In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

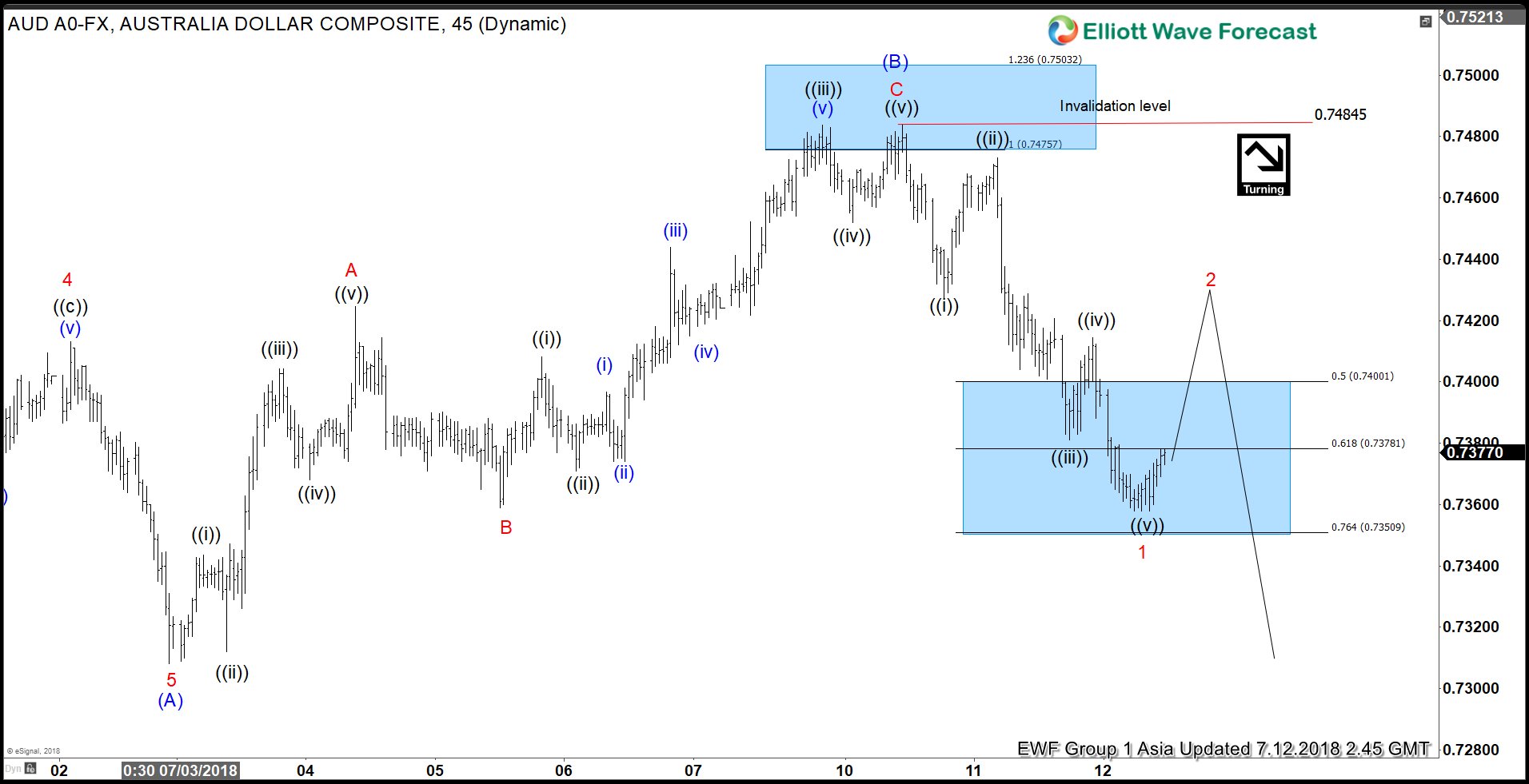

Elliott Wave Analysis: Is AUDUSD Ready to Resume Lower?

