-

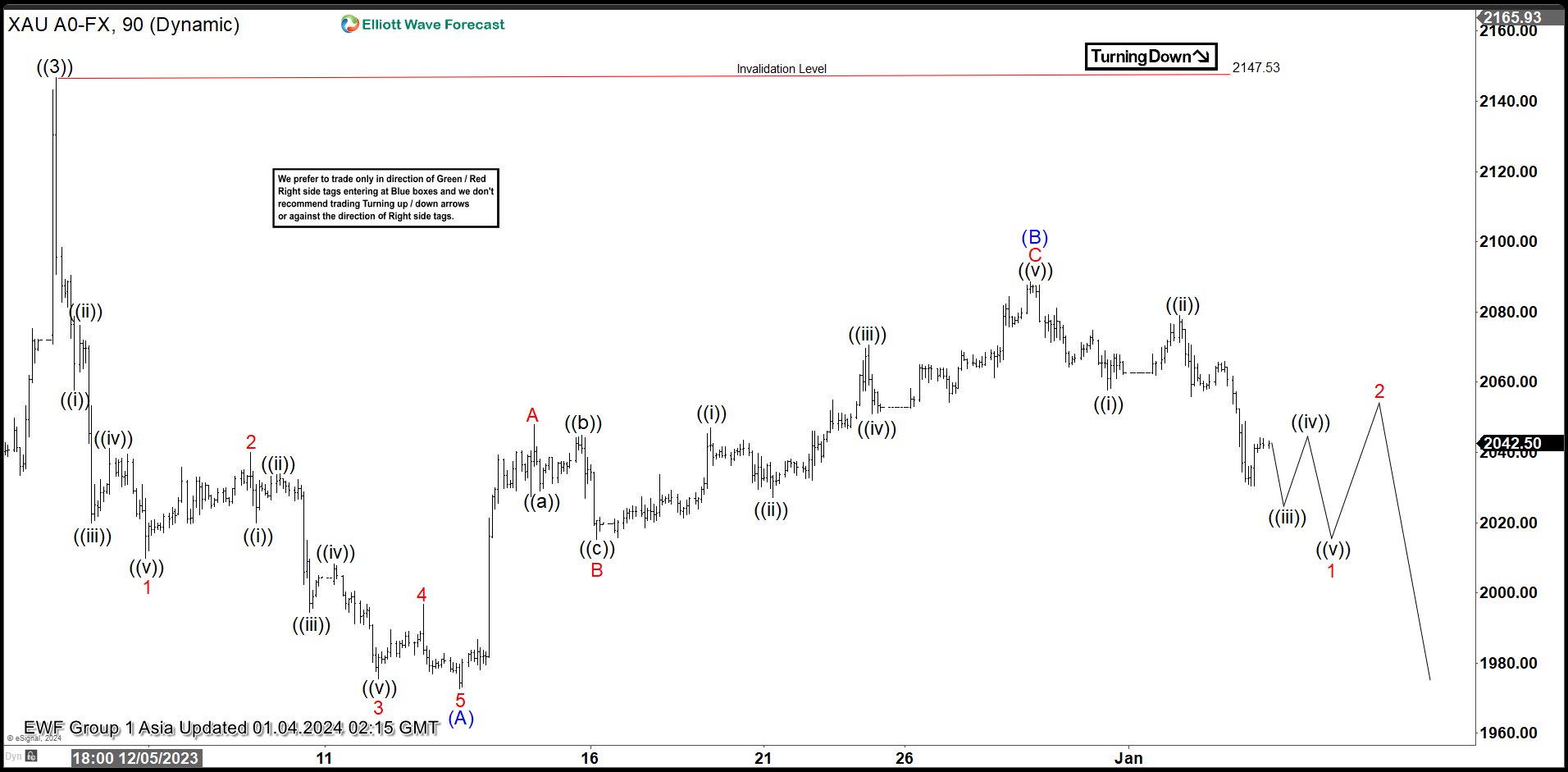

Gold (XAUUSD) Might See Larger Degree Correction

Read MoreGold (XAUUSD) is correcting larger degree cycle from 10.6.2023 low. This article and video look at the Elliott Wave path of the metal.

