-

Dow Futures (YM) Resumes Upward Drive in Impulsive Formation

Read MoreDow Futures (YM) extends higher in impulsive structure. This article and video looks at the Elliott Wave path of the Index.

-

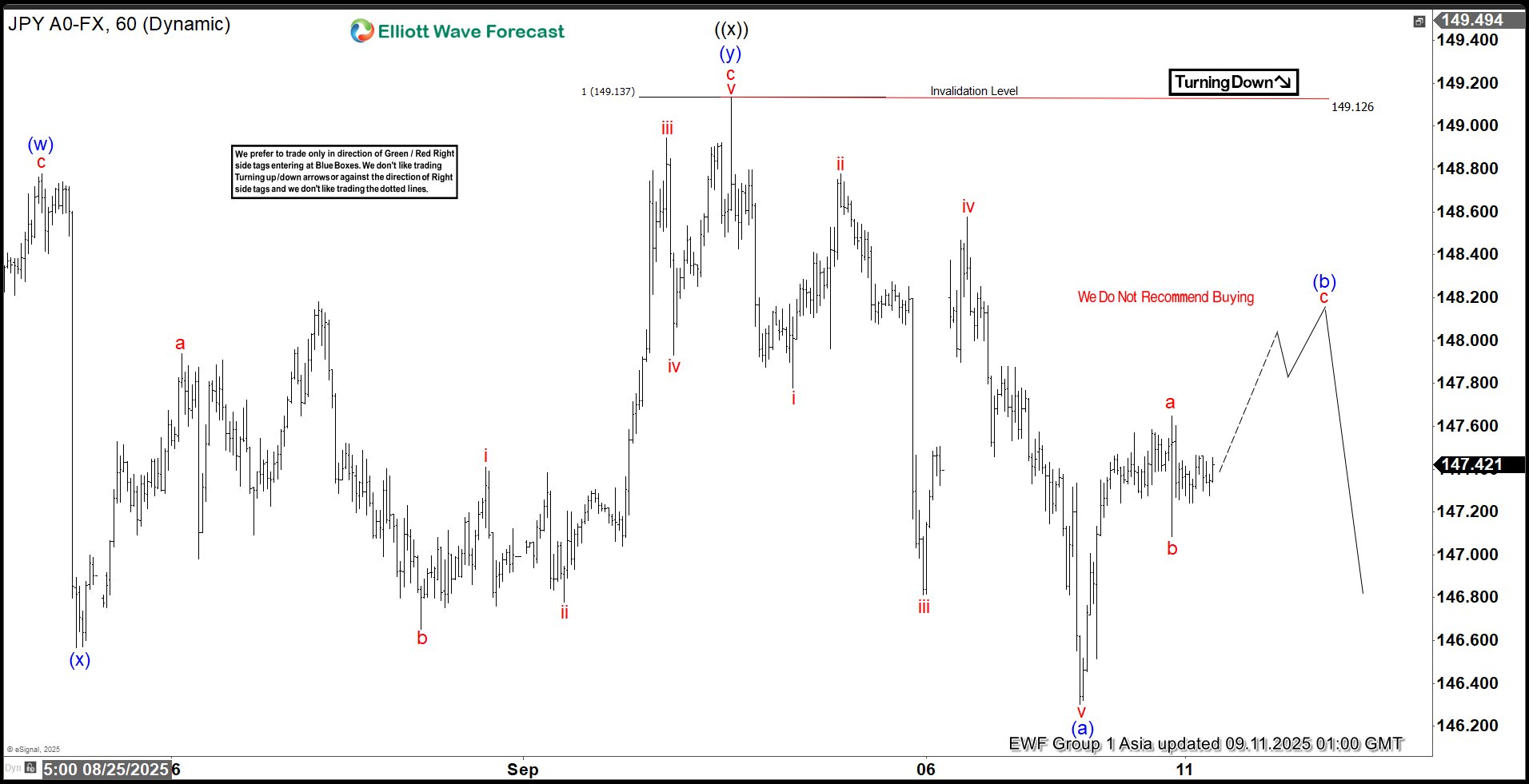

Elliott Wave Analysis: USDJPY Zigzag Correction Likely to Fail Below 149

Read MoreUSDJPY is poised to complete a corrective rally before resuming its downward trend. This article looks at the Elliott Wave path & target levels.

