In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

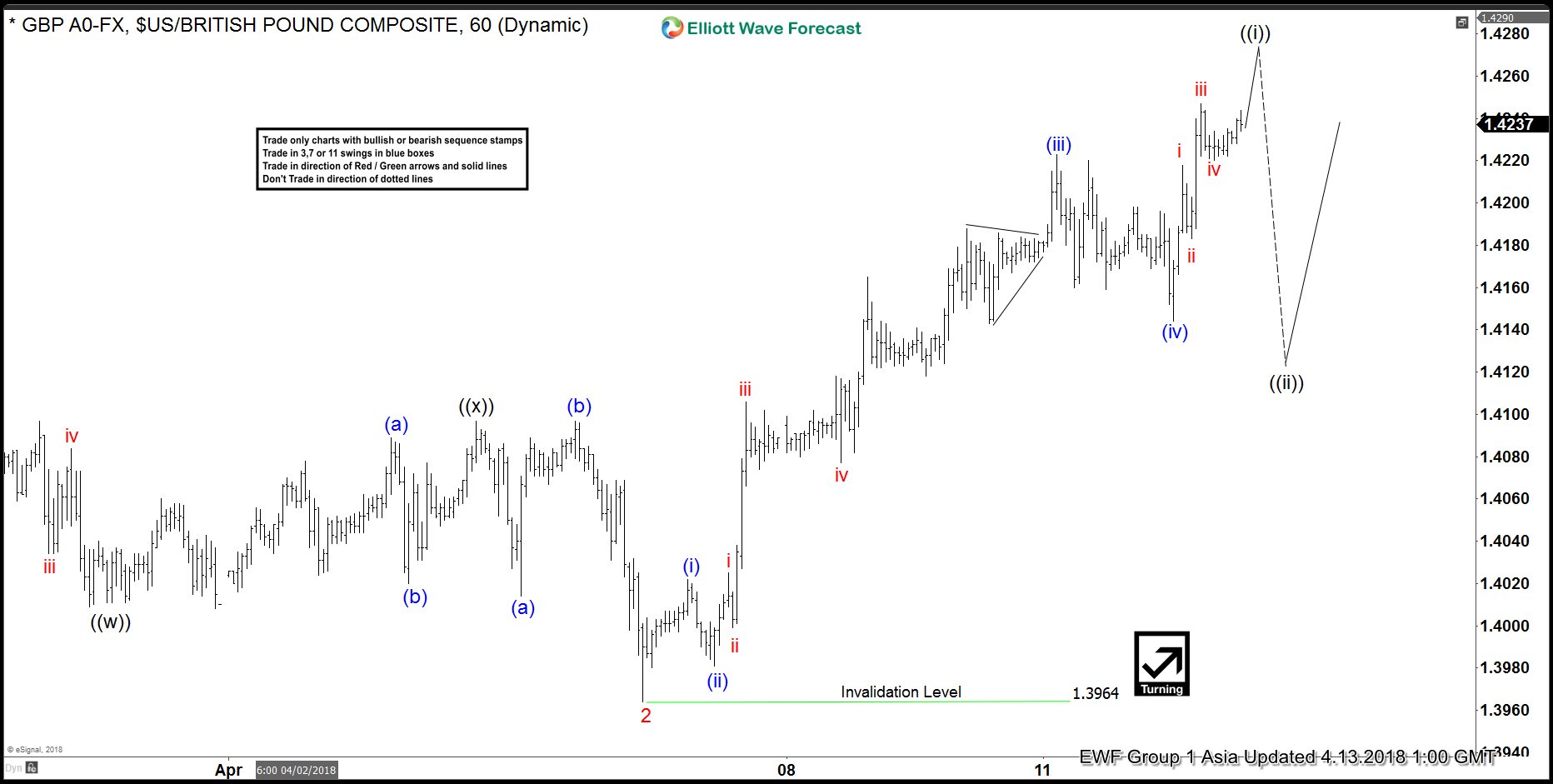

Elliott Wave Analysis: GBPUSD Strength Expected

Read MoreGBPUSD Short Term Elliott Wave view suggests that the rally from 3.1.2018 low (1.371) is unfolding as a 5 waves impulse Elliott Wave Structure. Up from 3.1.2018 low, Minor wave 1 ended at 1.4245 and Minor wave 2 ended at 1.3964. Pair has since broken above Minor wave 1 at 1.4245, suggesting that the sequence from […]

