-

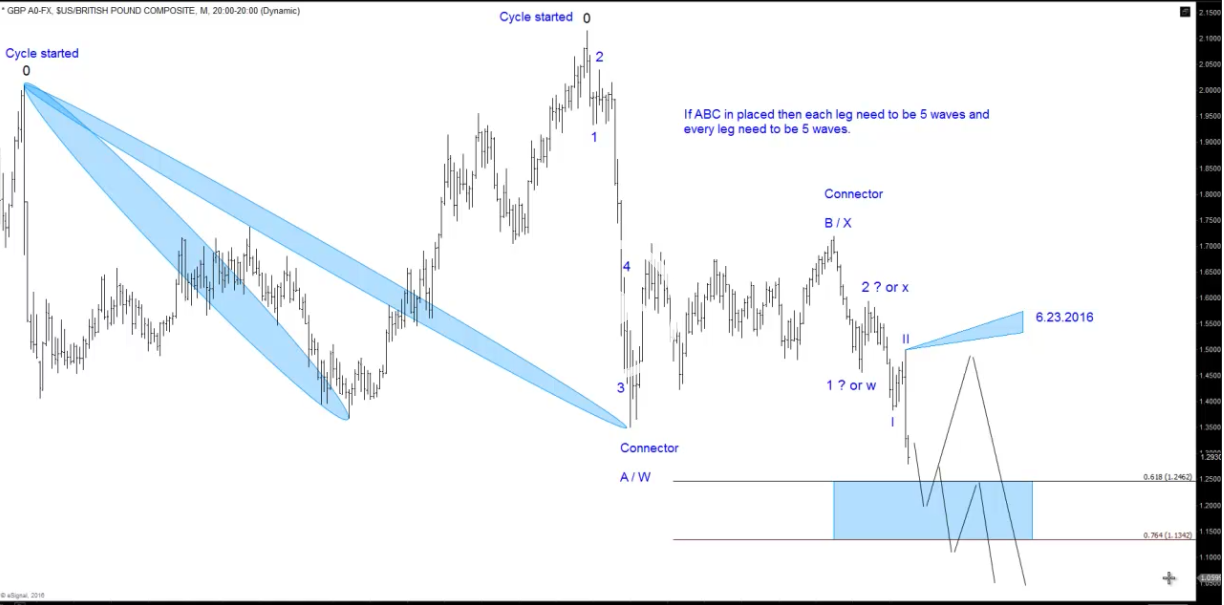

Elliott wave Theory: Is the Impulse count in GBPUSD right?

Read MoreThe Elliott wave Theory was developed in 1930 and of course the most popular pattern is the 5 waves advance and 3 waves back to correct the advance or decline. Since the Theory was developed the Marketplace has changed some as well as the charting tools we have at our disposal now. Consequently the main idea has […]

