In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Will Trump’s Remark Cap the US Dollar Strength?

Read MoreIn an interview with CNBC last Thursday, President Trump indicated that he is not thrilled about interest rate hikes. He went on to say that he did not agree with the Fed’s decision to keep raising the rate. Trump argued that the higher rate puts the U.S. at a disadvantage compared to the European Union […]

-

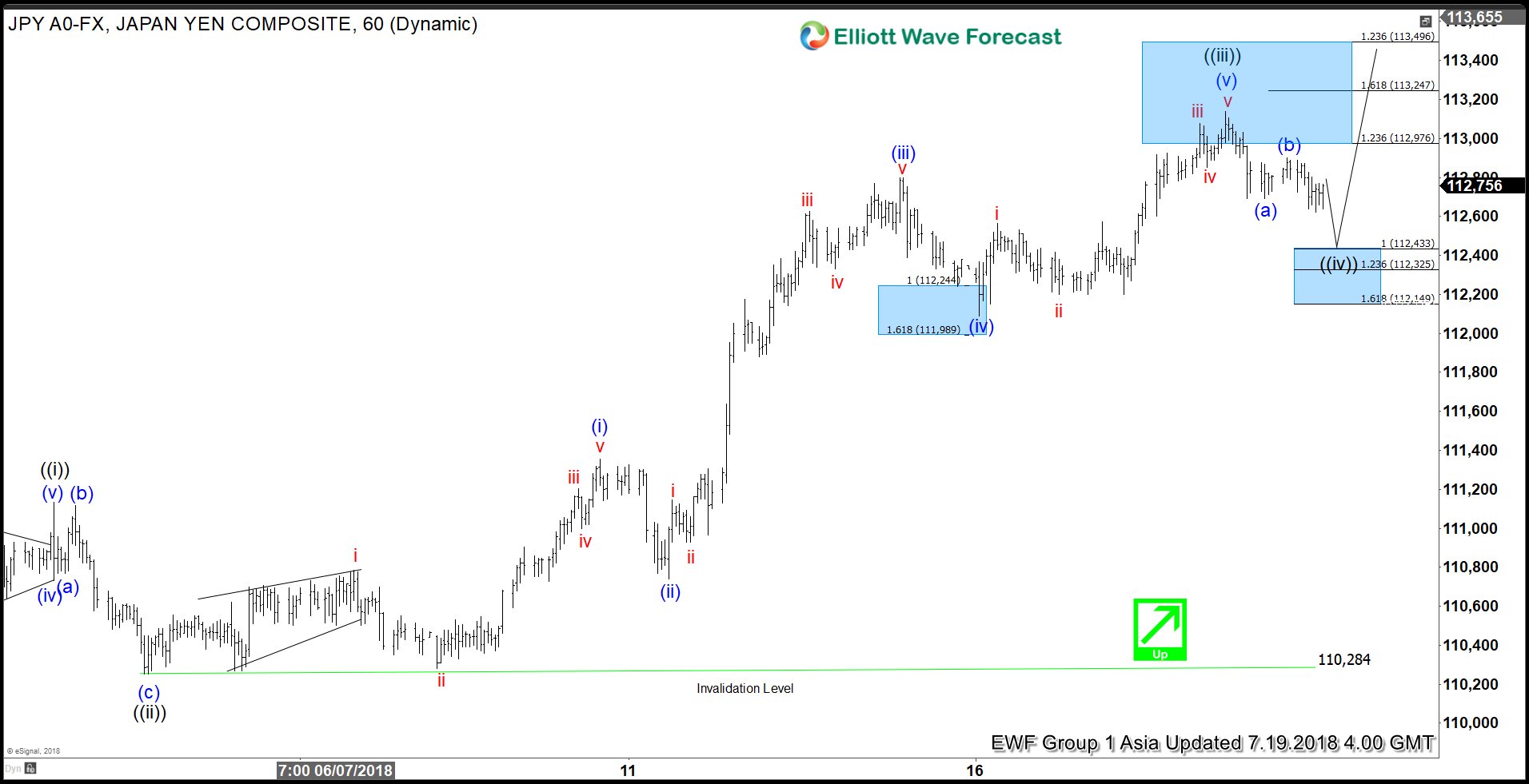

Elliott Wave Analysis: USDJPY Rallying Higher As Impulse

Read MoreUSDJPY short-term Elliott Wave analysis suggests that the pullback to 110.28 low ended Minute wave ((ii)) pullback. The