-

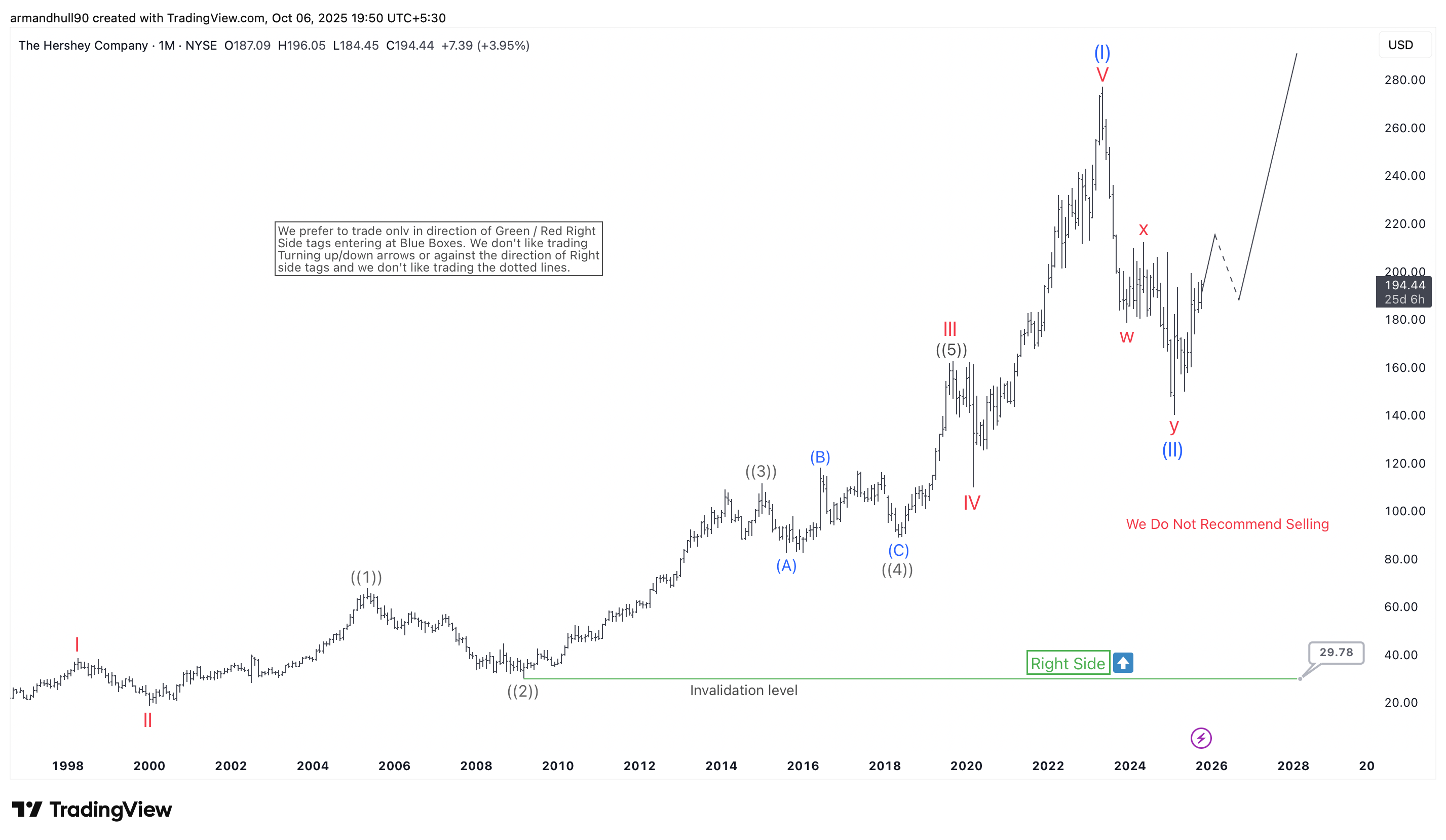

Hershey Company (HSY) Elliott Wave Analysis: Bullish Setup Suggests Next Rally Ahead

Read MoreHershey (NYSE: HSY) shows a bullish Elliott Wave structure indicating that the correction may have ended, and a new upward cycle could soon resume. The Hershey Company (NYSE: HSY) is showing early signs of strength after months of decline. Based on Elliott Wave Theory, the long-term chart suggests that the correction may have ended and […]