Read MoreAUDUSD short-term Elliott Wave view suggests that the decline to $0.7308 low ended Intermediate wave (A) of a possible Zigzag structure coming from 6/06/2018 peak ($0.7676). Above from there, the 3 waves recovery to $0.7484 high ended Intermediate wave (B) bounce. The internals of that Intermediate wave (B) unfolded as Elliott Wave Zigzag correction where […]

-

EURJPY Elliott Wave Analysis: Pullback can Provide Buying Opportunity

Read MoreEURJPY short-term Elliott wave analysis suggests that the decline to $126.63 on 6/19 low ended intermediate wave (2) pullback. Up from there, intermediate wave (3) remains in progress as Elliott wave impulse. The internals of Minor wave 1 is unfolding as a leading diagonal with sub-division of 5-3-5-3-5. Up from $126.63 low, Minute wave ((i)) […]

-

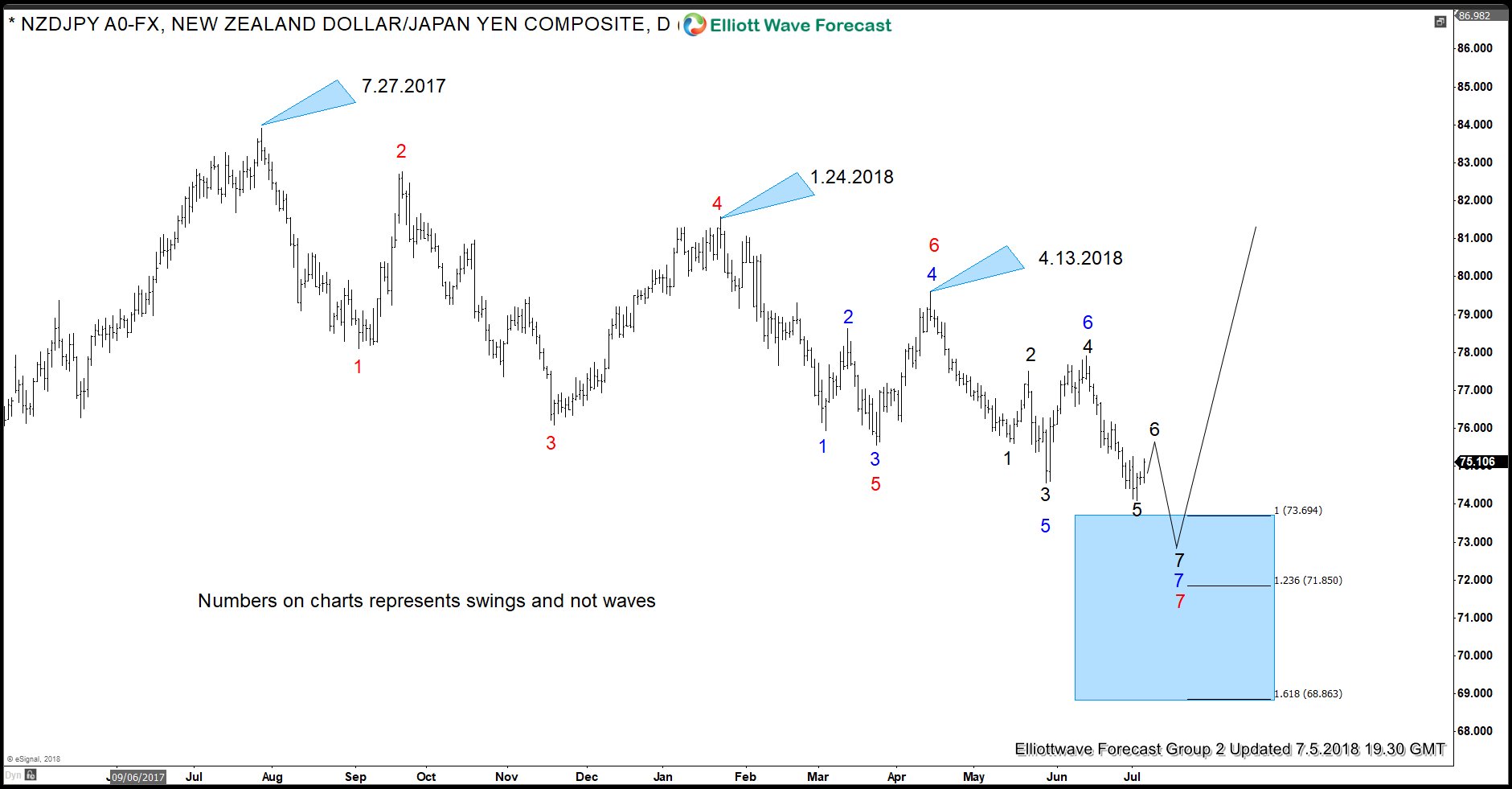

NZDJPY Turned Bearish Or Decline Is An Opportunity To Buy?

Read MoreNZDJPY recently broke below 5/29/2018 (74.54) low due to which there are a lot of bearish forecasts around, some extremely bearish and some less bearish. In this blog, we will look at whether new lows have made NZDJPY turn extremely bearish or this decline is an NZDJPY buying opportunity. Back in May this year we […]