-

Elliott Wave Analysis: USDCAD Moving in Impulsive Structure

Read MoreUSDCAD Elliott Wave view suggests that the decline from 3/19 high (1.313) is unfolding as a 5 waves impulse Elliott Wave structure. Minor wave 1 ended at 1.2819, Minor wave 2 ended at 1.2943, and Minor wave 3 is in progress. Internal of Minor wave 3 also unfolded as an Elliott Wave impulse structure in […]

-

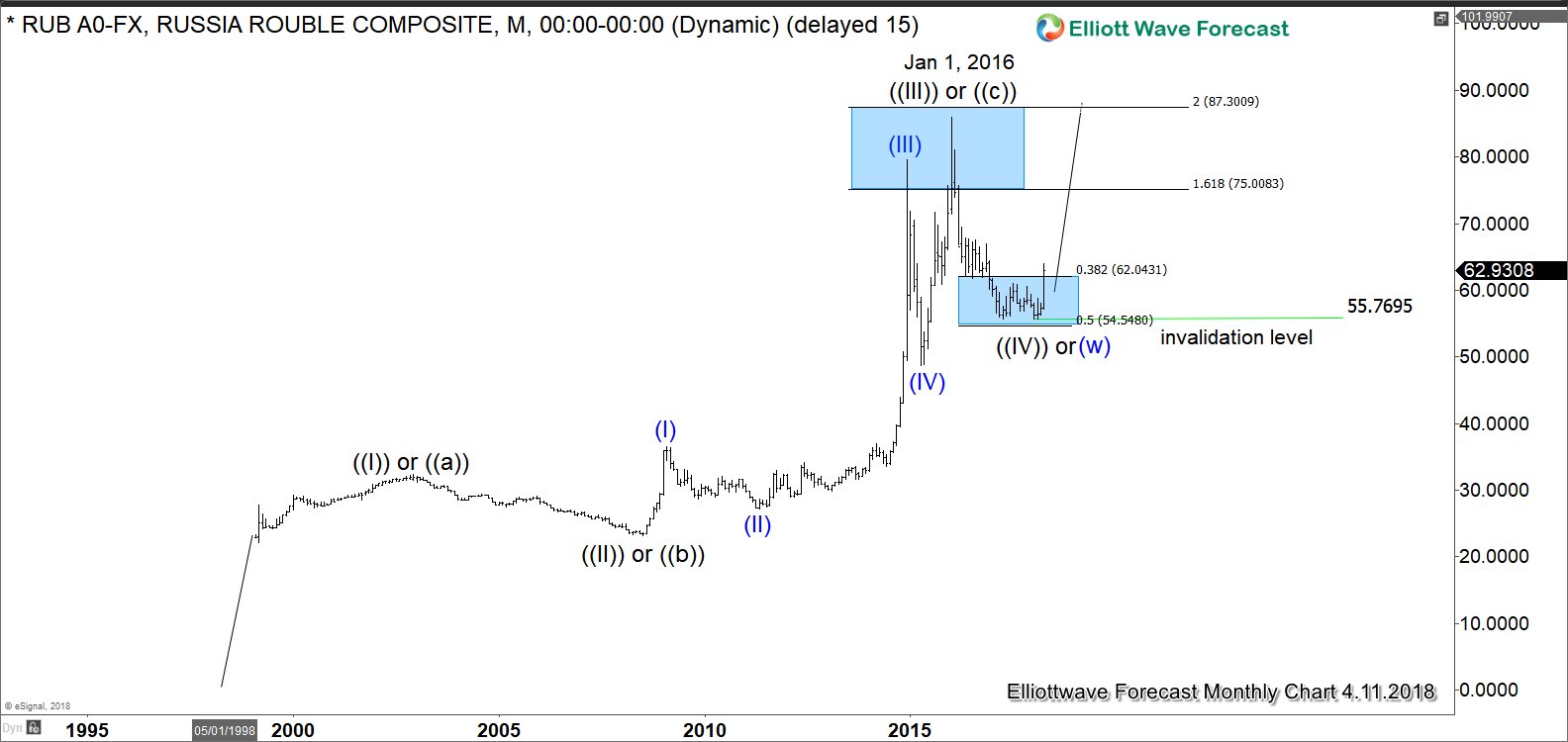

Ruble Falls Following US Sanctions Against Russia

Read MoreNew U.S. Sanctions Hurt Russia’s Ruble and Benchmark Index Last Friday, as part of the U.S. effort to punish Moscow for “malign activity around the globe”, the U.S Treasury Department targeted numerous Russian oligarchs, officials, and companies by freezing their assets under U.S. jurisdiction. In addition, the U.S. also prohibits U.S. citizens or entities from […]

