In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

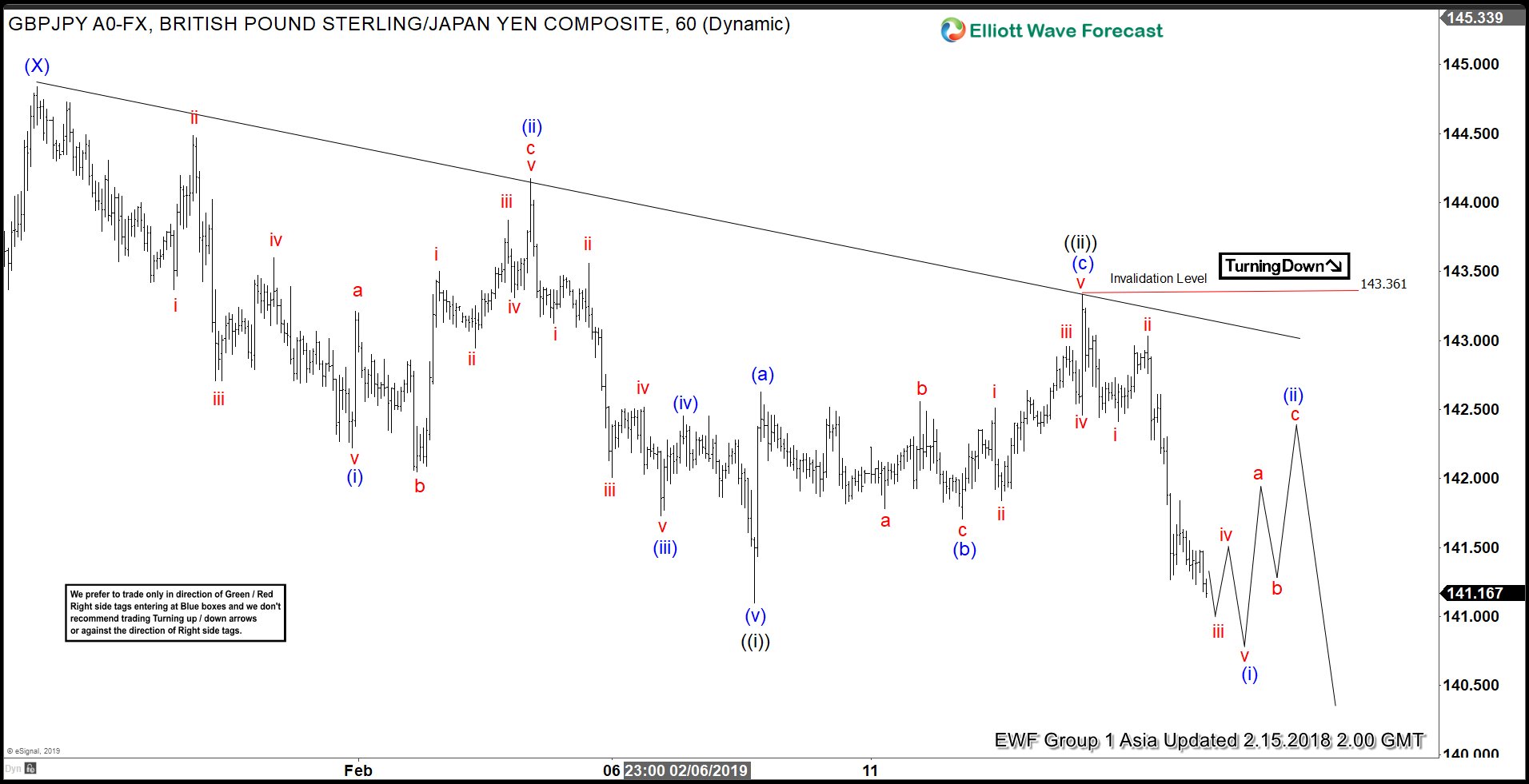

GBPJPY Sellers in Control | Elliott Wave Forecast

Read MoreThis article and video explains the short term path of GBPJPY. The pair shows a 5 swing sequence from Jan 26 high, favoring further downside. The article provides the level that should not be broken if the bearish view is going to play out.