-

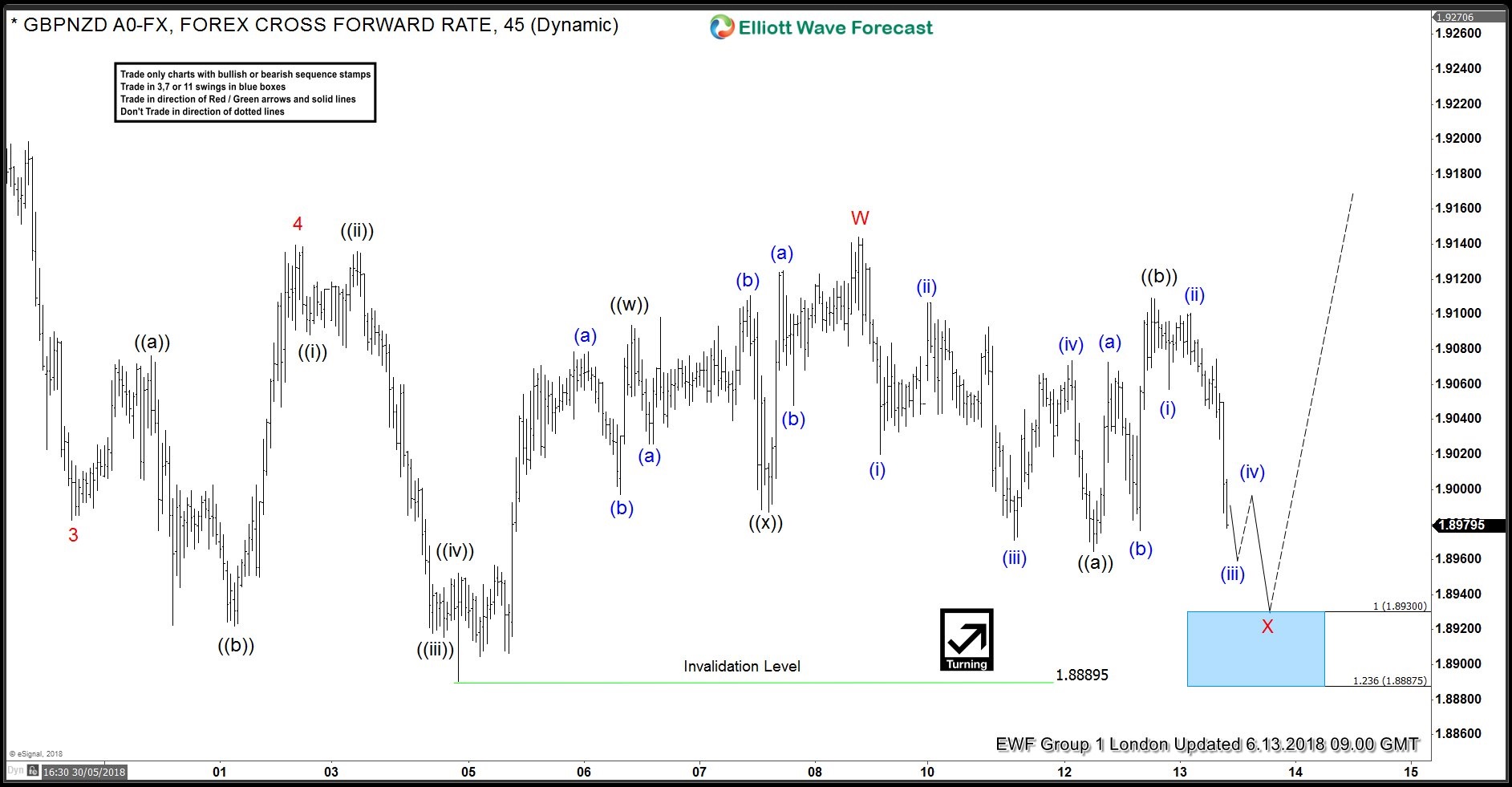

GBPNZD Forecasting the Rally after ZIGZAG

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPNZD published in members area of the website. As our members know, we have been calling for the recovery in the pair since the cycle from the April peak ended at 1.8889 low. In further text we’re […]

-

USDX Elliott Wave Analysis: Bullish Sequence Calling Higher

Read MoreUSDX short-term Elliott Wave view suggests that the decline to 94.18 on 6/25 low has ended correction to the