-

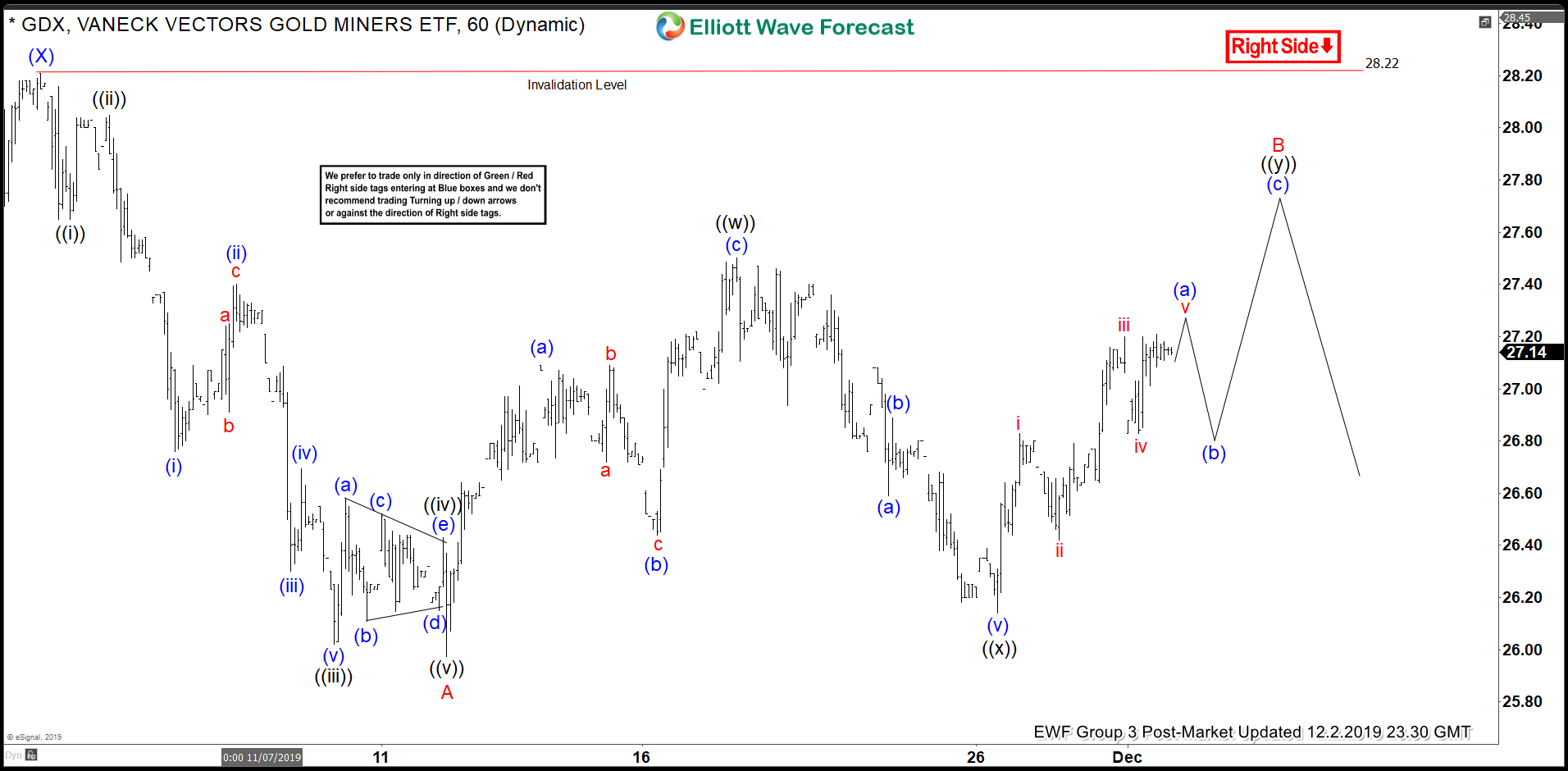

Elliott Wave View: GDX Rally Remains Corrective

Read MoreGDX rally from Nov 12 low is unfolding as a double zigzag Elliott Wave structure & while bounce stays below Nov 1 peak, it can extend lower.