-

Cameco (CCJ) Should Continue Bullish Trend in 2024

Read MoreCameco Corporation, headquartered in Saskatoon, is a key player in uranium production. It operates major mines globally. As a significant contributor to the nuclear energy sector, the company’s success is influenced by uranium prices and regulatory dynamics. Below we provide an Elliott Wave technical update for the stock. Cameco ($CCJ) Monthly Elliott Wave Chart Monthly […]

-

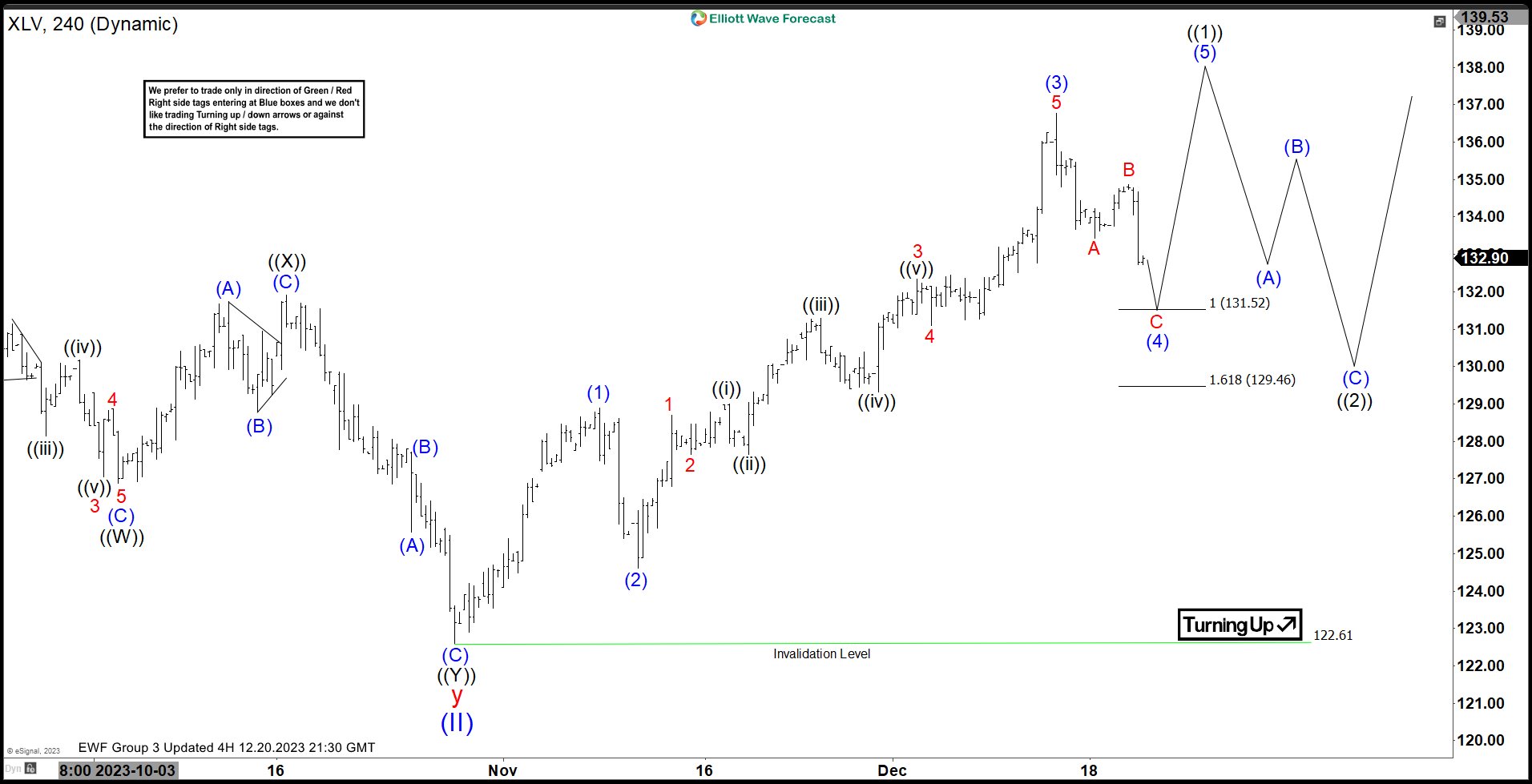

XLV Making Strong Reaction Higher From Extreme Area

Read MoreIn this blog, we take a look at the past performance of XLV charts. The ETF produced a strong reaction higher from the extreme area.

-

Dow Futures (YM) Looking to Extend Higher to Complete Impulsive Structure

Read MoreDow Futures (YM) is looking to end impulsive structure from 10.27.2023 low. This article and video look at the Elliott Wave path.