cycle from 6/7/2018 low as Intermediate wave (X). The internals of that pullback unfolded as a Flat correction where Minor wave A ended in 3 swings at 94.53, Minor wave B ended in 3 swings at […]

-

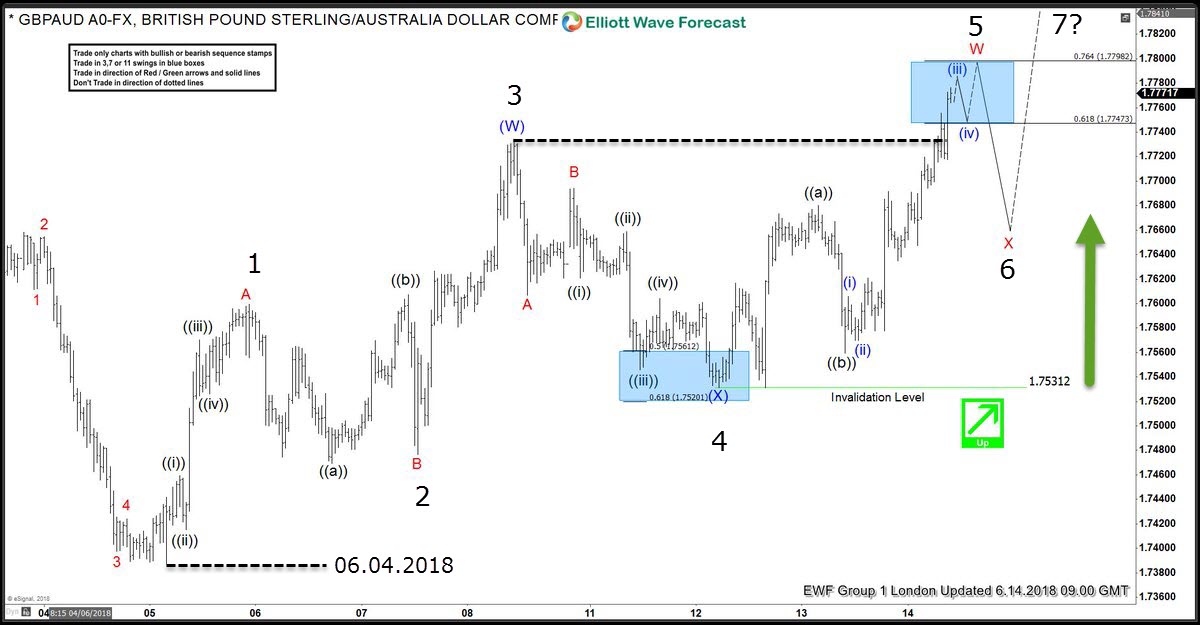

GBPAUD Incomplete Sequences Calling The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPAUD published in members area of the website. As our members know GBPAUD has been showing incomplete bullish sequence: 5 swing in the short term cycle from the June 4th low. These types of […]