-

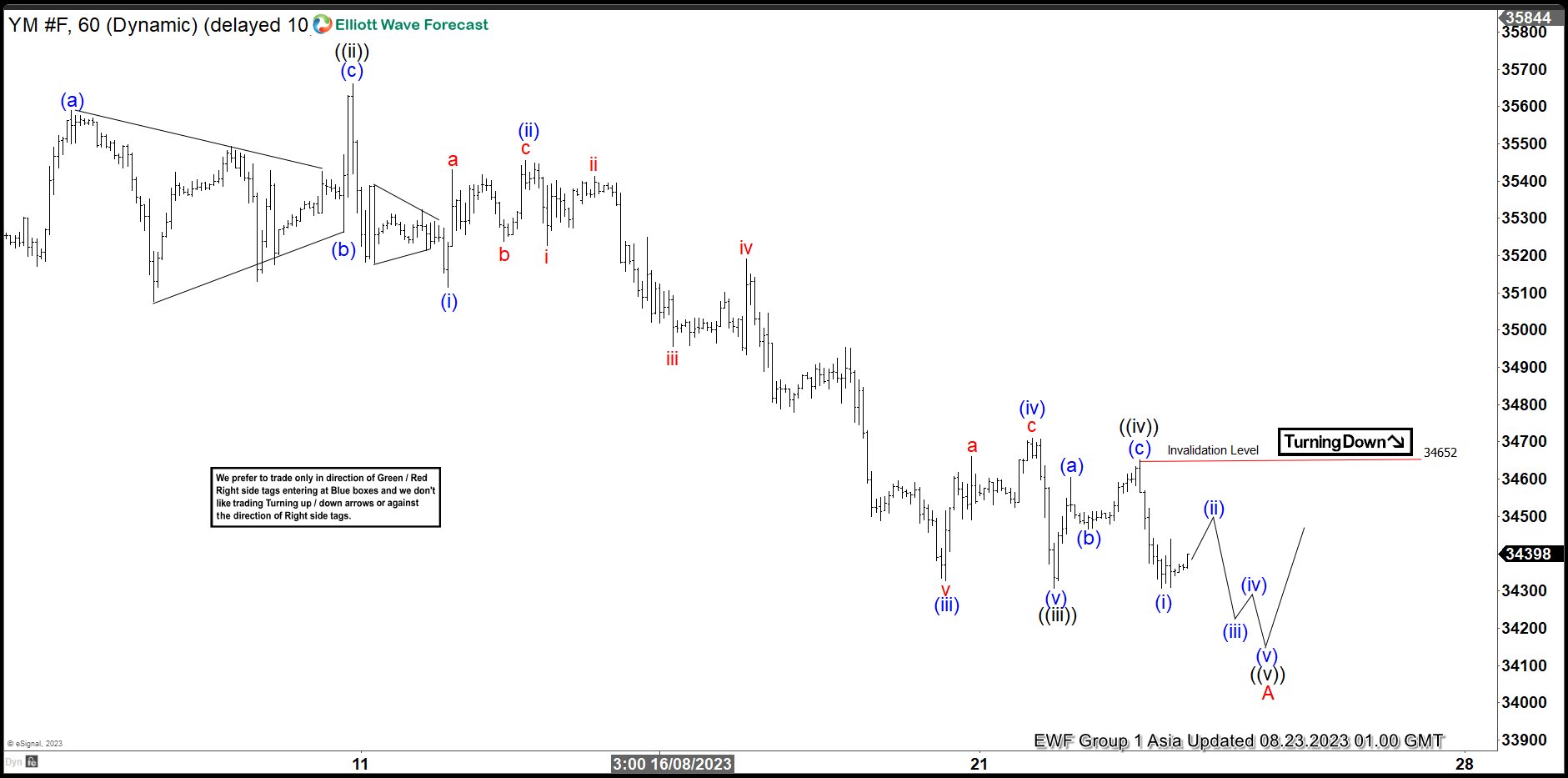

Dow Futures (YM_F) Looking for Corrective Rally Soon

Read MoreShort Term Elliott Wave view in Dow Futures (YM_F) suggests that cycle from 7.27.2023 high is mature and about to complete soon as 5 waves impulse. Down from 7.27.2023 high, wave ((i)) ended at 35076 and rally in wave ((ii)) ended at 35660. Index extended lower in wave ((iii)) as another impulse in lesser degree. […]

-

FTSE and Hangseng Should Act As a Floor for the Indices

Read MoreIndices sold off last week, while some Indices reached extreme Fibonacci extension areas from the highs in 3 or 7 swings, it remains to be seen whether correction in the Indices is over or will extend. Today, we will take a look at Elliott wave sequences in two Stock Markets like FTSE from UK and […]