-

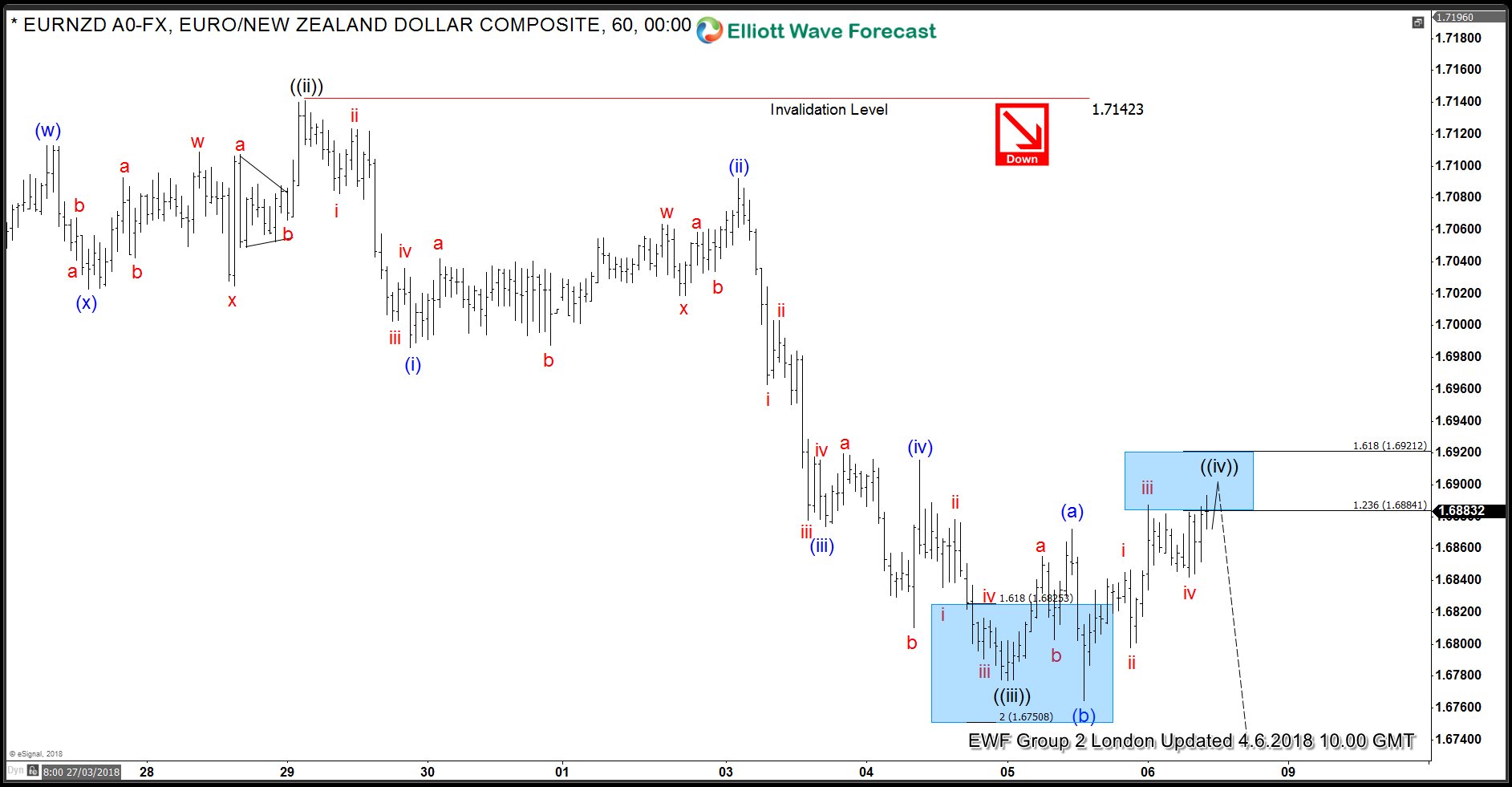

EURNZD Forecasting The Decline after Elliott Wave Flat

Read MoreHello Fellow Traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURNZD published in members area of the website. We’re going to explain the forecast and Elliott Wave Pattern. Before we take a look at the real market expample of Expanded Flat, let’s explain it in […]

