-

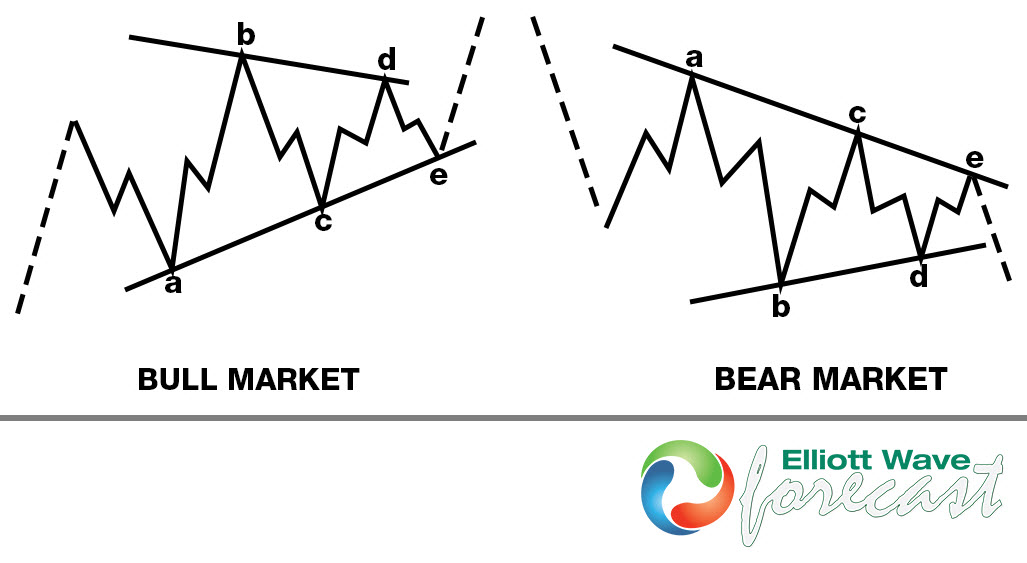

Elliott Wave Triangle Structure

Read MoreTriangle is an Elliott wave pattern seen during sideways market consolidations, it is composed of 5 corrective sequences. Triangle presents a balance of forces between buyers and sellers, causing a sideways movement that is usually associated with decreasing volume and volatility. This pattern subdivide into 3-3-3-3-3 structures labeled as A,B,C,D,E. It is a continuation pattern […]

-

Elliott wave pattern : Double Three (WXY) Structure

Read MoreDouble three is the most important patern in New Elliott Wave theory and probably the most common pattern in the market these days, also known as 7 swing structure. It’s a very reliable pattern which is giving us good trading entries with clearly defined invalidation levels and target areas. The picture below presents what Elliott […]

-

Trading with Elliott Waves using Fibonacci retracement levels

Read MoreOne of the ways to determinate end of corrections(potential reversal areas) is by using Fibonacci retracement levels in your analysis approach . In this blog, we’re going to explain some basic things about Fibonacci retracements. Fibonacci retracement is a popular tool among Elliott Wave practitioners and is based on the key founded by mathematician Leonardo Fibonacci. The most important […]

-

How to trade with Elliott Wave Forecast- follow the chart arrows

Read MoreOur new clients usually need at least 2 weeks to get familiar with EWF Services and trading system before they start enjoying the profit in trading. Every day we receive questions like: “How to trade with Elliott Wave” or “Which pair is best to trade at this moment?” or “Chart of Gold is calling for […]

-

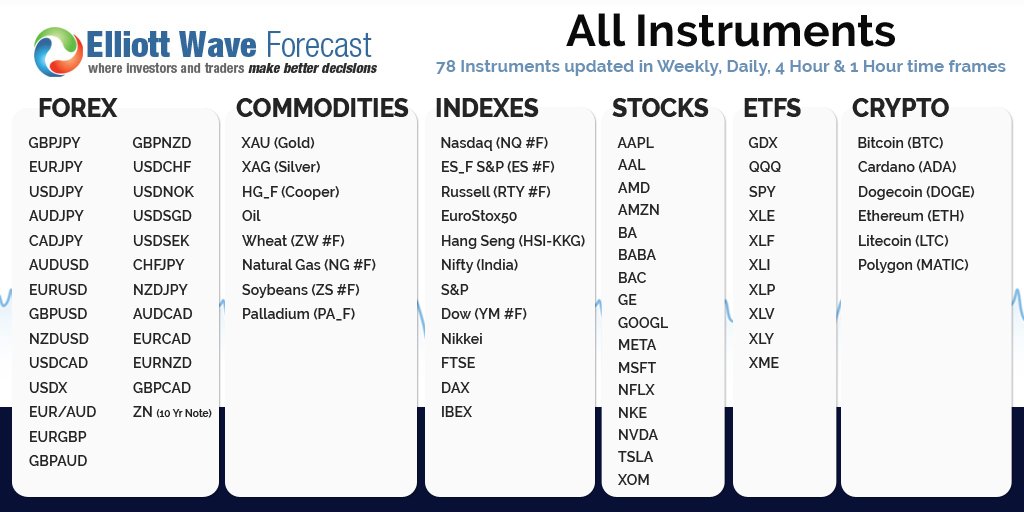

How to get the best of Free 14 day Trial

Read MoreBy signing up for Free 14 days Trial, you have taken the first step toward becoming a successful trader. We cover 78 instruments in total which are devided into 3 groups as listed below: Group 1: USD group : AUDUSD, EURUSD, NZDUSD, GBPUSD, USDCAD, USDX,ZN_F Yen group : GBPJPY, EURJPY , USDJPY, AUDJPY, CADJPY Crosses : […]

-

$USDCAD: Elliott Waves forecasting the rally & buying the dips

Read MoreAt the end of December 2014. USDCAD was doing bullish triangle in wave X connector. Wave ((c)) of triangle reached important technical area at 1.1583-1.1572 and rally was expected from there. We suggested our members to play long side in this pair against wave (( a )) of the triangle low at 1.5559. This was the […]