-

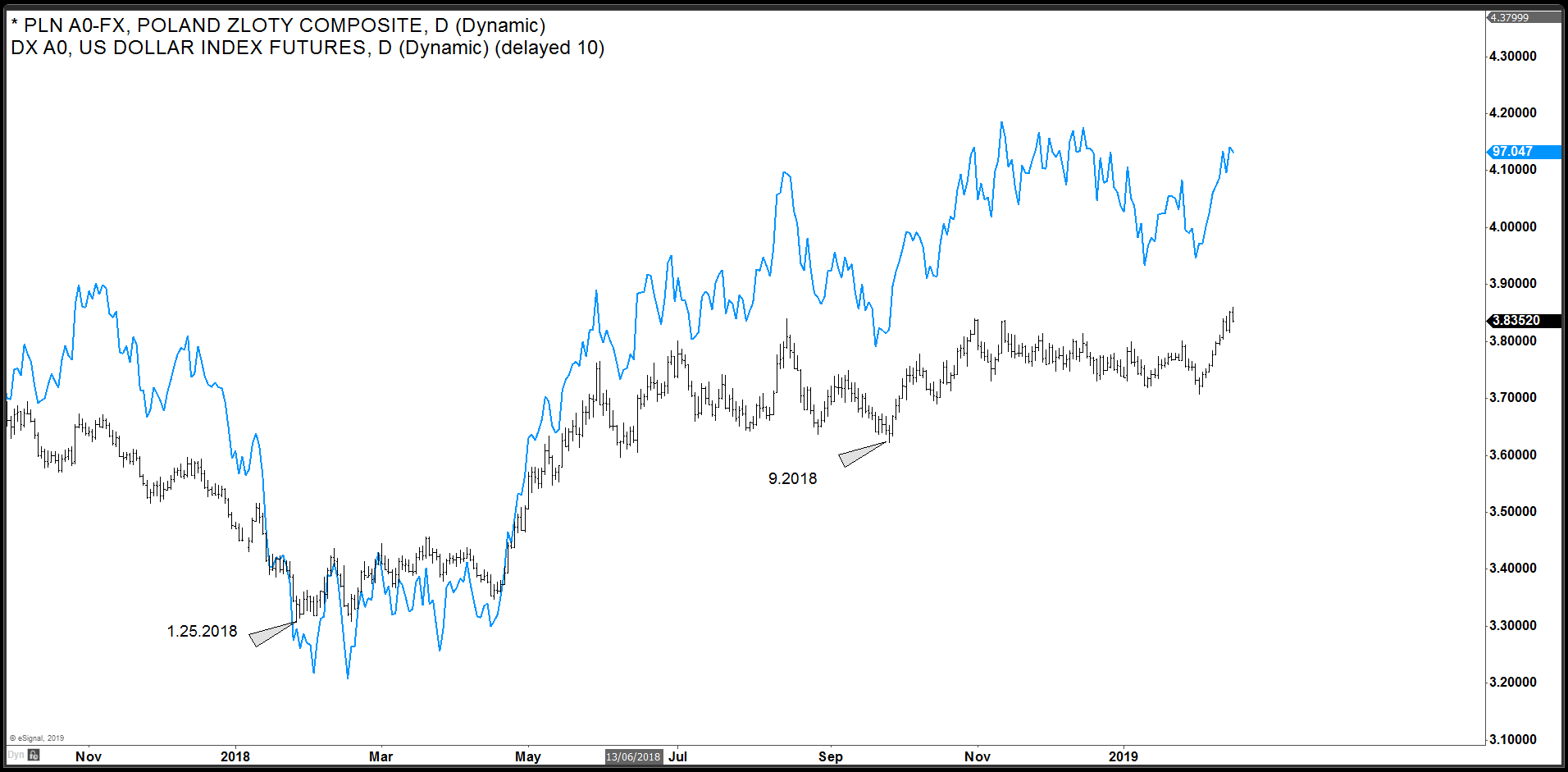

USDPLN Buyers In Control as October High Breaks

Read MoreUSDPLN has rallied strongly over the past 2 weeks which resulted in a break of October 2018 peak. In this blog, we will take a look at the mid-term and short-term Elliott wave structure of this Forex pair and what we can expect going forward. We have also overlaid DXY (US Dollar Index) chart with […]