-

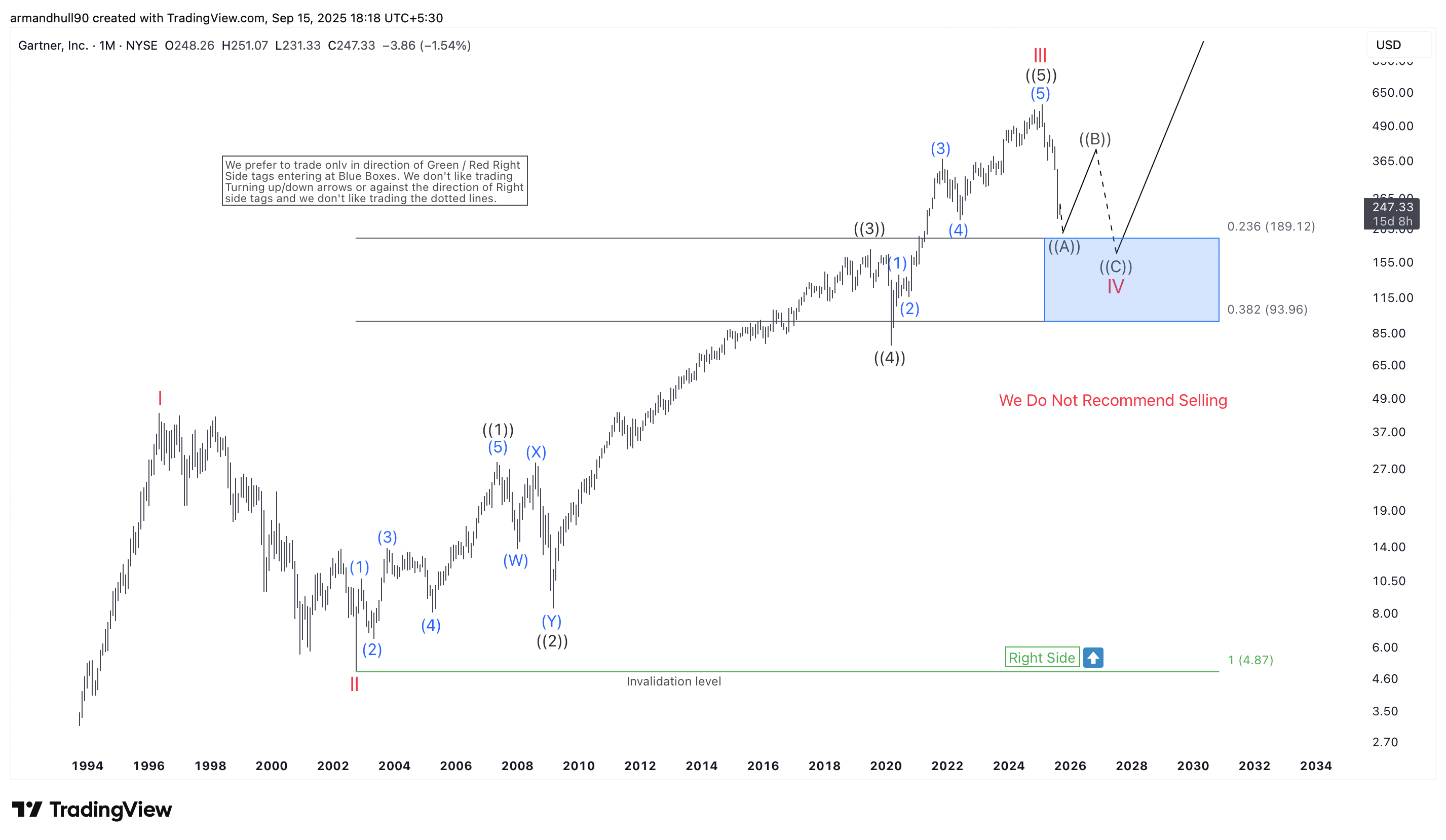

Gartner Inc. (IT) Elliott Wave Analysis: Wave IV Correction Targets Key Support Zone

Read MoreGartner Inc. enters a corrective wave IV, targeting key Fibonacci support before resuming its bullish Elliott Wave V trend. Gartner Inc. (NYSE: IT) has delivered an impressive multi-decade bullish cycle, advancing from the lows near $5 in 2002 to above $700 before the current pullback. The Elliott Wave count suggests that the stock recently completed […]