-

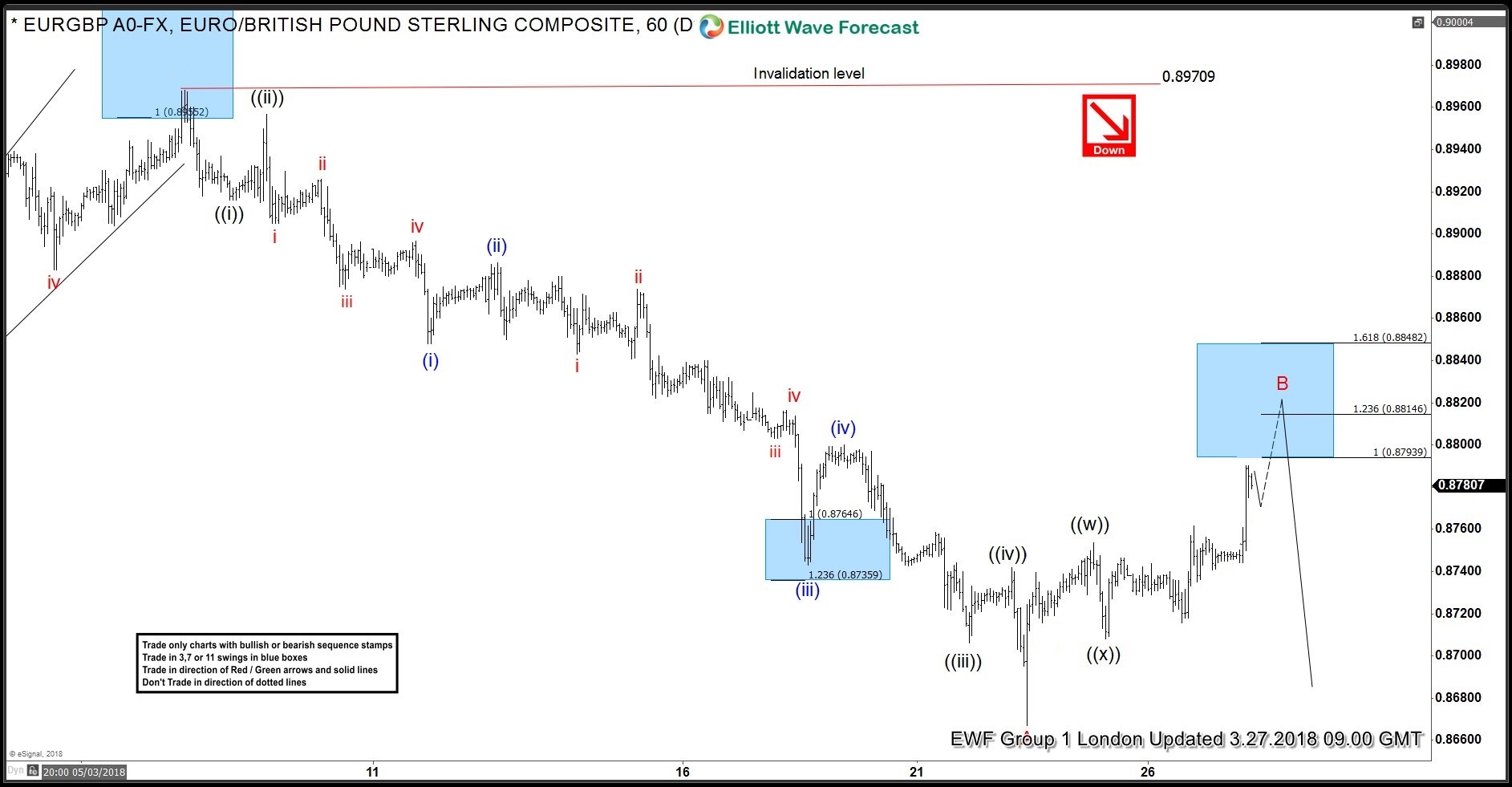

Elliott Wave Analysis: Calling The Weakness In EURGBP

Read MoreToday, we will have a look at some Elliott Wave charts of the EURGBP which we presented to our members in the past. Below, you can find our 1-hour updated chart presented to our members on the 03/27/18 calling for more downside after a Double Elliott wave correction in black ((w))-((x)). EURGBP ended the cycle from 03/07 […]