-

SPY Elliott Wave Outlook: Wave (3) Nearing Termination

Read MoreS&P 500 ETF (SPY) is looking to rally higher to end wave (3). This article and video look at the technical Elliott Wave path and target.

-

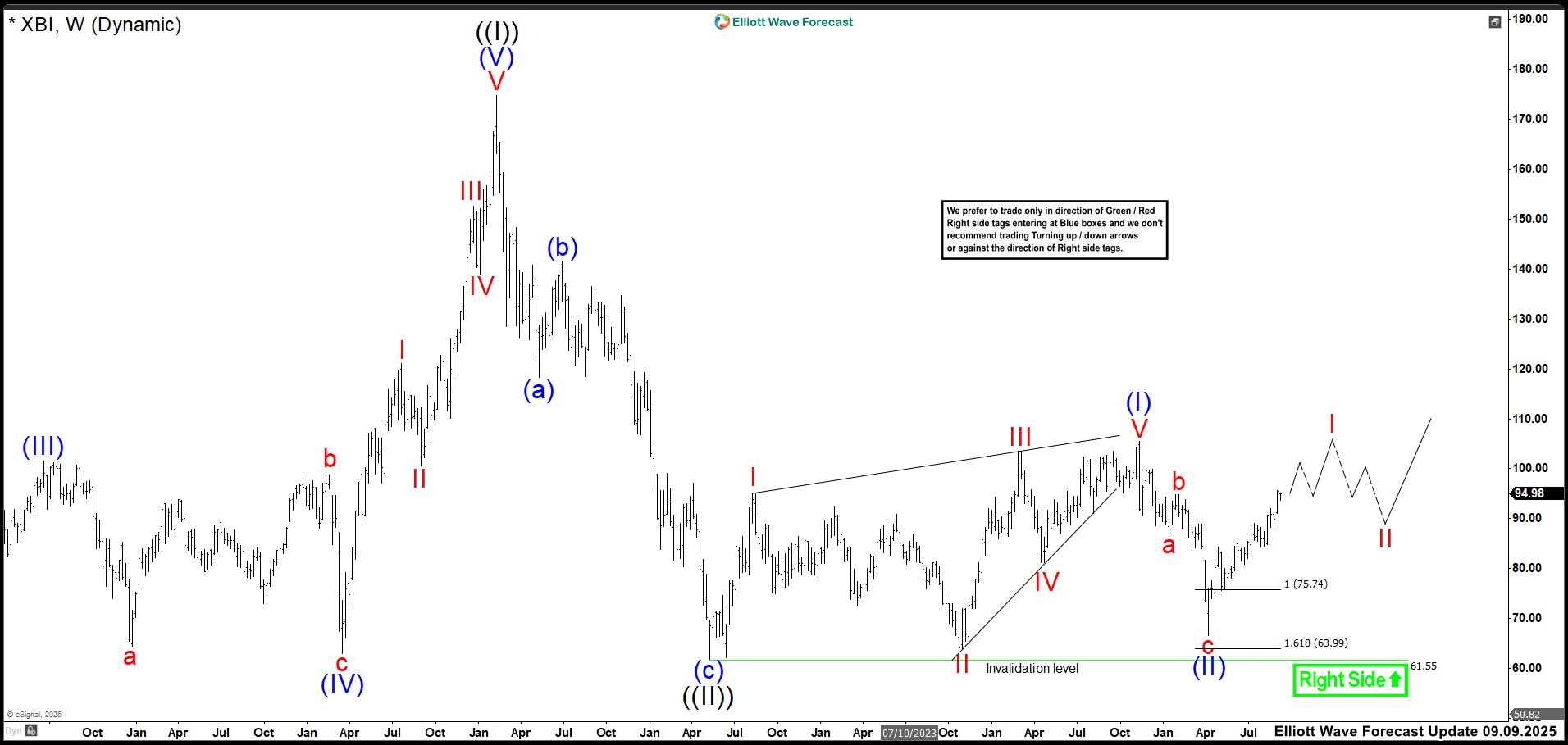

Biotech Surge: XBI Ends Correction and Rallies as Expected

Read MoreThe SPDR S&P Biotech ETF (XBI) draws investors who seek high-risk, high-reward exposure to the biotech sector. In late 2025, investor sentiment remains cautiously optimistic. This reflects both strong opportunities and ongoing uncertainty. Analysts set a 12-month price target near $141.31. That suggests a 48% upside from current levels around $95. Technical indicators support this […]