-

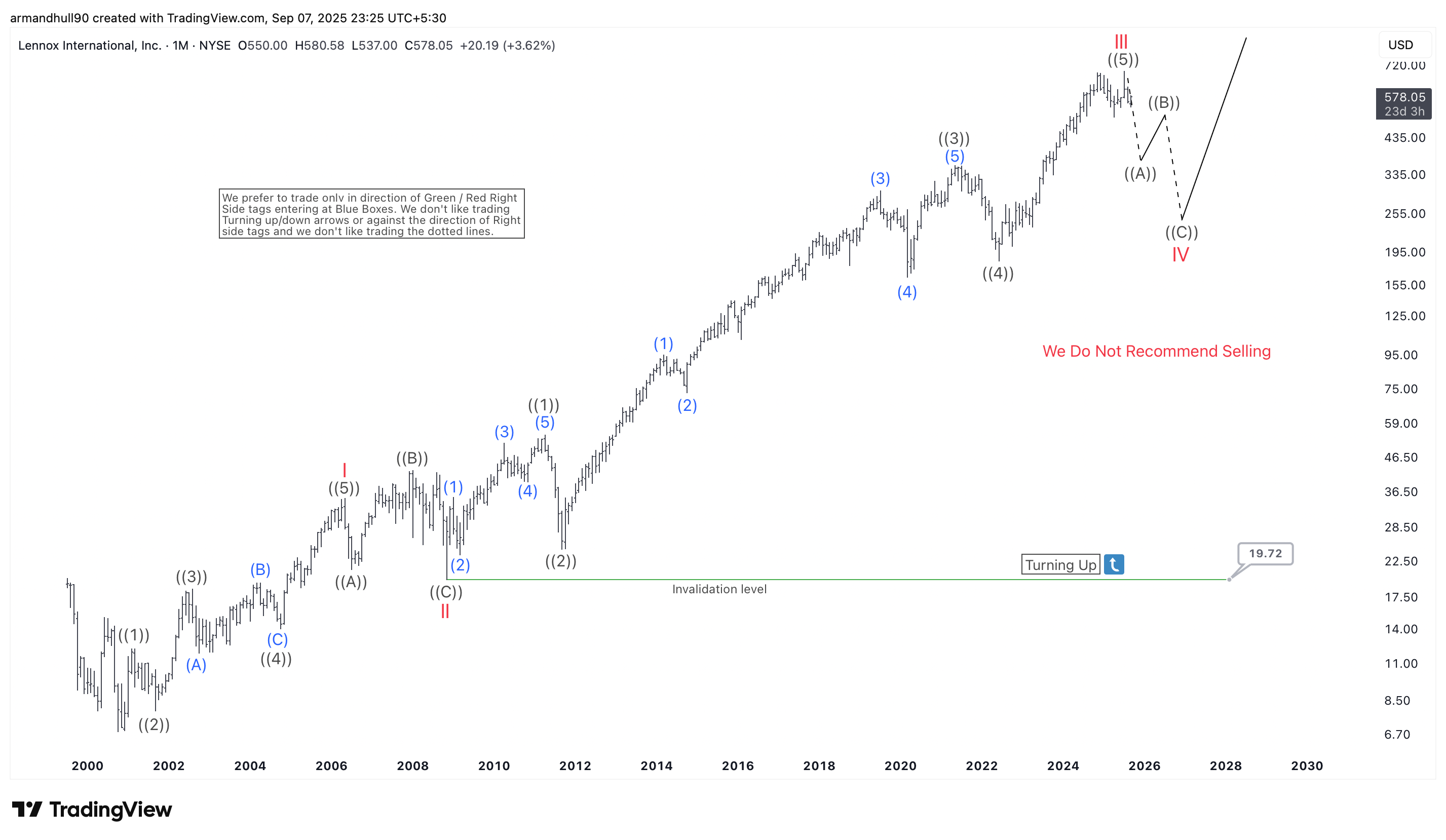

Lennox International (LII) Elliott Wave Analysis – Correction Ahead Before the Next Rally

Read MoreLII stock enters a wave IV corrective phase, offering potential buying opportunities before a strong bullish wave V rally resumes. Lennox International (LII) has been in a strong uptrend for many years, following a clear Elliott Wave impulsive structure. The stock recently completed wave III on the monthly chart and is now entering a corrective […]