-

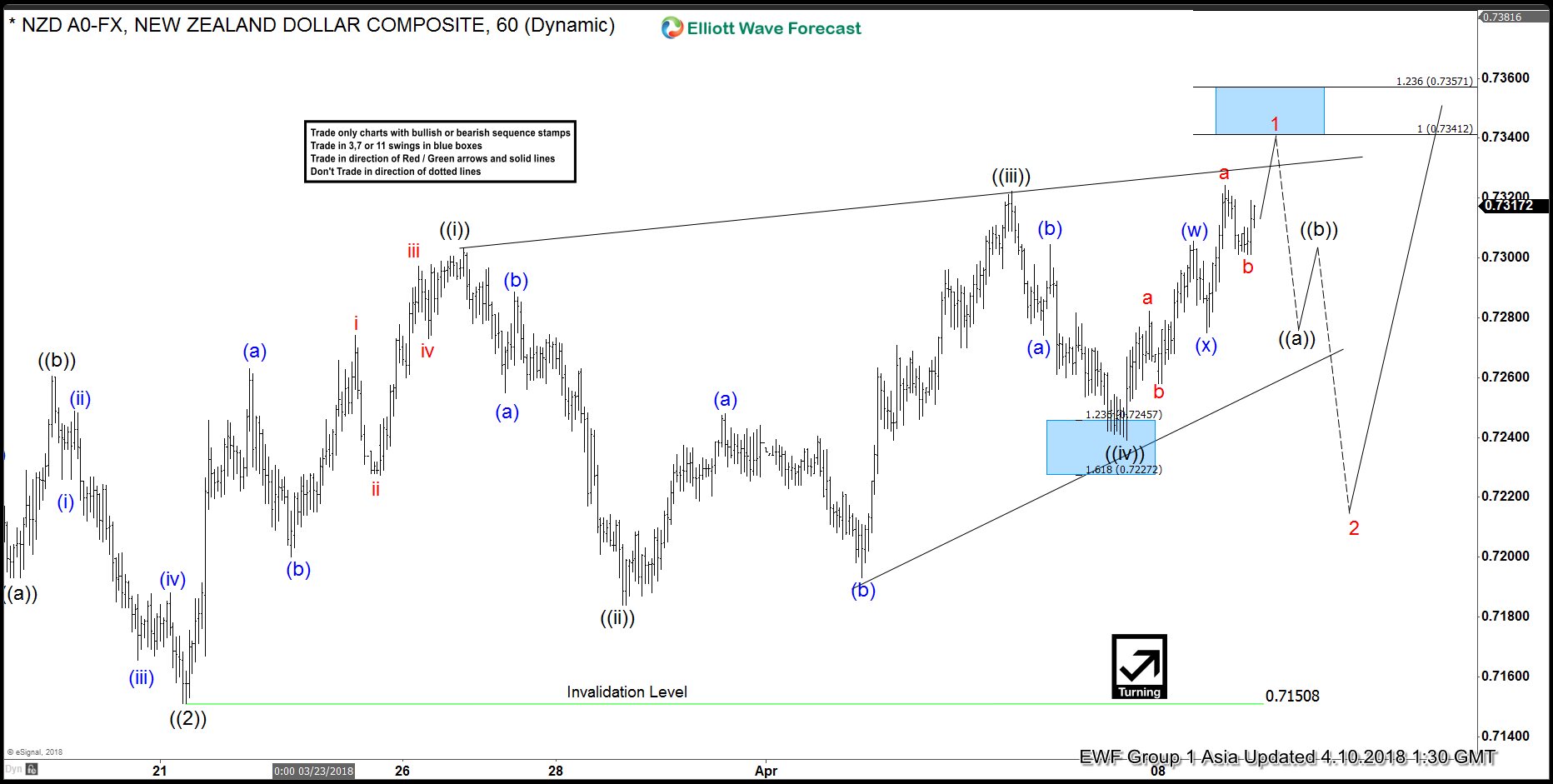

Elliott Wave Analysis: NZDUSD Rallies in 5 waves Diagonal

Read MoreNZDUSD short term Elliott Wave view suggests that the decline to 0.715 low on March 21 ended Primary wave ((2)). Primary Wave ((3)) is in progress as a 5 waves where wave 1 of ((3)) is unfolding as a 5 waves diagonal Elliott Wave structure. A 5 waves diagonal is different than 5 waves impulse […]