-

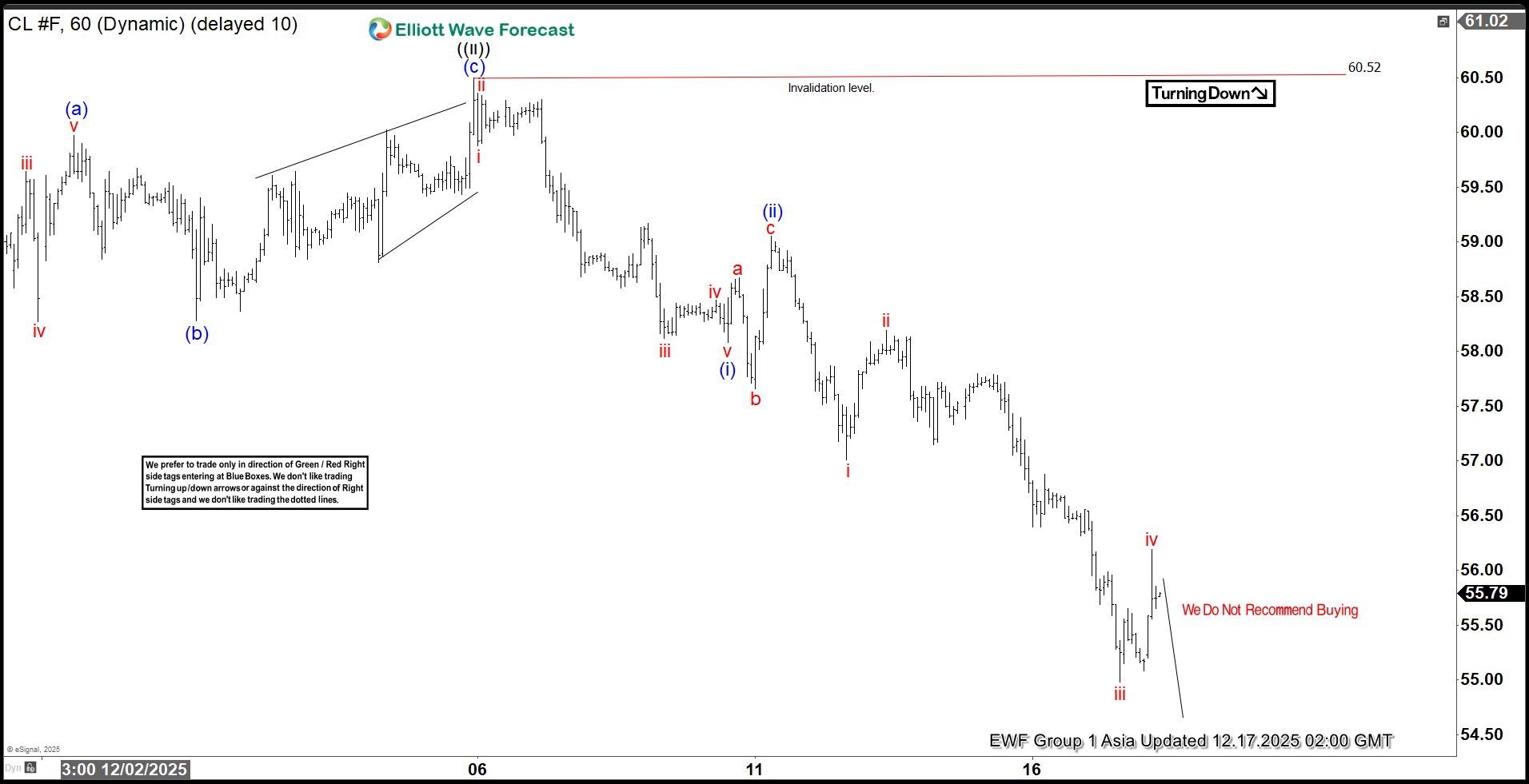

Bearish Sequence Pressures Oil (CL) Lower

Read MoreLight Crude Oil (CL) breaks to the downside and creates bearish sequence from March 2022 peak. This article and video look at the Elliott Wave path.