-

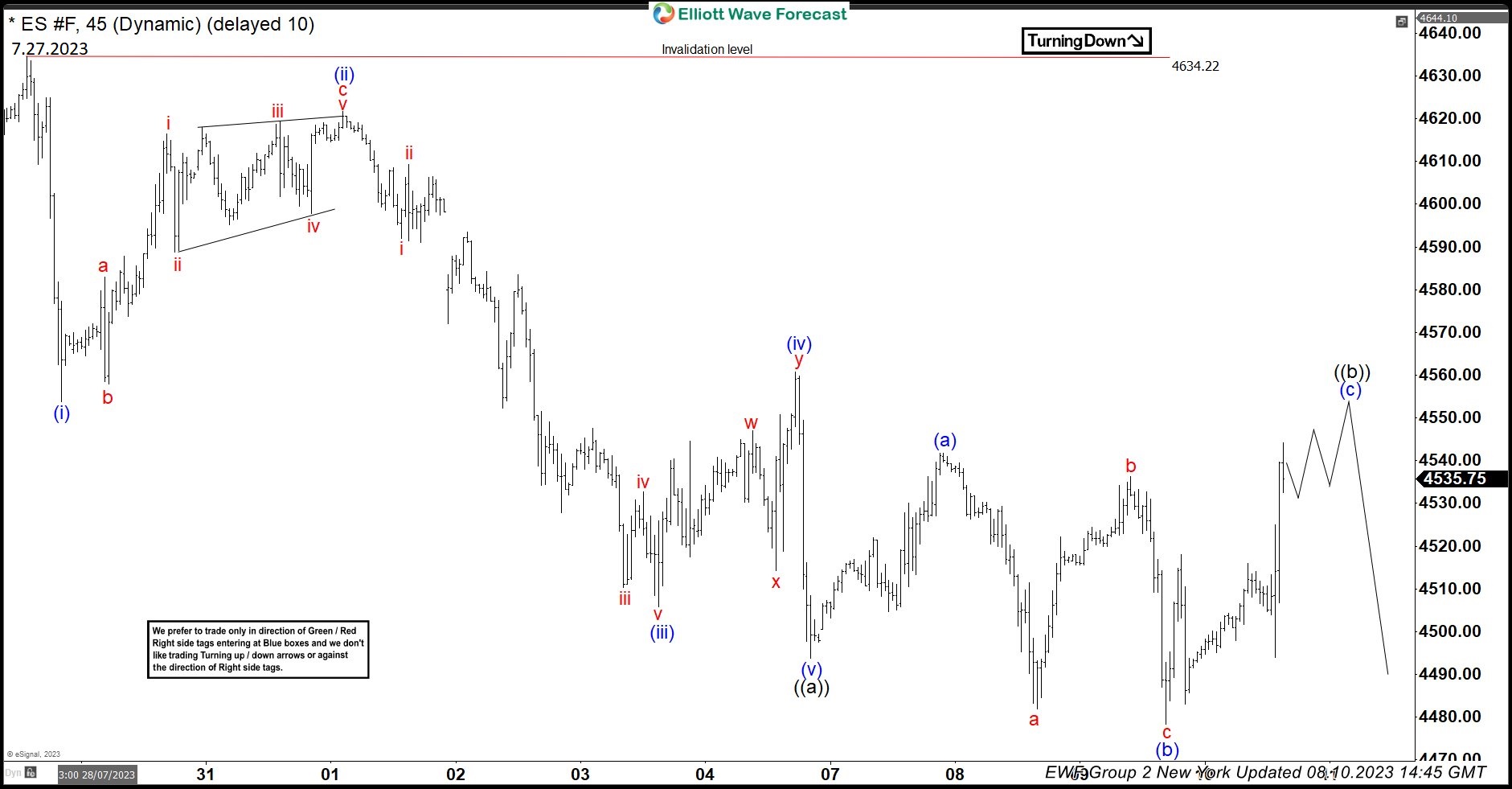

ES_F: Forecasting The Decline In A ZigZag Elliott Wave Structure

Read MoreES_F (E-mini S&P 500) dropped from 4634.50 to 4350 from 7.27.2023 to 8.18.2023. This decline took the form of a zigzag Elliott wave structure. Today, we will take a look at the structure of the decline from 7.27.2023 peak and how we spotted this zigzag structure and forecasted another leg lower in ES_F. Elliott Wave […]

-

Cameco (CCJ) Consolidation Resolve to the Upside

Read MoreCameco Corporation (ticker symbol: CCJ) is a prominent Canadian uranium mining company headquartered in Saskatoon, Saskatchewan. Founded in 1988, Cameco has established itself as one of the world’s largest and most respected uranium producers. The company is involved in all stages of the uranium mining process, from exploration and mining to refining and marketing. We […]