-

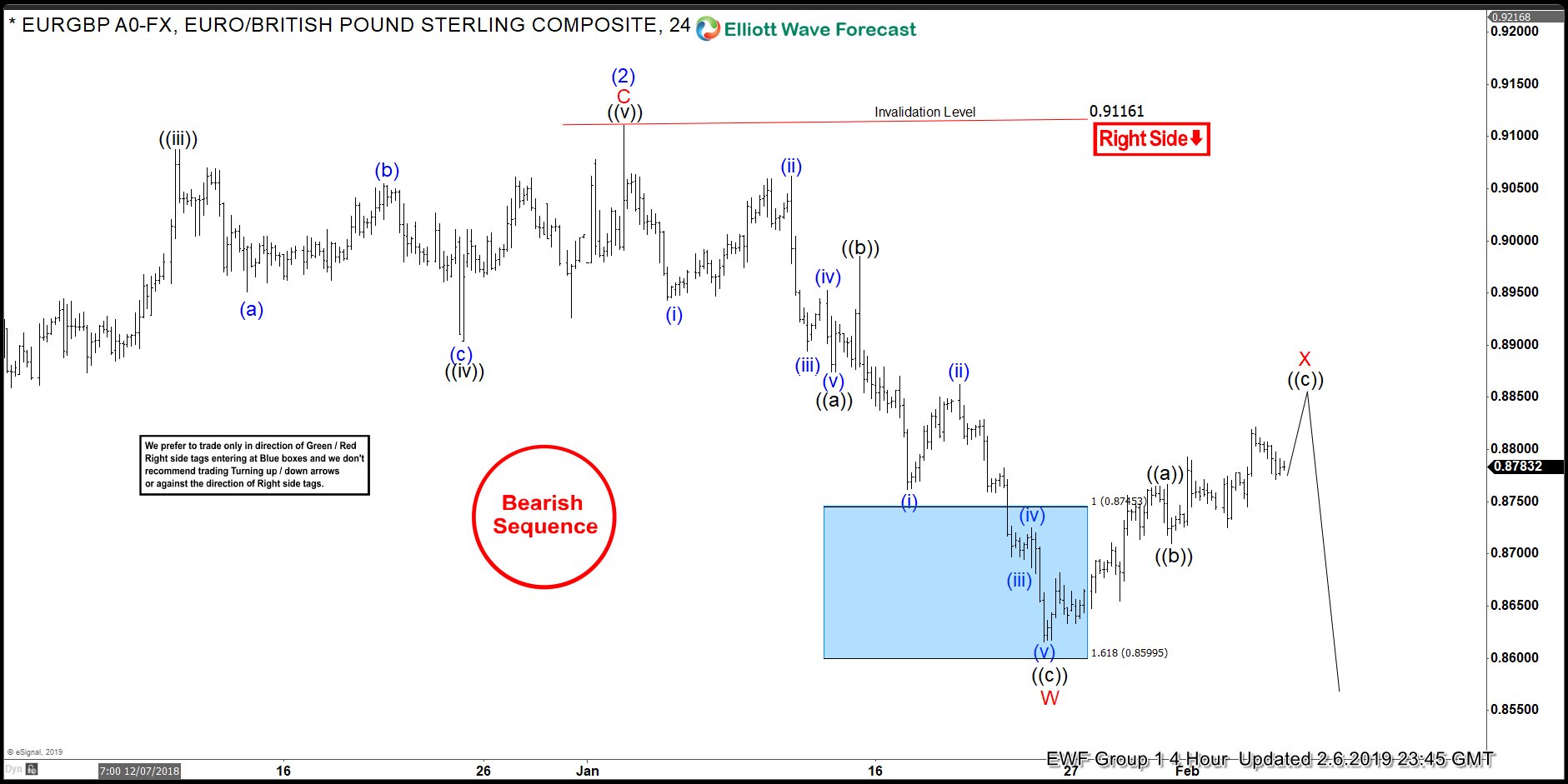

Elliott Wave Analysis: More Downside Expected in EURGBP

Read MoreHello fellow traders. I want to share with you some Elliott Wave charts of EURGBP which we presented to our members at Elliott Wave Forecast. You see the 4-hour updated chart presented to our clients on the 01/26/19 below EURGBP unfolded as an Elliott Wave Zig-Zag structure from 01/02/19 peak. Decline from there ended black wave ((a)) at 0.88768 and wave ((b)) […]

-

Elliott Wave View Favors More Downside in GBPUSD

Read MoreThis article and video explains the short term path for GBPUSD. Pair is showing a 5 waves move from Jan 26, 2019 high which favors the downside.

