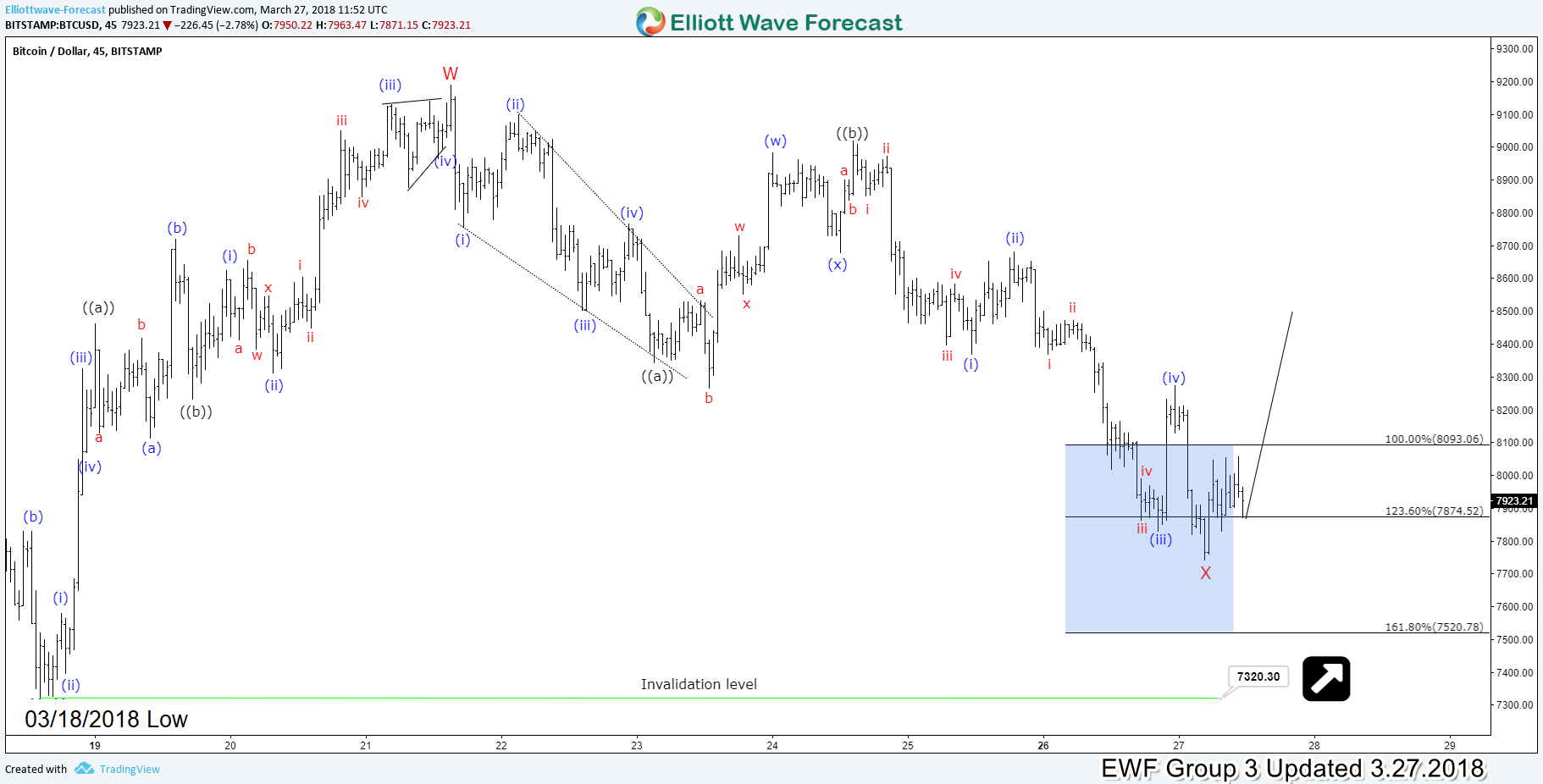

Bitcoin Elliott Wave Analysis Looking for Short Term Recovery

Read MoreBitcoin Elliott Wave Analysis in the short term is showing an interesting corrective structure suggesting a recover to take place after it finishes the current move. The digital instrument is correcting the cycle from 03/18 low in 3 waves as a Zigzag structure which reached the 100% – 161.8% Fibonacci extension area $8093 – $7520 from […]