-

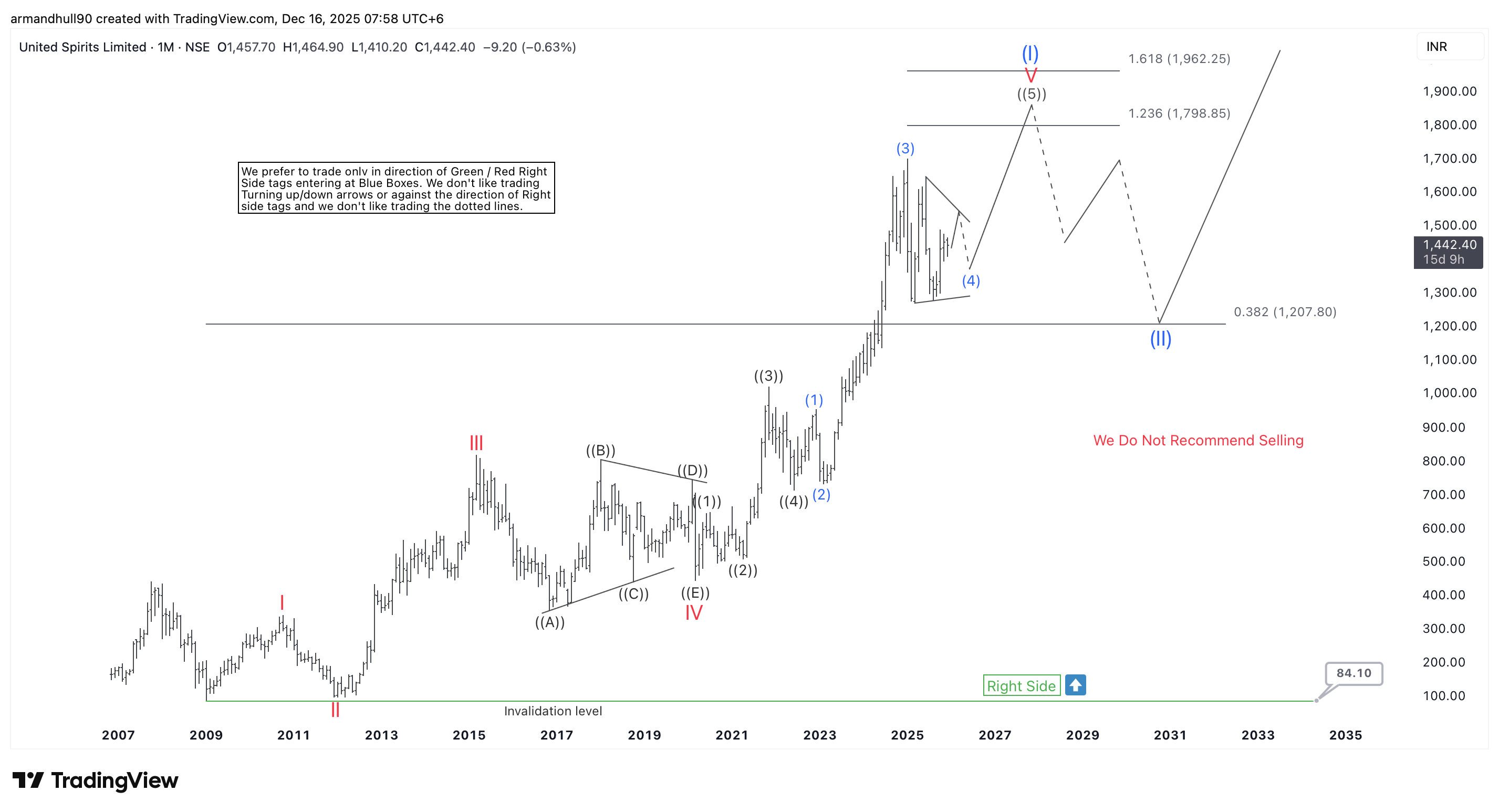

UNITDSPR Elliott Wave Outlook: Bullish Structure Points to ₹1,798–₹1,962 Targets

Read MoreMonthly Elliott Wave analysis shows Wave I nearing completion, key Fibonacci targets ahead, and a corrective pullback before the next major rally. United Spirits Limited (NSE: UNITDSPR) continues to trade in a strong long-term bullish Elliott Wave structure on the monthly chart. The broader trend remains positive despite short-term price swings. Since the 2020–2021 period, […]

-

Elliott Wave in Action: GBPUSD Blue Box Reaction

Read MoreIn this technical blog, we have looked at the past Daily charts of GBPUSD & analyzed bullish reaction higher from the blue box area.

-

TSM Road to $340 Target and Strategic Correction

Read MoreOur prior analysis established Taiwan Semiconductor (NYSE: TSM) bullish weekly trajectory. Now, we examine the daily Elliott Wave structure. This detailed view identifies the next key target and signals a potential near-term correction. Elliott Wave Analysis TSM daily rally began at the April 2025 low of $134. Subsequently, Wave ((1)) peaked at $248. Then, Wave […]