-

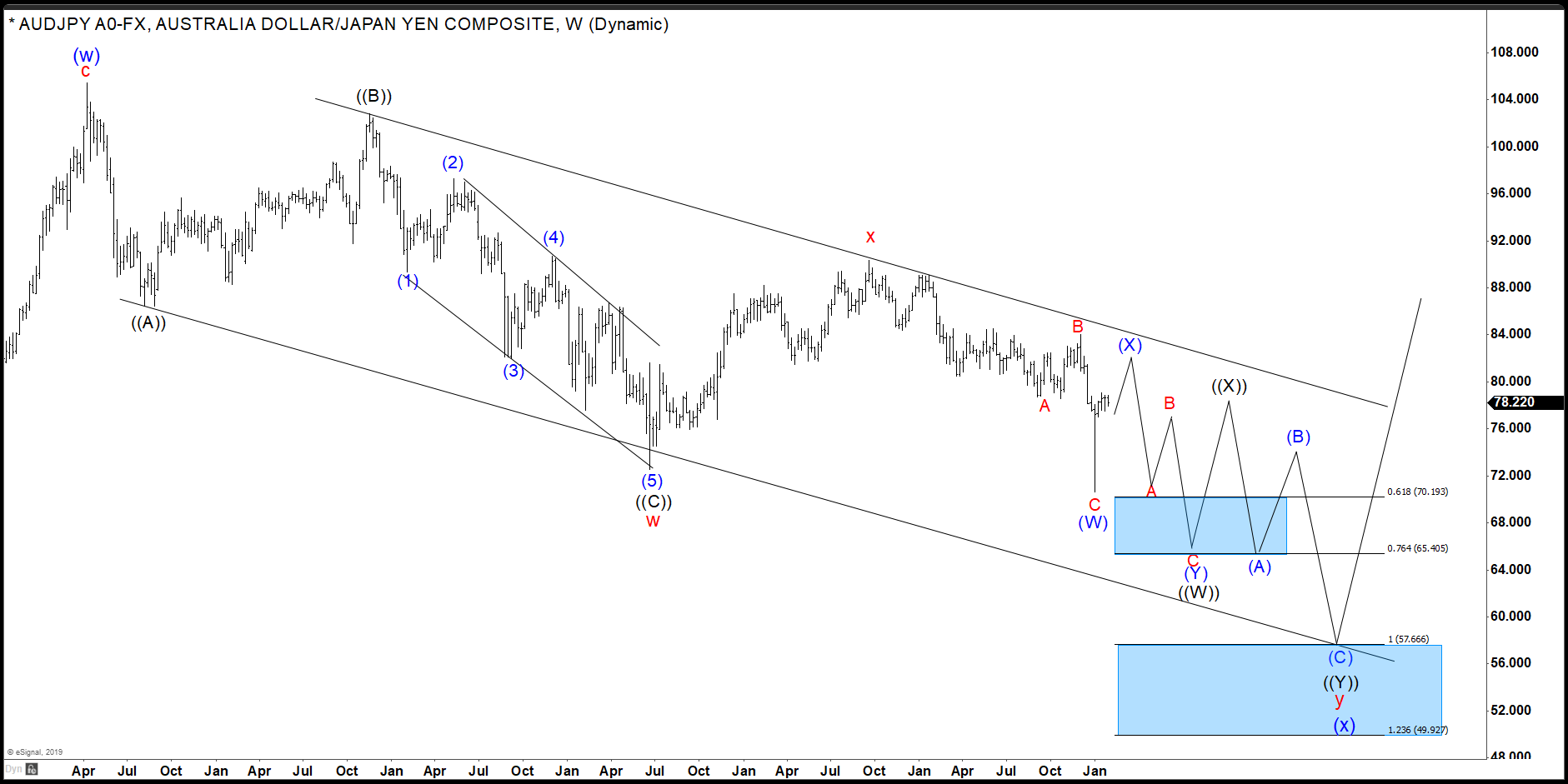

Yen Strength to Channel AUDJPY Lower

Read MoreOver the next few weeks Japanese Yen strength should drive prices of AUDJPY lower within a downward sloping channel. The current incomplete Elliott Wave structure also supports this expectation of further downside. In this article we’ll explore the basics of the current wave structure and its parallel channel. This combined analysis charts a great area […]

-

Elliott Wave Analysis: The Right Side Of A Choppy GBPUSD Price Action

Read MoreSay what you want about Brexit news or president Trump news, we only care about the chart! Our analysis and decisions do NOT depend on news but solely on what we refer to “the right side of the market”. Traders, today we will look at a couple of GBPUSD charts. The following analysis will show you […]