internals of that pullback unfolded as Elliott wave Flat structure where Minutte wave (a) ended at 110.77. Up from there, bounce to 111.11 ended Minutte wave (b), and Minutte wave (c) of ((ii)) ended in 5 waves at 110.28 low. […]

-

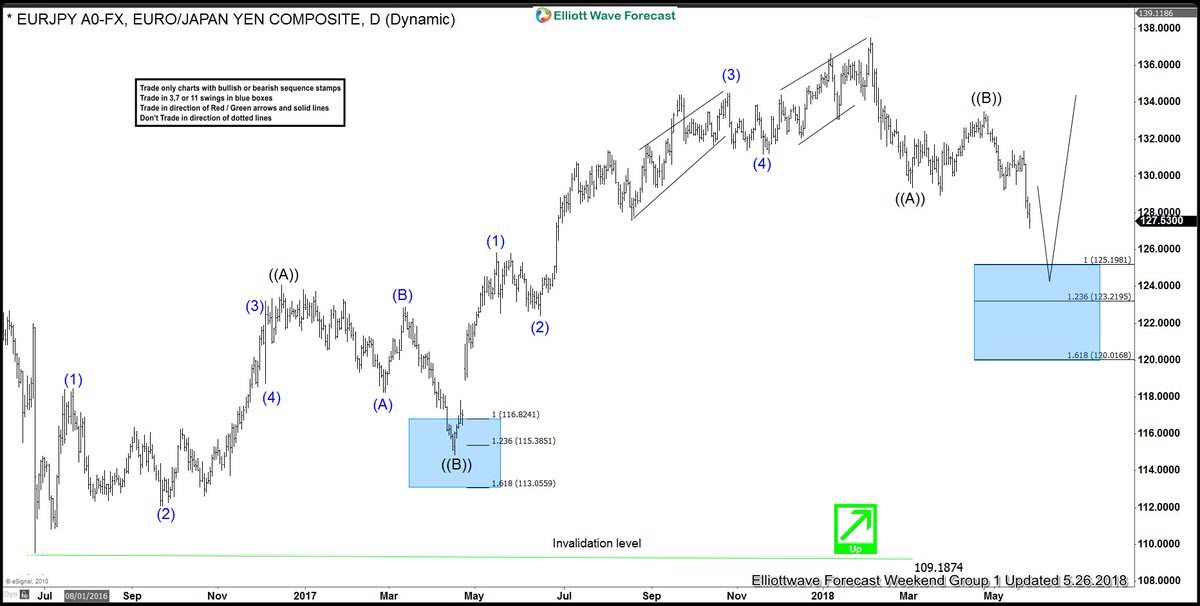

EURJPY Forecasting the Path & Buying the Dips

Read MoreHello Fellow Traders. Another instruments we have traded lately is EURJPY. As our members know, EURJPY has been correcting the cycle from the June 2016 low ( 109.187). We knew that price will find buyers as soon as it reaches extremes per Elliott Wave hedging strategy. We recommended members to wait for extremes to be […]