-

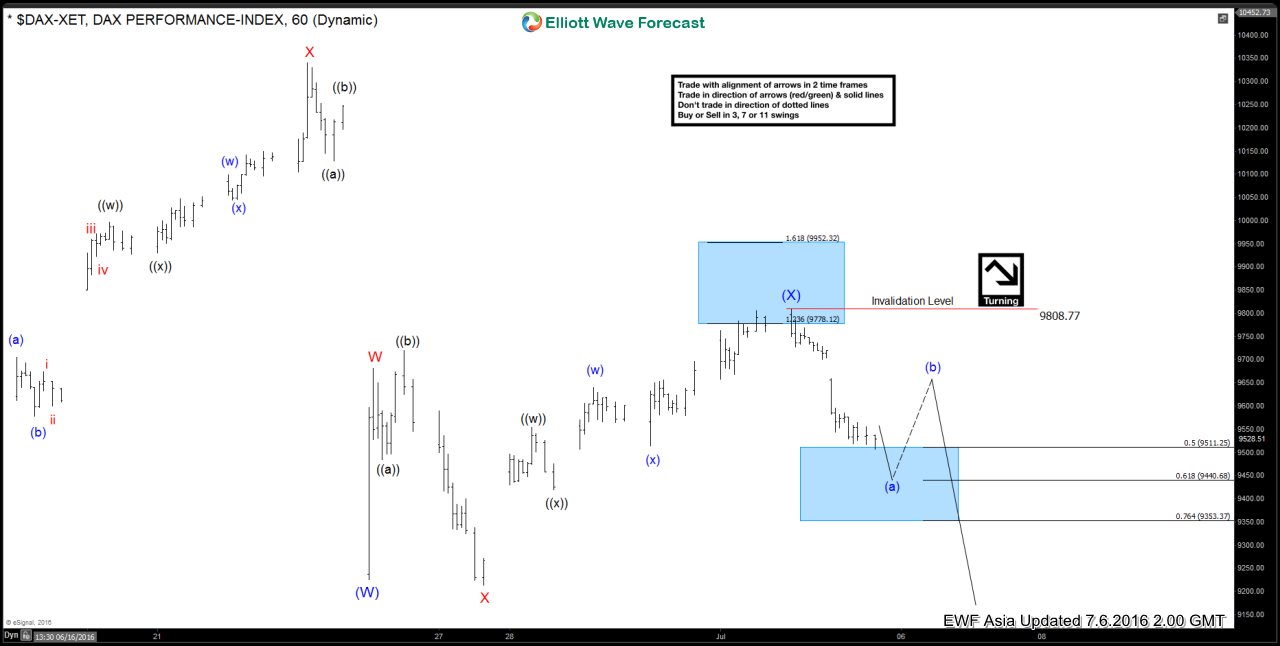

$DAX Short-term Elliott Wave Analysis 7.6.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X bounce at 10340. Decline from there is unfolding as a double correction where wave (W) ended at 9226.15 and wave (X) bounce is proposed complete at 9808.77. Near term wave (a) is expected to complete at 9353 – 9511 area, then it should bounce in wave (b) before […]

-

$DAX Short-term Elliott Wave Analysis 7.5.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X bounce at 10340. Decline from there is unfolding as a double correction where wave (W) ended at 9226.15 and wave (X) bounce is currently in progress as a Flat structure and has scope to extend 1 more leg higher towards as high as 10000 before Index resumes the decline. As […]

-

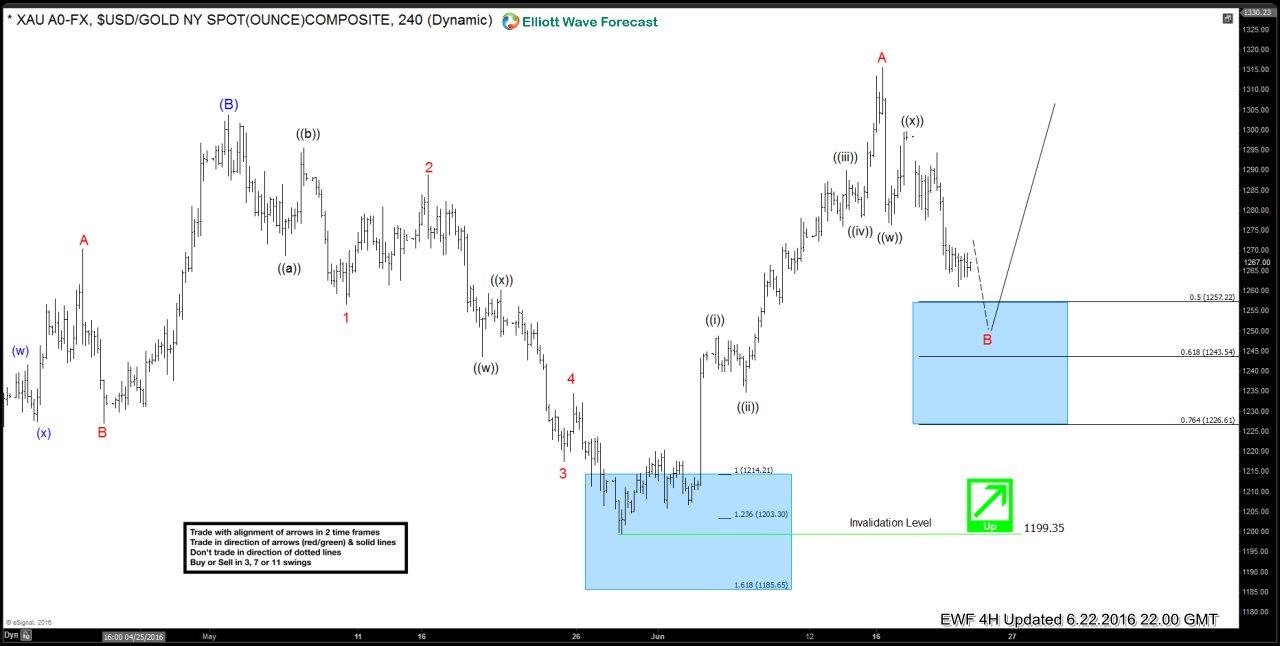

Is uncertainty Gold’s best friend?

Read MoreGold is enjoying a strong run in recent times due to the recent decision market shake Britain to leave the European Union. Healthy boost the yellow metal is exhibited by an increase roughly 24 % of its value since the beginning of this year. Gold prices rebounded as much as about 8 % to its […]