-

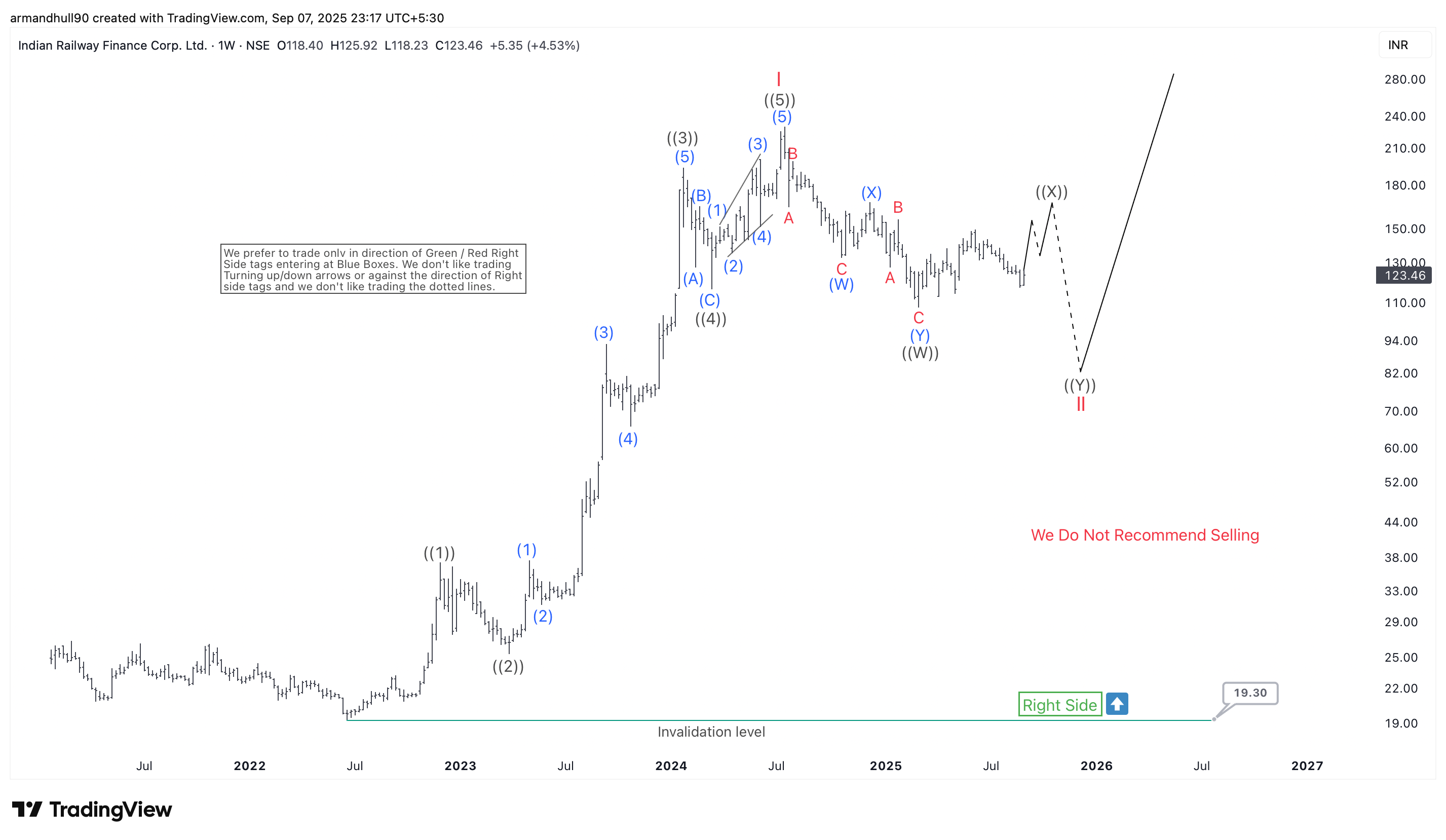

IRFC Elliott Wave Analysis: Wave II Correction Nearing Completion Before Major Bullish Rally

Read MoreIndian Railway Finance Corporation Ltd. (IRFC) is correcting within a double three Elliott Wave pattern in wave II after completing a strong five-wave rally in wave I. Indian Railway Finance Corporation Ltd. (IRFC) has maintained a strong bullish trend over the past months. After forming a significant low, the stock started a powerful rally, completing […]