-

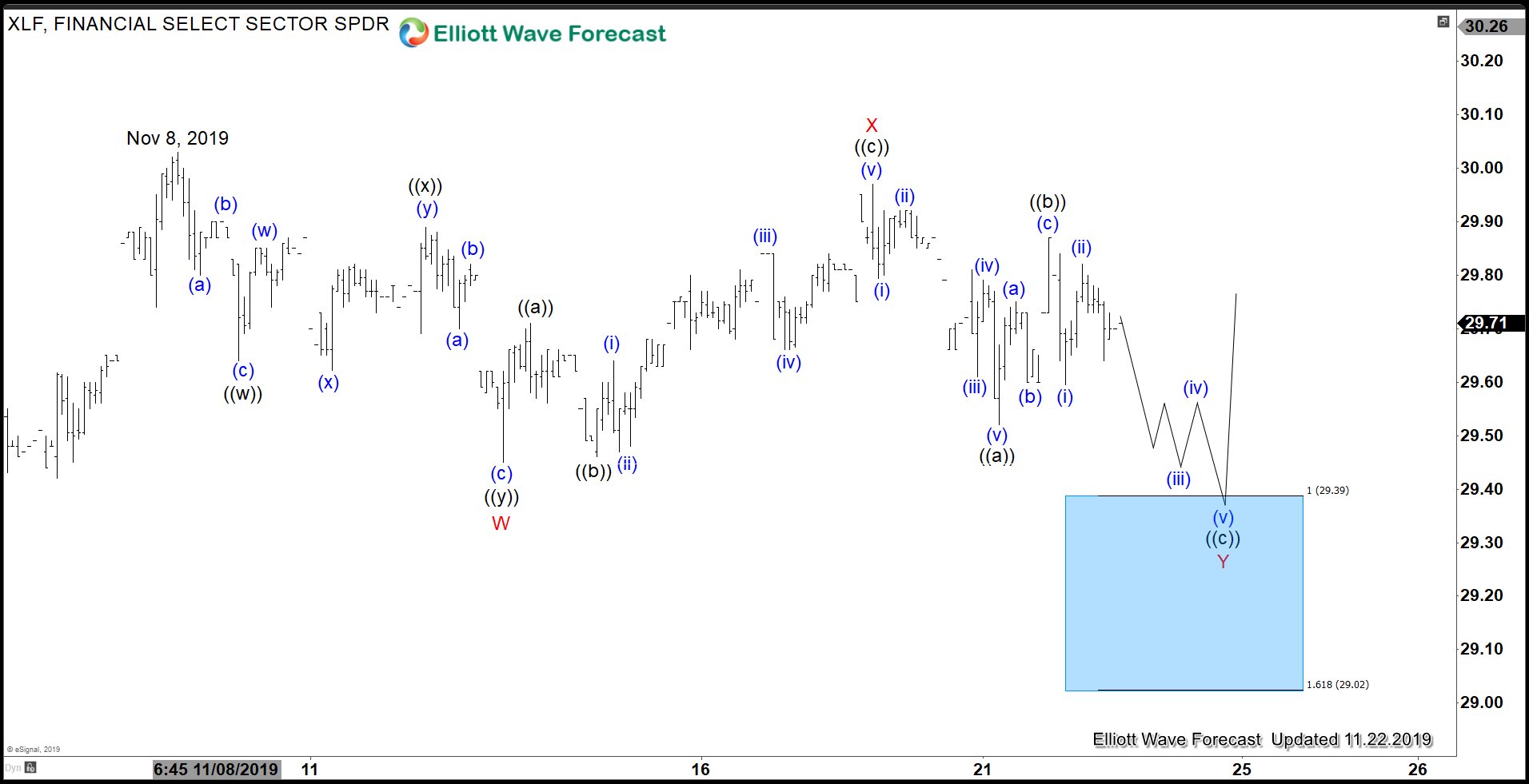

Global Indices Should Remain Resilient Despite Geopolitical Threat

Read MoreDespite Beijing’s objection, President Trump has gone ahead and signed two bills backing Hong Kong’s protesters into law. Beijing has continuously voiced strong objection against the legislation as China sees it as meddling in its domestic affairs. Trump signed these bills as US and China still try to reach a phase one trade deal. China […]

-

Elliott Wave View: FTSE Bullish Sequence Favors Higher

Read MoreFTSE shows a bullish Elliott Wave sequence from October 3, 2019 low favoring further upside. The rally from October 3 low is unfolding as a double three Elliott Wave structure. On the chart below, we can see wave ((w)) ended at 7431.94 and pullback in wave ((x)) ended at 7199.40. Internal structure of wave ((x)) […]