-

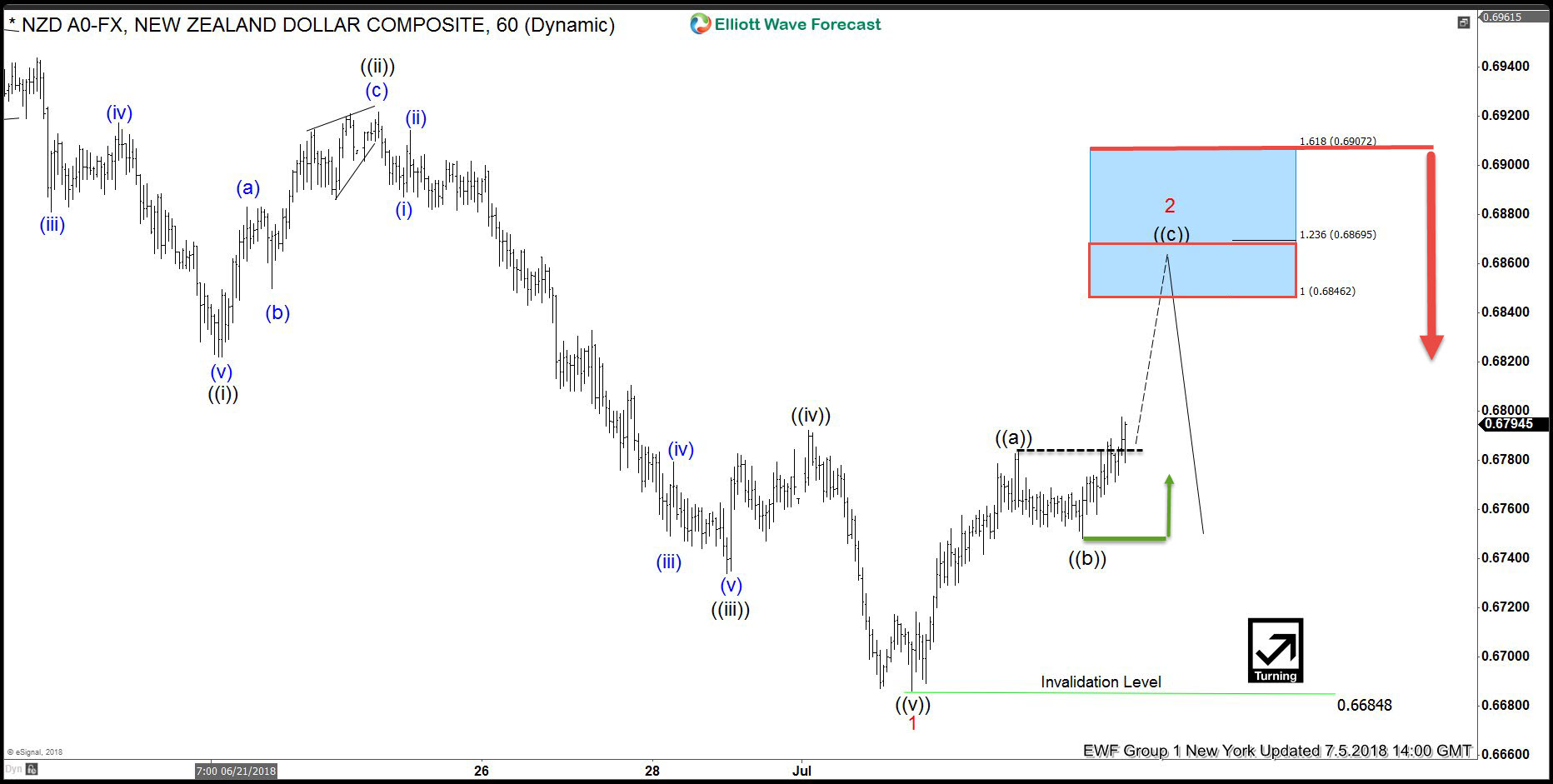

NZDUSD forecasting the path & selling the rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of NZDUSD . In further text we’re going to explain the Elliott Wave structure, forecast and trading strategy. As our members know, we were keep saying that NZDUSD has had incomplete bearish sequences in cycle from the July […]