-

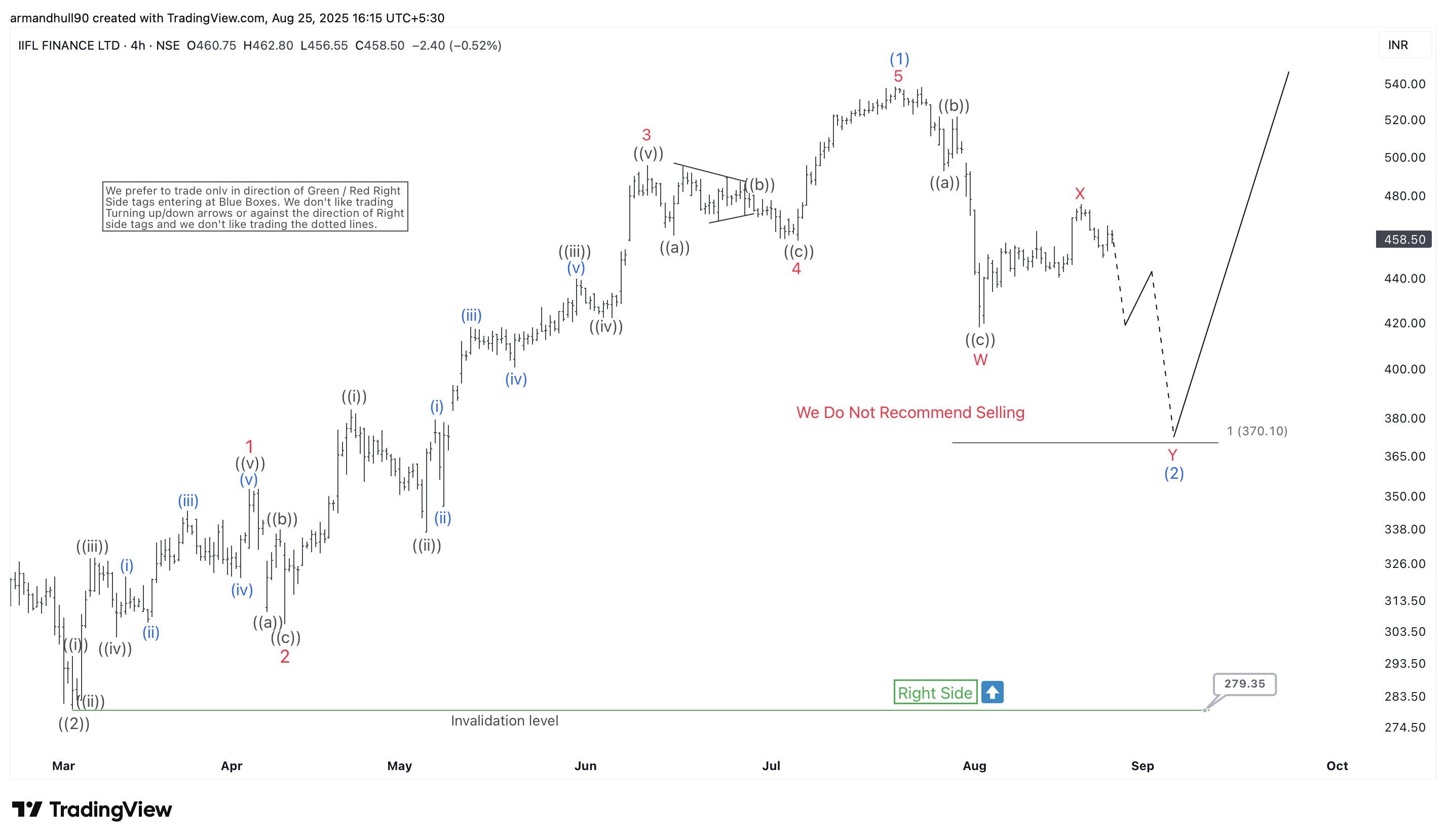

IIFL Finance Elliott Wave Analysis: Wave (2) Correction Nears Completion, Bullish Rally Ahead

Read MoreIIFL Finance (NSE: IIFL) shows a corrective Elliott Wave pattern (2) with key support at ₹370.10. A potential bullish wave (3) rally may follow soon. IIFL Finance Ltd (NSE: IIFL) continues to follow a well-defined Elliott Wave structure, suggesting the stock is undergoing a corrective phase before resuming its larger bullish trend. After completing wave […]