-

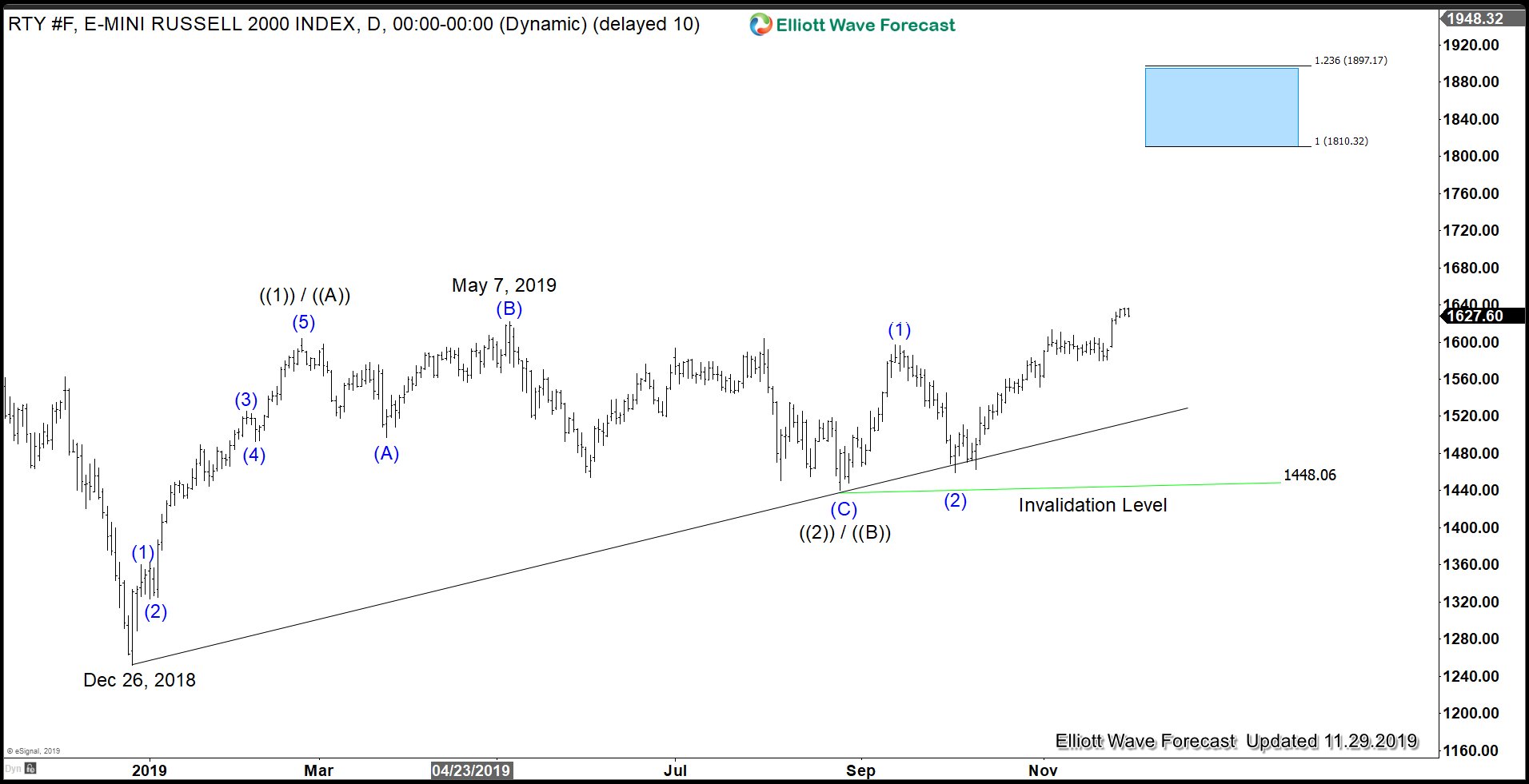

Elliott Wave View: Russell (RTY_F) Ending Wave 5

Read MoreRally in in Russell 2000 (RTY_F) from October 3, 2019 low is unfolding as 5 waves impulsive Elliott Wave structure. The chart below shows wave ((iv)) of the impulse ended at 1579.28. Index is currently within wave ((v)) before ending the cycle from October 3 low. Up from wave ((iv)), wave i ended at 1592.8 and wave ii […]