-

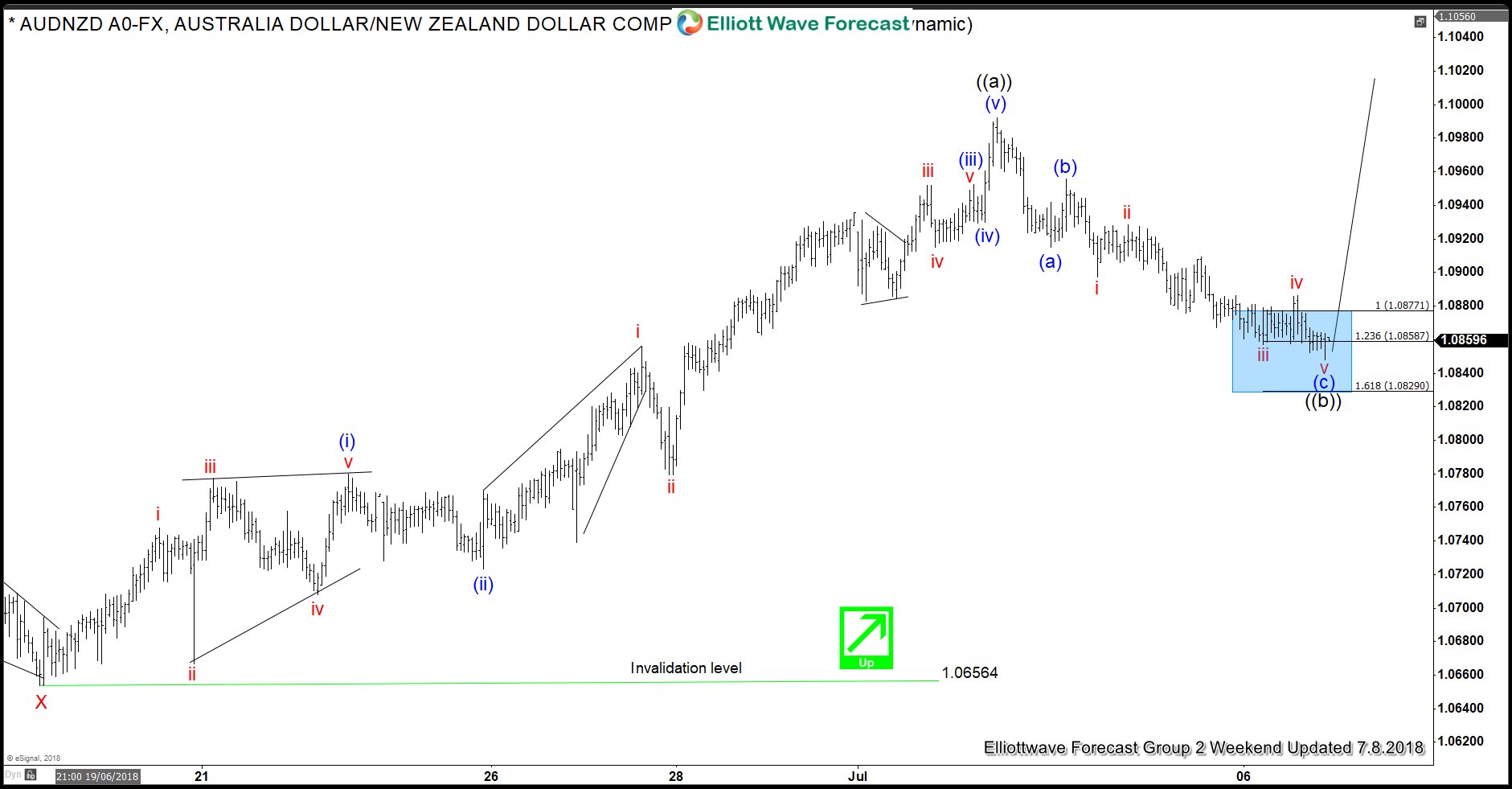

AUDNZD Elliott Wave Analysis

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of AUDNZD which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 07/8/18 showing that AUDNZD reached our high-frequency trading blue box area. AUNZD ended the cycle from 06/19 low, at the high of […]

-

Elliott Wave Analysis: USDJPY Extending Higher As Impulse

Read MoreUSDJPY short-term Elliott Wave view suggests that the rally to 111.13 high ended Minute wave ((i)). Down from there, the pullback to 110.24 low ended Minute wave ((ii)). The internals of that pullback unfolded as a Flat Elliott Wave structure where Minutte wave (a) ended in lesser degree 3 swings at 110.77. Then bounce to […]