-

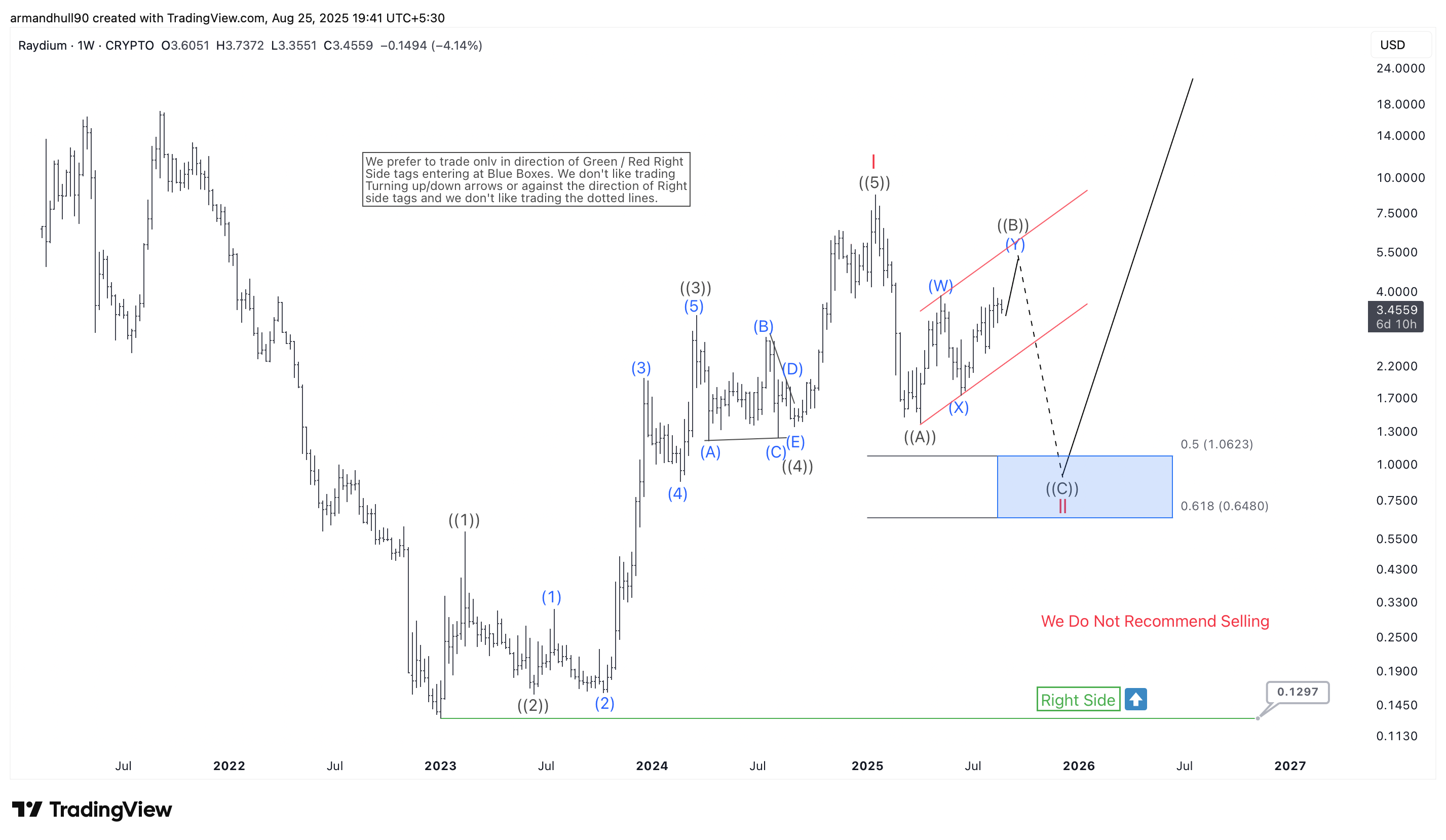

Raydium (RAYUSD) Elliott Wave Analysis: Wave II Correction Approaching Completion

Read MoreRaydium (RAYUSD) Elliott Wave analysis indicates Wave II correction is in progress, with a potential bullish Wave III rally expected after reaching the blue box support zone. Raydium (RAYUSD) completed a clean five-wave impulse from the January 2023 low, reaching $8.6642. According to Elliott Wave analysis, this move marked the end of Wave I. Since […]