-

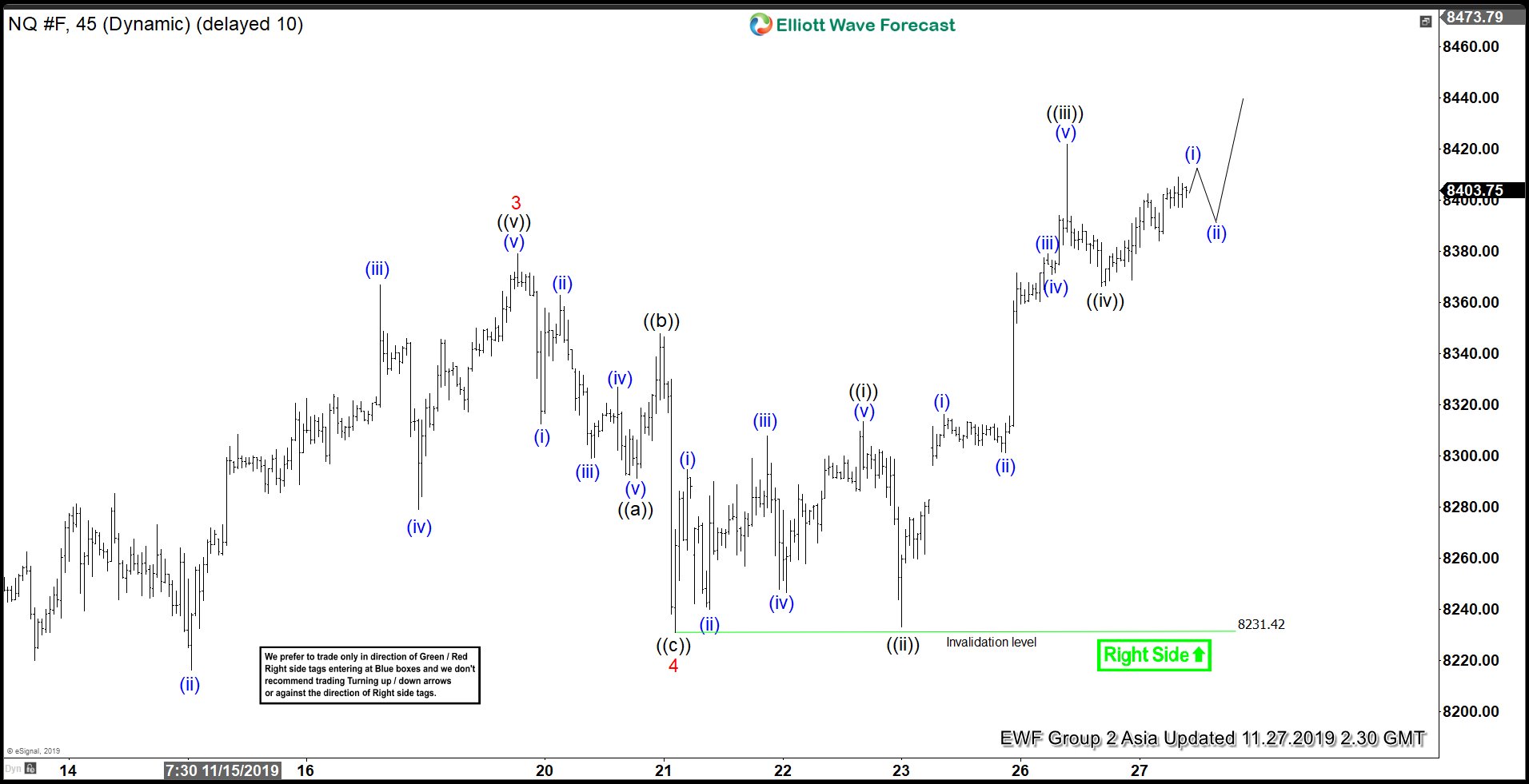

Elliott Wave View: Nasdaq (NQ_F) Extending Higher as Impulse

Read MoreElliott Wave View in Nasdaq (NQ_F) suggests that the rally from October 3, 2019 low is unfolding as 5 waves impulsive Elliott Wave structure. On the chart below, we can see wave 3 of the impulse from October 3 low ended at 8379. The pullback in wave 4 ended at 8231 as a zigzag Elliott Wave structure. Wave […]

-

Will the Passing of Hong Kong Human Rights and Democracy Act Threaten Stock Market Rally?

Read MoreSome market participants worry that the passing of Hong Kong Human Rights and Democracy Act can reverse the gain in stock market. Both the US Senate and House of Representative overwhelmingly voted 417 to 1 in favor of passing the bill. It is now waiting for President Donald Trump to sign. According to Bloomberg, Trump […]