-

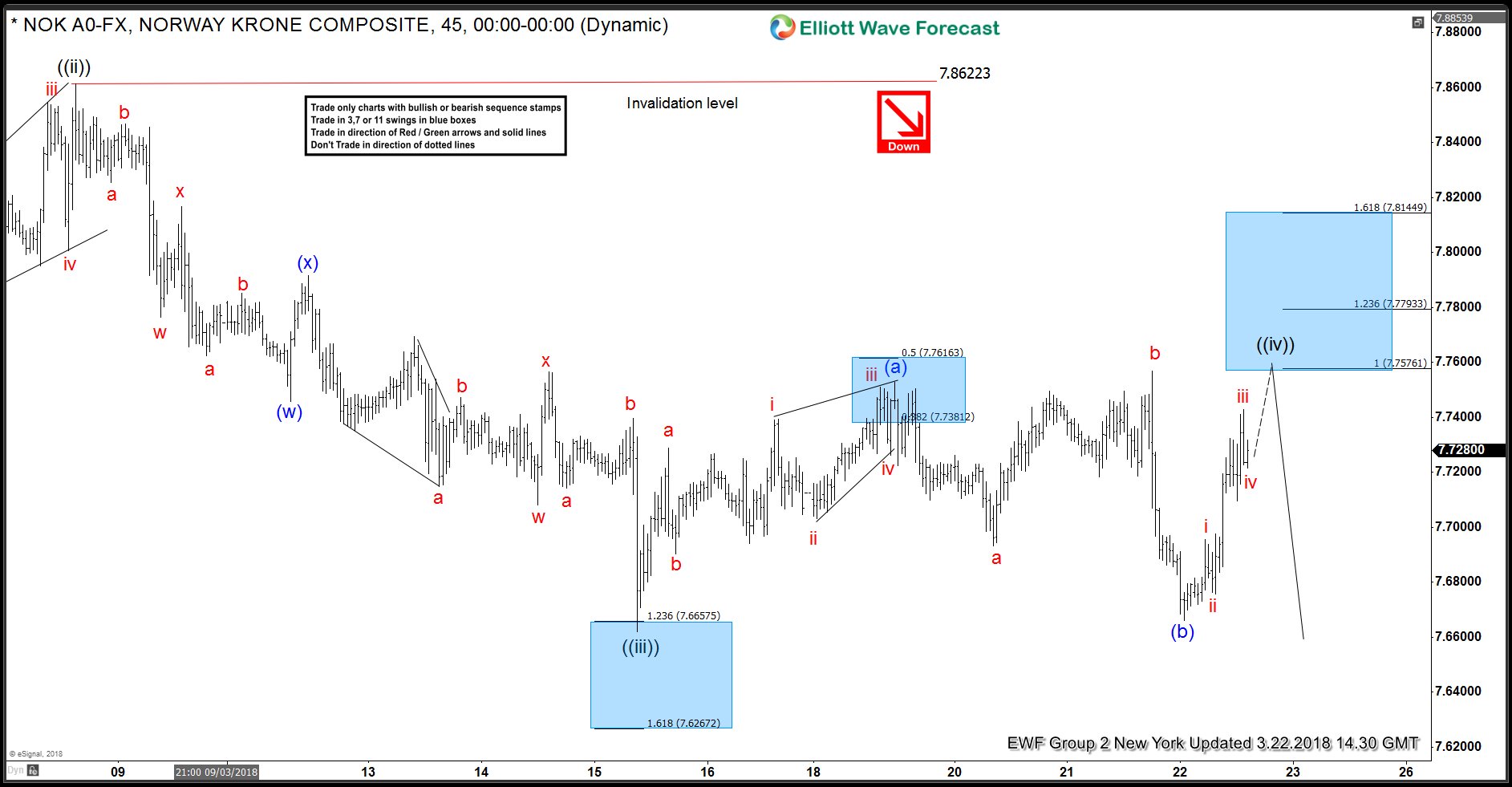

USDNOK Elliott Wave: Calling Extension Lower After The Bounce

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of USDNOK published in members area of the website. In further text we’re going to explain the short term Elliott Wave view. As our members know, the pair has incomplete bearish sequences in 4 Hour […]